How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

End of financial year doesn't need to be a drama. In MYOB Essentials, there's not much you need to do. But it's a great time to take a few moments to make sure your accounts are in order, and everything's ready for your accountant to take care of tax time. Get started by completing your usual Month-end tasks. Once they're done, here's some of the things you might want to do (and a couple that you need to do)

Invite your accountant

If you haven't already, invite your accountant to your MYOB Essentials business.

This will let them log in and work directly with your data, so they can do your tax and make any adjustments that are needed.

Complete your monthly tasks

If you've paid any employees, you'll need to lodge your monthly IRD returns. Unless you deduct more than $500,000 per year, these are due by the 20th of the following month. See Monthly IRD returns.

You'll also need to file your final GST return of the year.

You should also reconcile your bank accounts, send customer statements and record depreciation.

Run reports

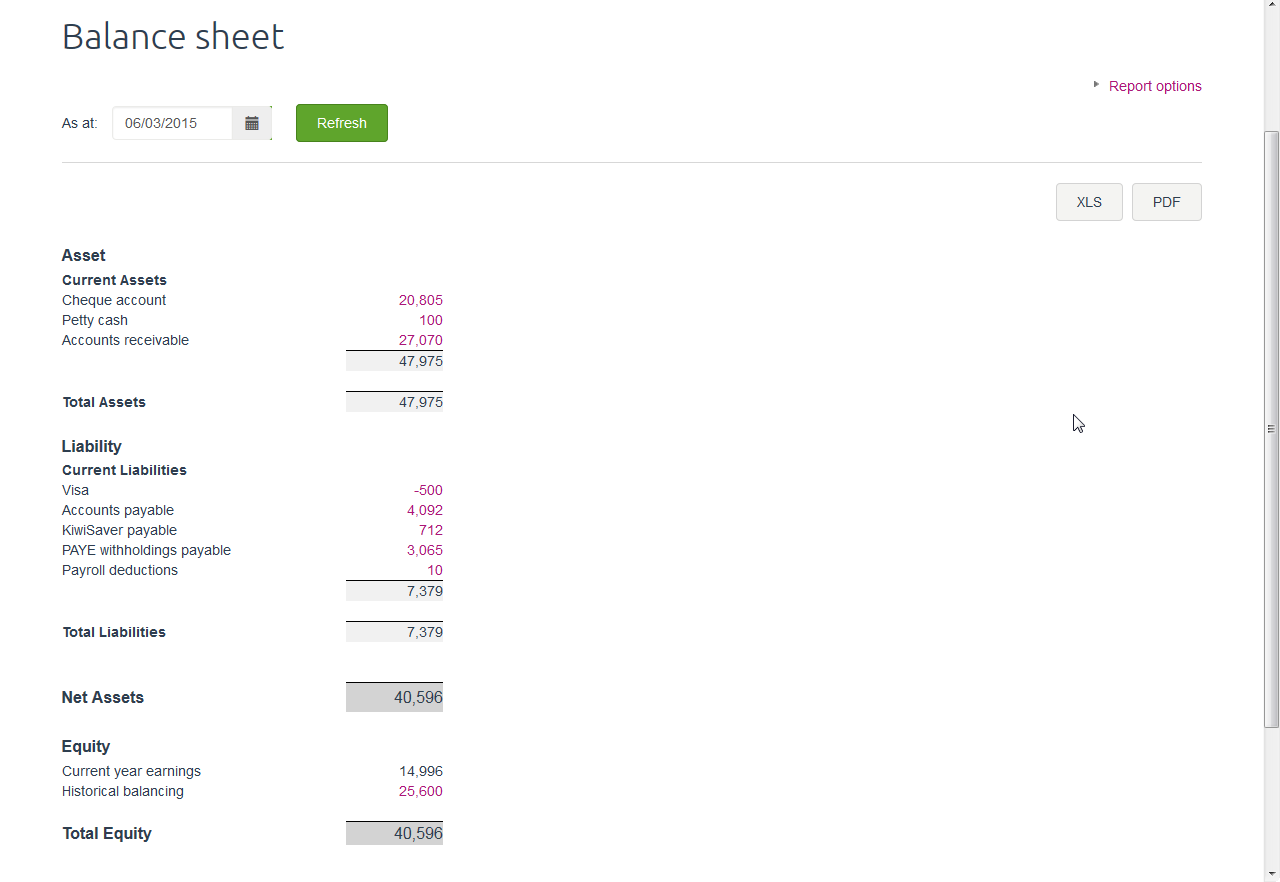

Your Profit & Loss and your Balance Sheet let you know how your business has performed throughout the year (which you've probably been checking regularly). You might like to print a copy for yourself.

- Profit and Loss tells you how much profit your business has made in the last year, divided into income, expenses and net profit.

- Balance Sheet tells you your business's net worth up to the end of the financial year. It's divided into assets, liabilities and equity.

See Business reports to learn how to produce these reports.

Enter end-of-year adjustments

After taking a look at your financial information, you or your accountant might need to make some adjustments to your records. In most cases, you'll enter these as journal entries. If you're missing any bank transactions (like deposits, withdrawals or bank charges), enter them on the Spend Money or Receive Money pages.

See General Journals for information about entering journal entries, or Spend money and Receive money for information about entering bank transactions.

Lock the period (optional)

Once you (and your accountant) are happy that your accounts are all reconciled and you're not going to need to make any more adjustments to the year's financial information, you can 'lock' the year. This means you won't be able to accidentally enter any transactions that will affect your reports, GST returns and anything else you've already reported to the IRD.

Don't worry - if you need to make changes later on, you can always go back and unlock the period.

See Locking periods.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.