- Created by ErikV, last modified by AdrianC on Feb 09, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 14 Next »

https://help.myob.com/wiki/x/0KoHAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Many businesses want their employees' leave to be reflected in dollar terms in general ledger payable accounts.

These accounts, commonly known as leave provisions, reflect the monetary liability the business has for leave owing to employees.

Here's how to set this up in your company file.

Set up a liability and expense account

- Go to the Accounts command centre and click Accounts List then click the Liability tab.

- Click New and enter the new number for the account and press tab.

- Give the account an appropriate name such as Provision for Holiday Leave.

- Enter any optional details in the other tabs.

- Click OK.

- Click the Expenses tab and using the above steps create the related expense account.

- Repeat for any other liability and expense accounts for other leave such as Provision for Sick Leave Accrual.

Link your liability account to your leave wage categories

- Go to the Payroll command centre and click Payroll Categories.

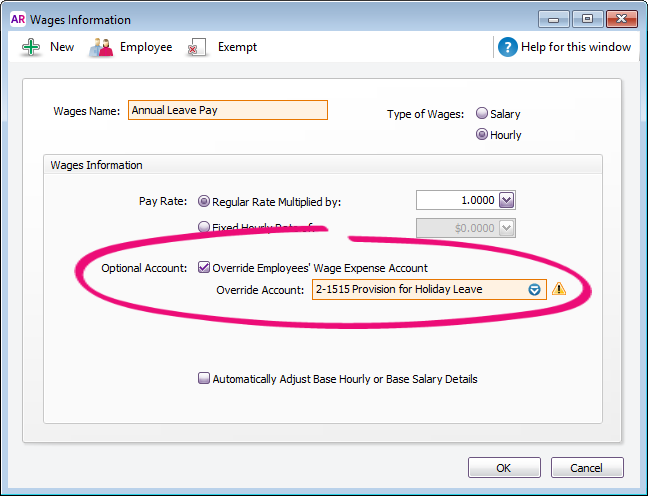

- In the Wages tab, click the zoom arrow beside the Holiday Pay wage category. The Wages Information window appears.

- Select the Override Employees' Wage Expense Account option.

- Click the drop-down arrow beside the Override Account field and select the appropriate account. If you choose a liability account, a warning will appear advising that the linked account should be an expense account. Disregard the warning. See our example below.

- Repeat for all other wage categories that you want to show as a liability, such as Sick Pay.

If you're not sure which account to choose, check with your accounting advisor.

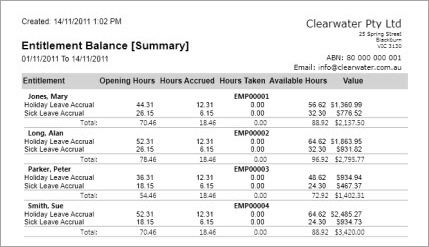

Determine the dollar value of your leave accruals

To view the current dollar value of your existing accrued leave balances run the Entitlement Balance Summary report.

- Go to the Reports menu and choose Index to Reports.

- Click the Payroll tab.

- Under the Entitlements heading, select Balance Summary.

- Select the period for the report in the Dated From and To fields.

- Click Advanced Filters.

- Select the appropriate Employees.

- In the Display by field, select either Employee or Entitlement.

- Click Run Report. to determine the current dollar value of your employees' leave.

Here's an example:

Record your existing accrued liabilities

- From the Entitlement Balance [Summary] report, obtain the dollar amounts you want to record as your liability.

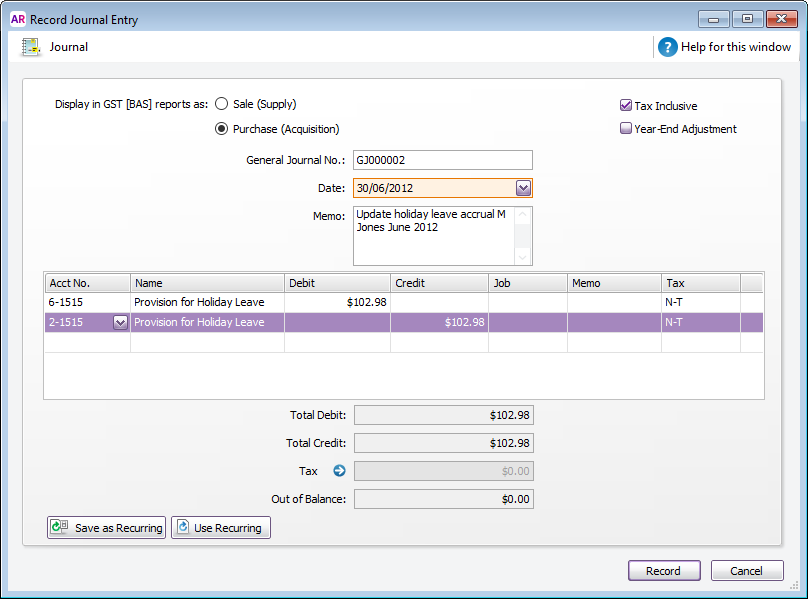

- Go to the Accounts command centre and click Record Journal Entry.

- For positive balances (leave owed to the employee), select the expense account for the leave expense and enter the dollar value of the accrual as a debit. Select the liability account for the leave liability and enter the dollar value the accrual as a credit. The tax code would normally be N-T.

- For negative balances, select the leave liability account for debit amounts and the expense account for the credit amount.

- Click Record.

Since these balances may be attributable to prior year(s) accruals, you may choose to apportion part of the value to retained earnings. If you're not sure which accounts to use, check with your accounting advisor.

Regularly update your accrued liabilities

You can regularly update the monetary value of your leave accrual liabilities. For example, if you want to update the liabilities each month you will need to run the Entitlement Balance Summary report filtered for the specific month in question. Do this once you have completed all payroll transactions for that month. Note that the report will need to be dated from the last time you recorded a journal entry to update the accrued liabilities, up to the current date.

The value shown in the report will be the current entitlement balance, so you will need to subtract the previously reported entitlement balance value to determine the value of the accrued leave for the reported period.

Example: The last time you completed this process an employee's accrued leave value was $2500. The following month when you run the Entitlement Balance Summary report, the employee's accrued leave value is $2602.98.

$2602.98 - $2500=$102.98.

This means the value of the accrual liability for this employee needs to be increased by $102.98.

The journal shown here will increase the value of the leave accrual liability by $102.98.

To decrease the value of the leave accrual liability, you would debit the liability account and credit the expense account.

If you want to make provision for Leave Loading, increase the values by the applicable leave loading percentage.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.