- Created by admin, last modified by AdrianC on Jun 20, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 21 Next »

This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/tbAHAQ

ANSWER ID:9100

When receiving payment for an invoice or paying a bill, sometimes an overpayment is made or the payment is recorded twice. Mistakes can happen, but there are a number of ways you can easily handle the overpaid amount:

- apply it to another unpaid invoice or bill

- create a credit or debit and process a refund

- create a credit or debit and apply it to a future invoice or bill

- write it off (customer overpayments only).

Each of these options is detailed below, and it's a good idea to first check with your customer or supplier on their preferred option. But no matter what route you choose, you'll be back to doing business in no time.

To create a credit for the overpaid amount

How you create a credit depends on how the overpayment was made. After creating the credit, you can settle it by refunding the amount or applying it to a future invoice. For more information on settling credits, see the AccountRight help (Australia | New Zealand).

| Did your customer... | Here's what to do |

|---|---|

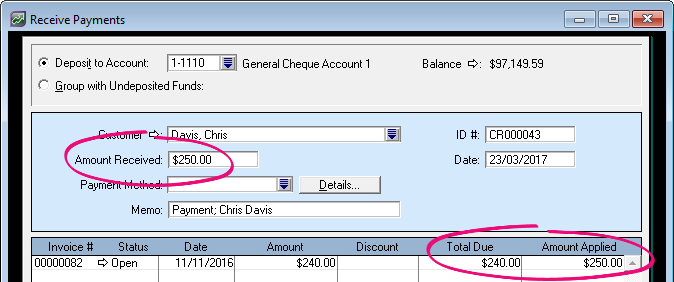

| Overpay the invoice amount | When recording the payment in the Receive Payment window, enter the full payment in the Amount Received field and in the Amount Applied column in the scrolling list. A credit for the overpaid amount will be automatically created.

After creating the credit, you can settle it by refunding the amount or applying it to a future invoice. For more information on settling credits, see the AccountRight help (Australia | New Zealand). |

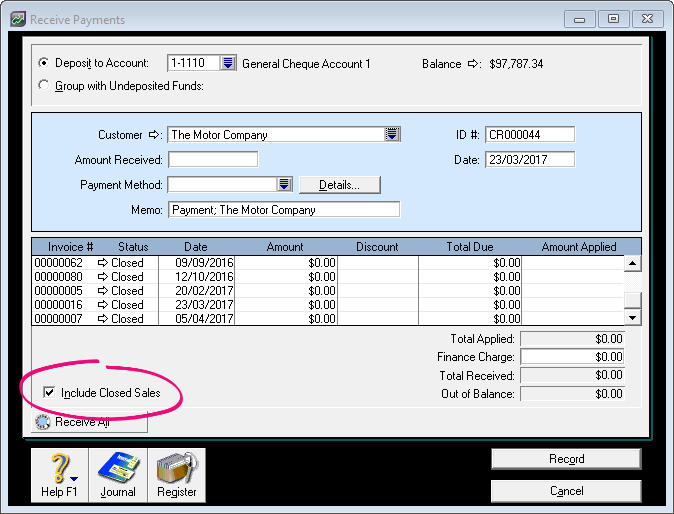

| Pay an invoice twice | Apply the first payment to the unpaid (open) invoice as you normally do and then record another customer payment and apply the second payment to the same invoice. As this invoice is now paid (or closed), you'll need to select the Include Closed Sales option to see it. A credit for the second payment will be automatically created. You record the payment using the Receive Payment window or by selecting the Receive Payment option in the Band Feeds window.

After creating the credit, you can settle it by refunding the amount or applying it to a future invoice. For more information on settling credits, see the AccountRight help (Australia | New Zealand). |

To write-off a small overpaid amount

Sometimes the amount is very small, like a rounding error of a few cents. When this happens, you can record a new invoice for the overpaid amount (allocate to a rounding income account, if you have one) and then apply a credit to this invoice to close it (see table above for details on how to create a credit). Learn more about writing off bad debts.

FAQs

Why am I getting the error "An unbalanced transaction may not be recorded"?

When recording your receive payments transaction the error "An unbalanced transaction may not be recorded" may occur.

This will occur when the Amount Applied column doesn't match the Amount Received. When doing an overpayment remember to enter the Amount Applied column as the full amount received.

To create a debit for the overpaid amount

How you create a debit depends on how the overpayment was made. After creating the debit, you can settle it by receiving a refund or applying it to a future bill. For more information on settling supplier debits, see the AccountRight help (Australia | New Zealand).

| Did you... | Here's what to do |

|---|---|

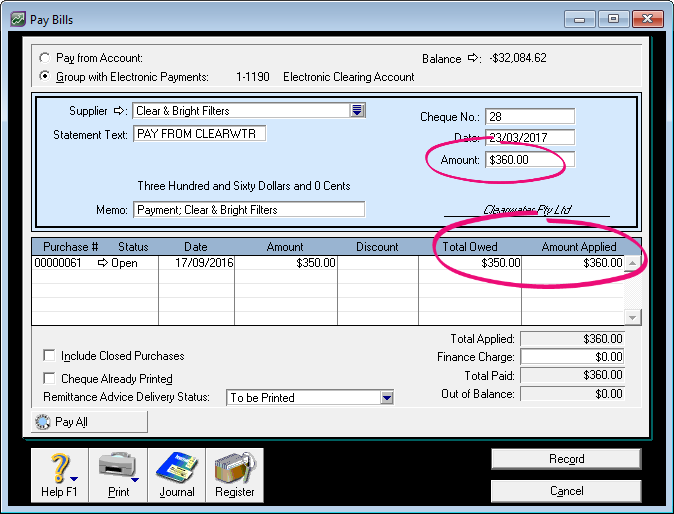

| Overpay the bill amount | When recording the payment in the Pay Bills window, enter the full payment in the Amount field and in the Amount Applied column in the scrolling list. A debit for the overpaid amount will be automatically created.

After creating the debit, you can settle it by receiving a refund or applying it to a future bill. For more information on settling supplier debits, see the AccountRight help (Australia | New Zealand). |

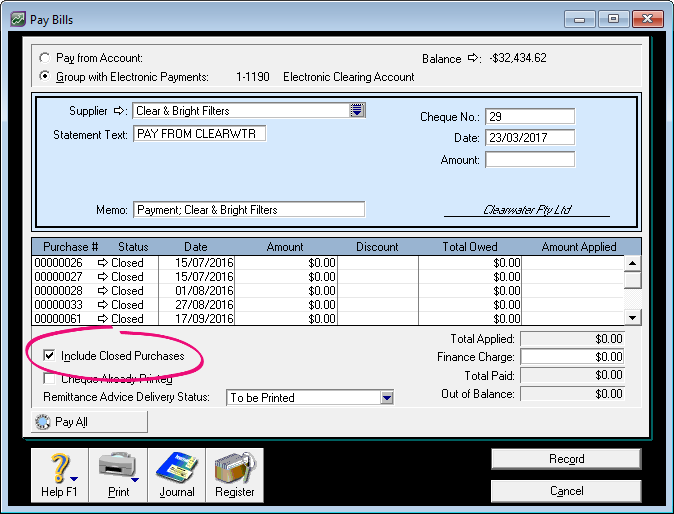

| Pay a bill twice | Apply the first payment to the unpaid (open) bill as you normally do and then record another supplier payment and apply the second payment to the same bill. As this bill is now paid (or closed), you'll need to select the Include Closed Purchases option to see it. A debit for the second payment will be automatically created.

You record the payment using the Pay Bills window or by selecting the Pay Bills option in the Band Feeds window. After creating the debit, you can settle it by receiving a refund or applying it to a future bill. For more information on settling supplier debits, see the AccountRight help (Australia | New Zealand). |

FAQs

Why am I getting the error "An unbalanced transaction may not be recorded"?

When recording your receive payments transaction the error "An unbalanced transaction may not be recorded" may occur.

This will occur when the Amount Applied column doesn't match the Amount Received. When doing an overpayment remember to enter the Amount Applied column as the full amount received.