You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 4 Next »

https://help.myob.com/wiki/x/9pUHAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Do you have petty cash that you use for small purchases like stamps, stationary or cupcakes for the team? There's many ways to manage petty cash, you could set a limit (such as $200) and replenish on a date each month, or just slip in $20 whenever the cupboards look bare. Regardless of your approach, you manage petty cash purchases similarly to a bank account: you deposit money into a petty cash account, record expenses against it and top it up with a transfer from another bank account (which could be an ATM withdrawal).

By default, your accounts list should have a petty cash account. Check your accounts list and, if you don't have one, set one up (it needs to be an Asset account with the Bank account type).

1. Deposit money into your petty cash account

Petty cash is usually started with money withdrawn from a savings account. You might withdraw funds from an ATM or over the counter.

- From the Banking menu, click Spend Money.

- In the Pay from field, select the bank account your opening balance will come from (usually your business bank account).

- In the Notes field, enter a description of this transaction.

- In the Allocate to field, select your petty cash account.

- Enter the Amount for the opening balance.

- Select the NTR Tax/GST code. Here's our example:

- Click Save.

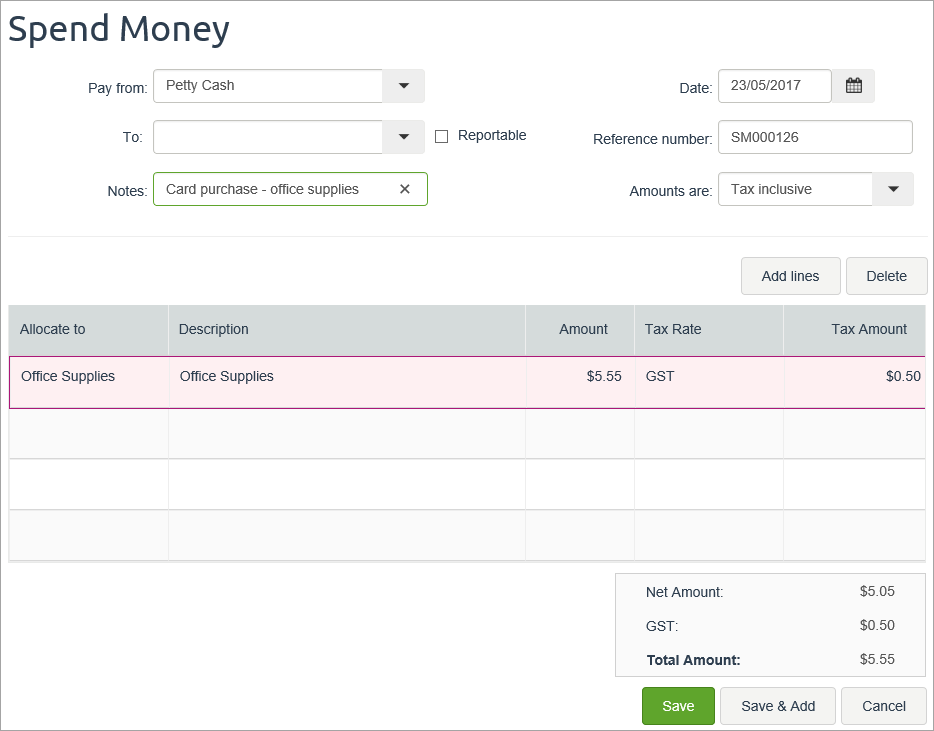

2. Record a petty cash purchase

You record petty cash purchases in the same way as other Spend Money transactions, just use the Petty Cash account rather than your bank account.

- From the Banking menu, click Spend Money.

- In the Pay from field, select your petty cash account.

- In the Notes field, enter a description of this transaction.

- In the Allocate to field, select the applicable expense account.

- Enter the Amount for the purchase.

- Select the applicable Tax/GST code. Here's our example:

- Click Save.

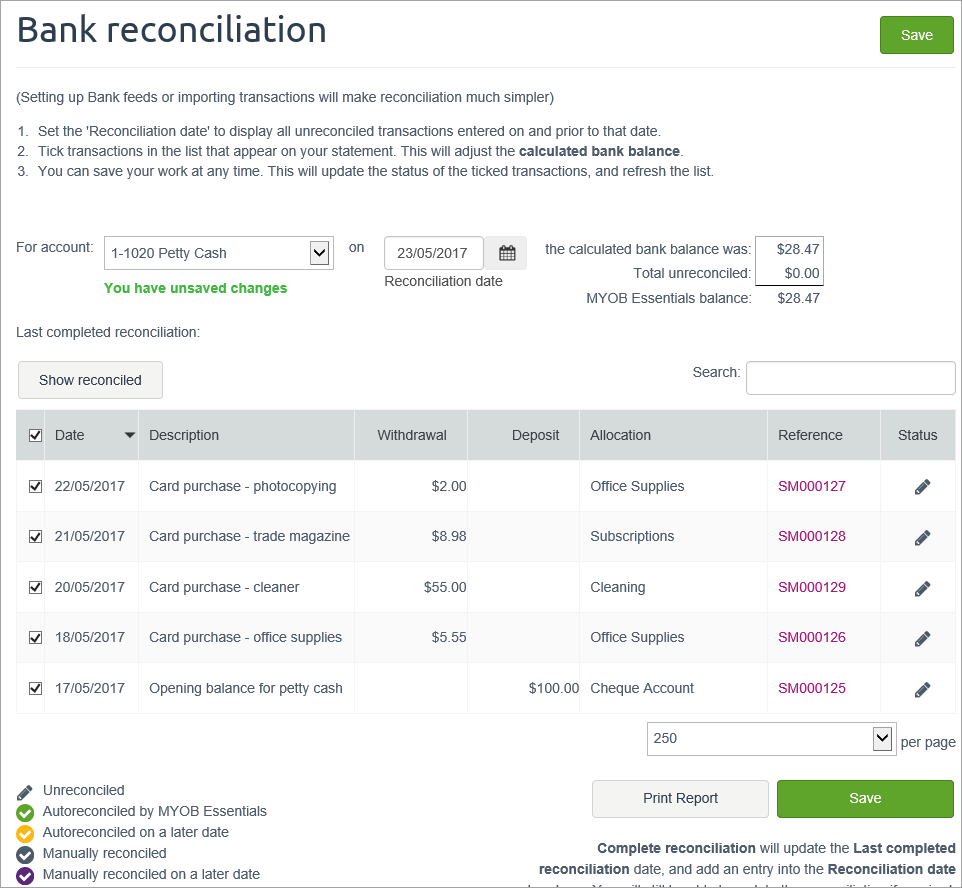

3. Reconcile the petty cash account (optional)

From time to time, you may want to reconcile your petty cash account to make sure it balances with your cash receipts. It also provides you with the reimbursement amount.

- From the Banking menu, click Bank reconciliation.

- In the For account field, select the petty cash account.

- in the Reconciliation date field, enter the current date.

- Match the payments in the Bank reconciliation window with your cash receipts, marking the corresponding transactions off as cleared. You'll also need to reconcile the reimbursement deposit which you can check against your banking records.

Here's our example:

- (Optional) Click Print report to print the reconciliation report for your records.

- Click Complete reconciliation to reconcile the account.

4. Reimburse the petty cash account

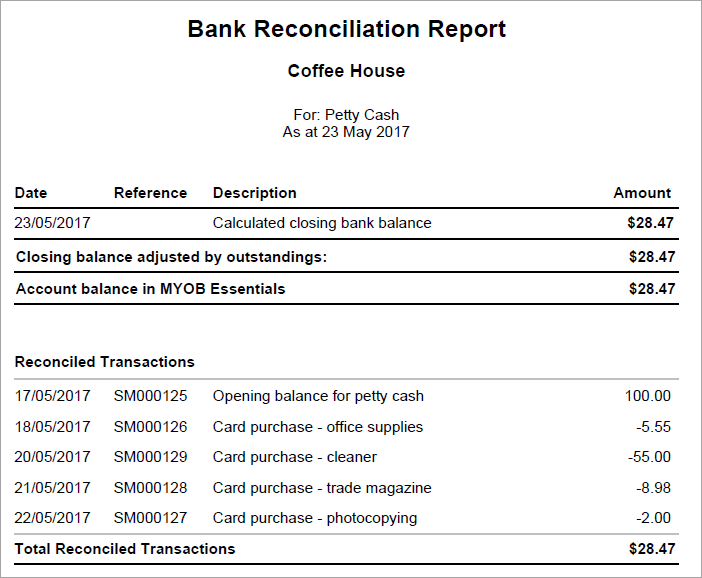

You can use the Bank Reconciliation Report to work out how much you need to top up your petty cash to get it back to its required balance.

Here's an example report which shows a remaining balance of $28.47 in the petty cash account, which means $71.53 is needed to return the balance to its original $100.

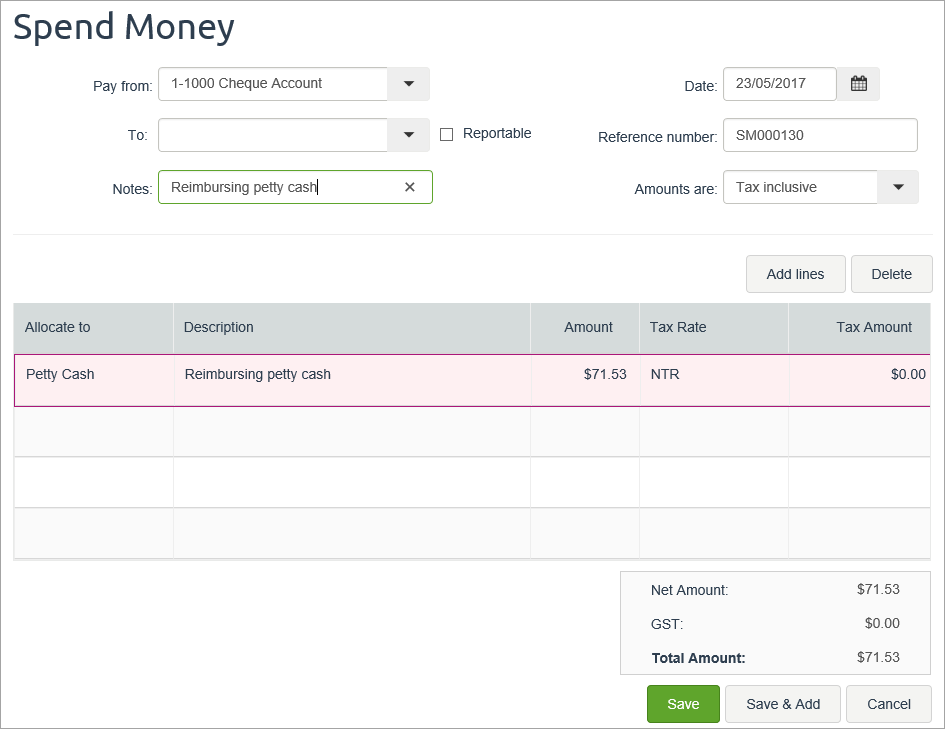

You can now record a Spend Money transaction to reimburse the account.

- From the Banking menu, click Spend Money.

- In the Pay from field, select your business bank account.

- In the Notes field, enter a description of this transaction.

- In the Allocate to field, select your petty cash account.

- Enter the Amount for the reimbursement.

- Select the NTR Tax/GST code. Here's our example:

- Click Save.

After entering this transaction, the petty cash account balance should equal its original opening balance.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.