- Created by BrianQ, last modified by TaelorR on Aug 10, 2017

https://help.myob.com/wiki/x/oYei

ANSWER ID:30933

Employers should only use a common anniversary date if they have an official closedown of at least two weeks (10 working days).

If the 31st of March is used as a common anniversary date, Payroll needs to be able to move forward into the new financial year before the holiday updates are carried out.

To ensure a successful holiday update please follow the instructions below:

Go to the Tools menu and choose Options.

- Click the Leave tab and deselect Common Holiday Anniversary.

- Finish the last pay of March completing the month-end process as you normally would:

- If using ir-File, create the csv file.

- Run your Employer Monthly Schedule as usual.

- Create any journals required if you are integrating with MYOB accounting software.

- Complete all other end of month procedures.

- Perform an additional backup and keep one off-site.

- Print the following reports:

- Employee Balances

- Pay Audit Trail

- Pay Code Totals

- Holiday Accruals

Earnings Certificates. These are not required by the IRD, but we recommend that they be printed so that employees can check the information provided by the IRD. They are designed for printing on letterhead.

If you have entered all or part of your Pay History manually through ENTER HISTORY, this data will not be included in the Gross earnings/PAYE details of the Earning Certificate.

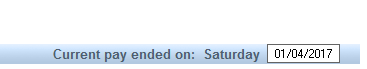

- In the bottom right hand corner of the window, change the Current pay ended to a date on or after the 1st of April. Payroll will prompt you to update your PAYE Period to April and roll into the new financial year. (Follow through this process).

- Go to the Tools menu and choose Options.

- Click the Leave tab, tick both boxes under Leave Anniversary, and re-enter the common anniversary date.

- Click OK to the holiday message which opens, and then OK to exit the options tab.

- Go to the Tools menu and choose Holiday Anniversary and follow the prompts.

You will now be able to process your pays in the new financial year following your normal procedure. Your holiday updates will have been carried out.

FAQs

If you have already rolled into the new year without following the above procedure, the only workaround is to:

- Restore the most recent backup prior to 1 April.

- Ensure the backup is finalised.

- Go to the Tools menu and choose Options.

- Click the Leave tab and remove the common anniversary date.

- Change the Current pay ended on or after the 1st of April. The payroll will prompt you to update your PAYE Period and roll into the new financial year. (Follow through this process).

- Go to the Tools menu and choose Options.

- Click the Leave tab, tick both boxes in the leave anniversary area and re-enter the common anniversary date.

- Click OK to the holiday message received and then OK to exit the options tab.

- Go to the Tools menu and now choose Holiday Anniversary and follow through the Holiday Anniversary update process.

You will now be able to process your pays in the new financial year following your normal procedure. Your holiday updates will have been carried out.