- Created by ErikV, last modified by AdrianC on Jan 20, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 28 Next »

https://help.myob.com/wiki/x/sYEHAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

A gift voucher or certificate is a piece of paper or electronic card loaded with a value that's later exchanged for goods or services.

When you sell a gift voucher, the customer is holding an asset of your business until the voucher is redeemed. So when you record the sale of a gift voucher, it needs to be recorded as a liability posted to an Unclaimed Gift Certificate account.

When the customer redeems the voucher, all you need to do is create an invoice and pay for it using the funds from the Unclaimed Gift Certificate account.

This way, you can easily track the value of outstanding gift vouchers or write-off any that remain unredeemed.

OK, let's take you through the details.

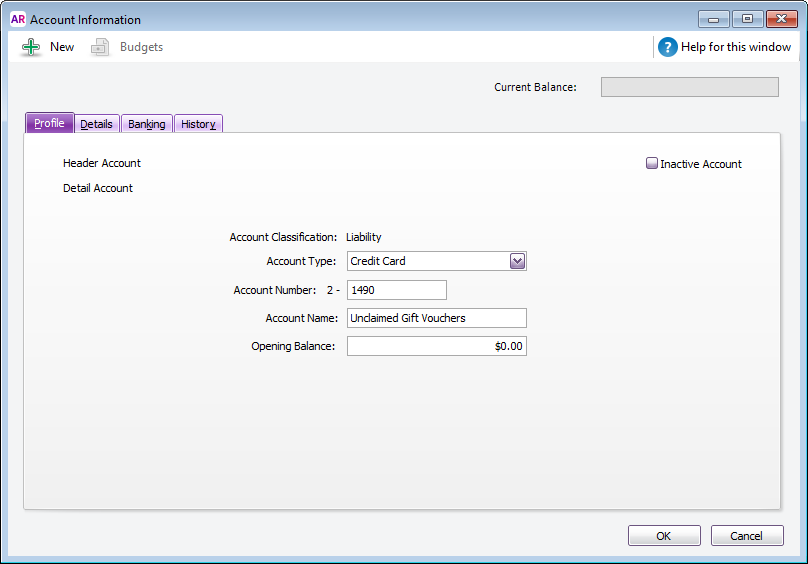

You'll first want to create a liability account which will hold the value of issued gift vouchers.

- The Account Type will be Credit Card

- Name the account something that suits your list. In our example, we chose Unclaimed Gift Vouchers

When you sell a gift voucher, record it using a Receive Money transaction. This lets you allocate the funds to the Unclaimed Gift Vouchers account created earlier.

- Select the Deposit to Account option and choose your applicable business bank account.

- In the Acct No. field, select the Unclaimed Gift Voucher account.

- In the Amount field, enter the gift voucher amount.

Enter the applicable tax/GST code. Check with your accounting advisor if you're not sure which code to use.

Here's our example for the sale of a $100 gift voucher:

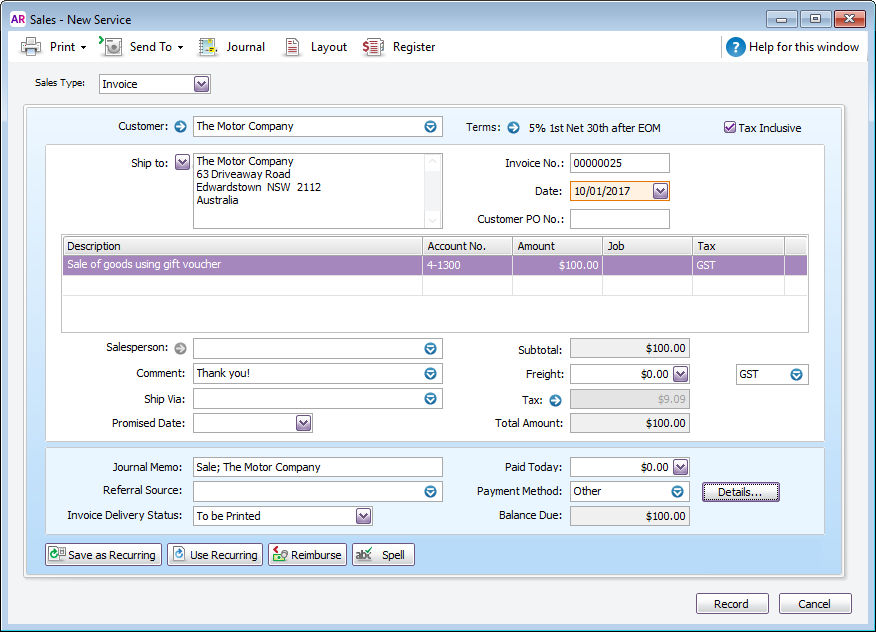

When a customer redeems their gift voucher, it's recorded as an invoice because the customer is using it to buy something. You can then "pay" for the invoice using funds from the Unclaimed Gift Certificate account.

- Create an invoice for the sale.

- Specify the applicable tax/GST code. Check with your accounting advisor if you're not sure which code to use.

- Record the invoice.

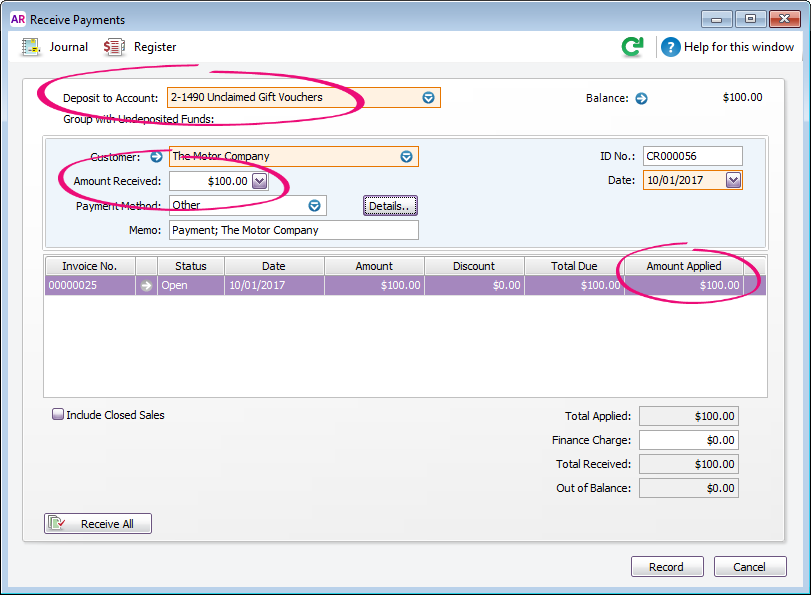

- Open the Receive payment window to close (pay) the invoice.

- Select the Deposit to Account option and select the Unclaimed Gift Voucher account.

- Specify the gift voucher value in the Amount Received field.

- Apply this amount to the invoice.

- Record the payment.

The gift voucher is redeemed and the Unclaimed Gift Certificate account balance is reduced by the voucher amount.

FAQs

To determine the value of all unclaimed gift vouchers, check the balance of the Unclaimed Gift Vouchers liability account by running the Accounts List (Summary) report (Reports > Index to Reports > Accounts > Accounts List (Summary)).

To see a history of gift vouchers sold and redeemed, check the transaction history of the Unclaimed Gift Vouchers liability account:

- Click Find Transactions and click the Account tab.

- Select the Unclaimed Gift Vouchers account.

- Specify the desired date range. Credit transactions represent gift voucher sales, and debit transactions represent gift voucher redemptions.

Unredeemed gift vouchers represent income, so they can be written off using a Receive Money transaction.

For this transaction:

- Select the Deposit to Account option then select the Unclaimed Gift Voucher liability account.

- In the Amount Received, enter the value of the gift voucher being written off.

- In the Acct No. field, select the relevant income account. If you want to track unredeemed gift vouchers seperately, you can create an income account for this purpose.

- Specify the relevant tax/GST code. Check with your accounting advisor if you're not sure which code to use.

Recording this transaction will reduce the balance of the Unclaimed Gift Vouchers liability account and credit the balance of the chosen income account.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.