- Created by Rachael Mullins, last modified by AdrianC on Jul 18, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 21 Next »

https://help.myob.com/wiki/x/DrIHAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Use the Receive Money window to record money your company receives, other than for sales you recorded in the Sales command centre (for invoice payments use the Receive Payments window in the Sales command centre).

You can use the Receive Money window to record amounts paid to the business such as interest payments or capital injections. Enter the details of the payment, such as the payment details, payee and whether the amount is GST inclusive or not.

You can specify whether the payment was made directly to a bank account or whether it will be deposited together with other undeposited funds later.

Speed up data entry

Use bank feeds to bring your bank transactions into AccountRight. For recurring transactions, set up rules to automatically record these transactions.

To record money you receive

- Go to the Banking command centre and click Receive Money. The Receive Money window appears.

- Choose the account that will be used to record the money.

- Deposit to Account. Select this option if the money was deposited directly to your bank account.

- Group with Undeposited Funds. Select this option if the money will be deposited at a later time. For information about undeposited funds, see About undeposited funds.

- If the deposit amount included tax or GST, select the Tax Inclusive (Australia) or GST Inclusive (New Zealand) option.

- In the Payor field, enter the payor’s card.

- In the Amount Received field, type the amount received.

- [Optional] In the Payment Method field, select the payment method.

- [Optional] If you want to record additional details about the transaction, such as a cheque number, click Details and record the details in the Applied Payment Details window that appears.

- Enter the date of the transaction.

- [Optional] Type a detailed comment in the Memo field to help you identify the transaction later.

Allocate the amount to the appropriate account.

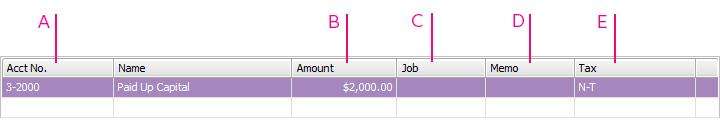

A Enter an account to which you want to assign the transaction or part of the transaction. B Type the amount you want to assign to this account. The total amount in this column must equal the amount in the Amount Received field before you can record the transaction. C [Optional] Assign the amount to a job by entering the job code here. D [Optional] Type a memo for each entry in the transaction. E The tax/GST code that is linked to the allocation account appears here automatically. You can change it if necessary. If the payment covers more than one account, repeat step 10 on a new transaction line.

- If you want to view or change the tax or GST amounts assigned to the transaction, click the zoom arrow (

) next to the Tax (Australia) or GST (New Zealand) field.

) next to the Tax (Australia) or GST (New Zealand) field. [Optional] If you use categories and want to assign the transaction to a particular category, select a category from the Category list.

To store the transaction as a recurring transaction so that you can use it again, click Save as Recurring. In the Recurring Schedule Information window, enter the necessary information and click OK. For more information, see Recurring transactions.

- Click Record.

Receive money FAQs

Which accounts can I receive money into?

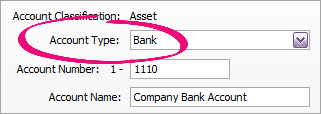

Only banking accounts can be selected as the Deposit to Account in the Receive Money window. Banking accounts have a Bank (for 1-xxxx accounts) or Credit Card (for 2-xxx accounts) account type. If you can't select an account in the Receive Money window, check the account set up (Lists > Accounts > select the account and click Edit). Here's an example of a bank account.

How do I delete a line from a Receive Money transaction?

To delete a line from a Receive Money transaction:

- Click to highlight the account number for the line to be removed.

- Press the Delete key on your keyboard.

- Click out of the account number field. The line will be removed.

What does Auto # mean in the ID No. field?

The default number shown in the ID No. field is the next available number. When you click in the ID No. field, Auto # appears to confirm that the number has been automatically selected for you. You can type a different number into the field if you want. Subsequent ID numbers will then increment from the new number. If your ID number includes letters, the letters won't automatically appear in subsequent ID numbers (you'll need to enter these each time).

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.