- Created by Rachael Mullins, last modified by AdrianC on Jul 13, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 15 Next »

https://help.myob.com/wiki/x/R6wHAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

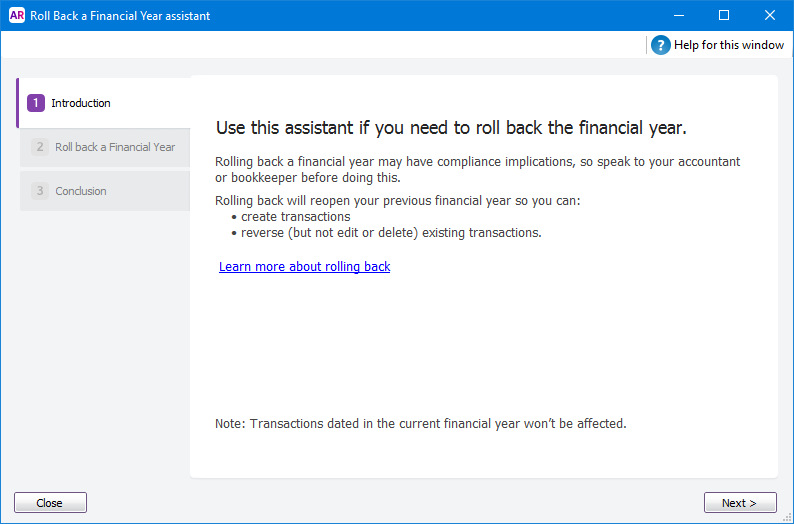

There might be times when you need to enter adjustments for the last financial year. If you've already closed that year, you can still make changes by rolling back the financial year.

This means you can add new transactions for the previous year, and reverse existing transactions. But you can't edit or delete transactions dated in the year you have rolled back to.

You should speak to your accountant or bookkeeper before doing this. Making changes to a period you have already prepared reports for could have compliance implications.

For example, say your current financial year is 2017. If you need to enter an adjustment for the 2016 financial year, you will need to roll back the year. Once you've recorded the adjustment, you can close the 2016 financial year again.

To roll back the last financial year, go to the File menu > Close a Year > Roll Back a Financial Year. An assistant appears that will step you through the process.

Can't see the roll back option? Maybe you're using an old version of AccountRight. This feature was added to AccountRight 2015.1.

If the option is in the File menu, but you can't select it, it means that you've already rolled back the financial year, you've never closed a financial year in this company file or you don't have the required user access.

Financial year rollback FAQs

Why isn't the rollback option available in the File menu?

Maybe you're using an old version of AccountRight. This feature was added to AccountRight 2015.1.

If the option is in the File menu, but you can't select it, it means that you've already rolled back the financial year, you've never closed a financial year in this company file or you don't have the required user access.

Can I roll back more than one financial year?

No, sorry.

How do I know what my current financial year is?

Go to the Setup menu > Company Information. This window shows you the year that’s considered to be the current financial year in AccountRight. You can only roll back to the year prior to the current financial year, also known as “Last Year” in AccountRight.

What happens to transactions dated in the year that follows the one I’m rolling back to?

They won't be affected at all.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.