- Created by ErikV, last modified by AdrianC on Sep 12, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 25 Next »

https://help.myob.com/wiki/x/r4A_AQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

According to the ATO:

- Luxury car tax (LCT) is payable by businesses that sell or import luxury cars (dealers), or individuals who import luxury cars.

- LCT is calculated on cars with a GST inclusive value above the LCT threshold.

- If your business sells luxury cars, you need to be registered for GST and LCT.

For all the details of LCT, including the current rate, threshold, and how to register check the ATO website.

Ask an expert

LCT is a complex area. An accounting advisor will usually help a business who pays LCT to meet their ATO reporting obligations.

We'll explain how AccountRight handles LCT, but if you need help beyond what's provided here, try our community forum. There you'll find lots of accountants, bookkeepers and other tax experts who are happy to share their business-specific knowledge and advice.

Tracking LCT in AccountRight

AccountRight uses tax codes to calculate tax. By default there's a a GST tax code in your company file to calculate 10% GST, and there's also an LCT tax code to calculate LCT. The LCT tax code is where the tax rate and threshold is set. This ensures LCT is only calculated on values above the threshold.

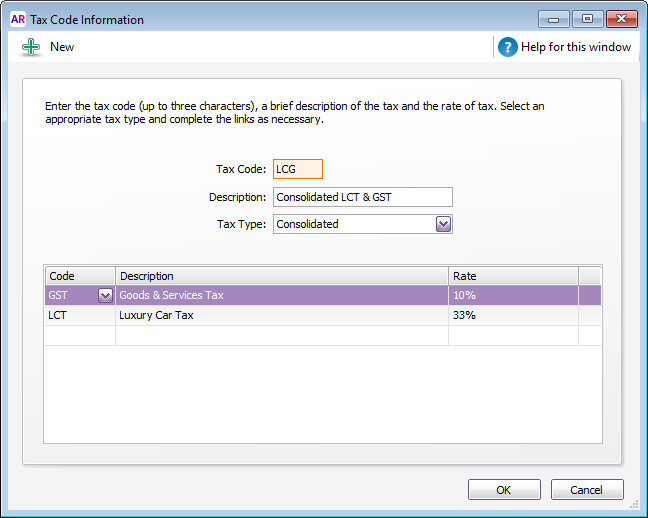

A luxury car will typically attract GST and LCT. Because you can only specify one tax code against a sale item, AccountRight also has a consolidated tax code (LCG). This tax code combines GST and LCT to ensure both taxes are calculated and tracked.

Before tracking LCT in AccountRight, you'll need to set up the LCT tax code. AccountRight can then calculate LCT on your luxury car sales.

- Go to the Lists menu and choose Tax Codes. The Tax Code List window appears.

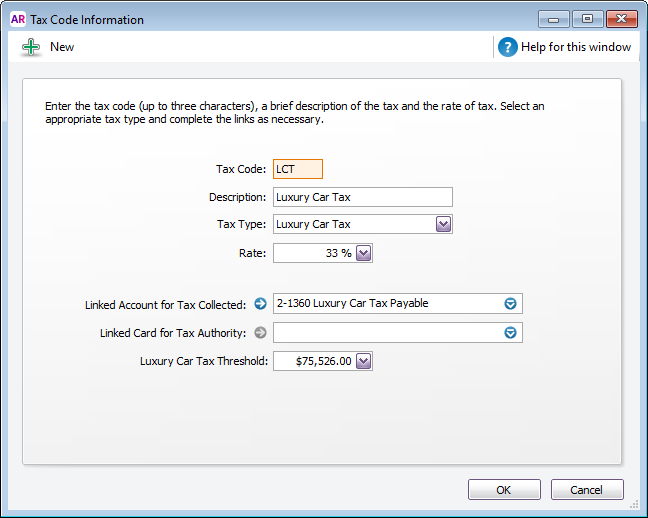

- Click the zoom arrow next to the LCT tax code. The Tax Code Information window appears.

- Set the Rate and Luxury Car Tax Threshold. Check the current values on the ATO website.

- Select your Linked Account for Tax Collected. Check with your accounting advisor if unsure.

- Click OK. Here's our example:

Opening the LCG (Consolidated LCT & GST) tax code shows it combines GST and LCT.

Need to create a tax code? Learn how.

Example

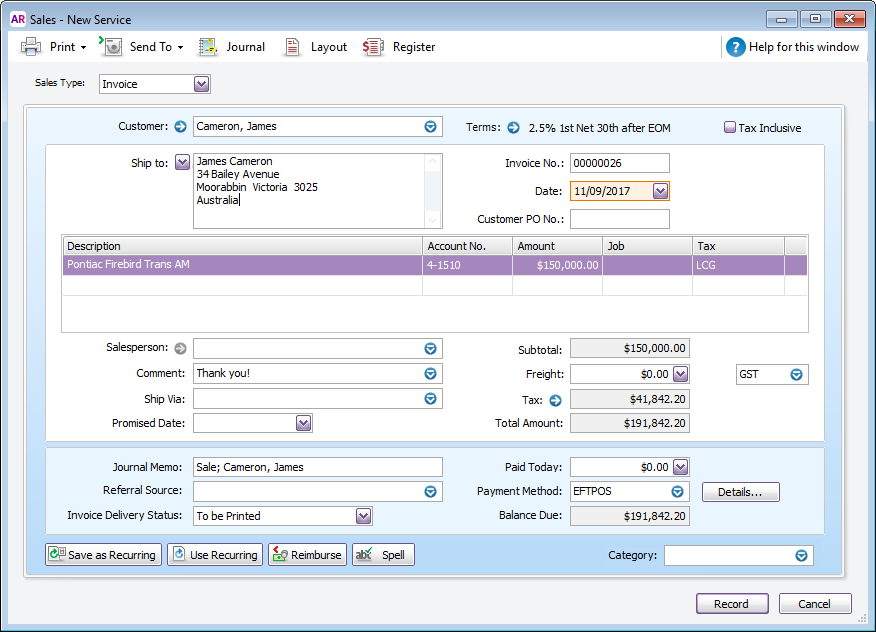

XYZ Company sells a luxury car to a customer worth $150,000 (GST exclusive value). This means the LCT value of the car is $165,000 ($150,000 + 10% GST).

- Create an invoice for the luxury car.

- Deselect the Tax Inclusive option.

- Use the consolidated tax code LCG. Here's our example:

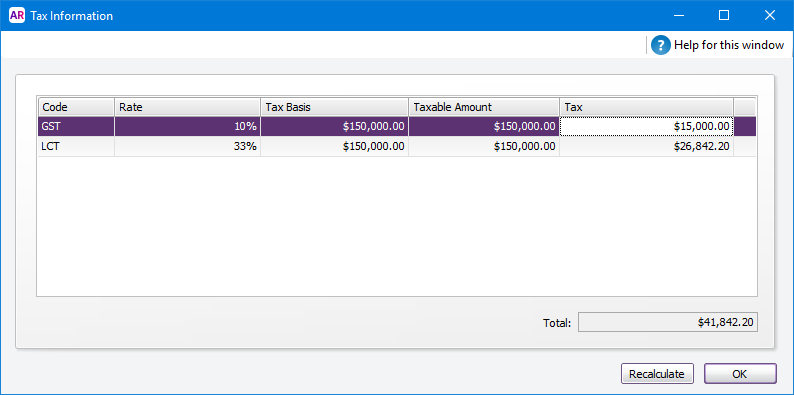

- To view the calculated GST and LCT values, click the zoom arrow beside the Tax amount on the invoice.

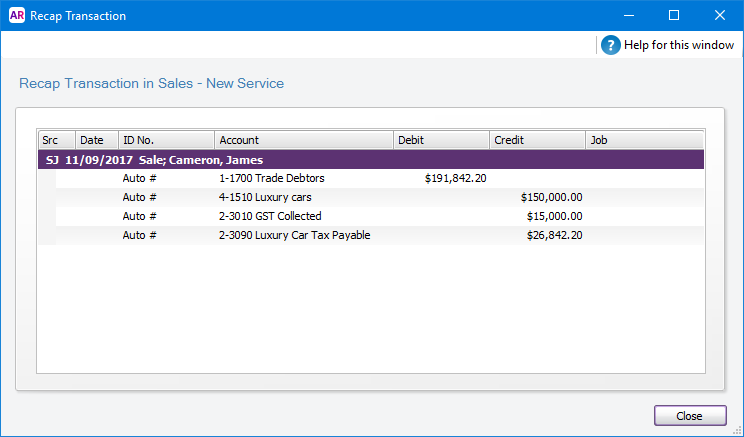

- To view the account allocation for this transaction, go to the Edit menu and choose Recap Transaction:

- Complete the sale as usual.

LCT calculation

LCT = 33/100 x 10/11 x (tax inclusive car value - LCT threshold)

So in our example:

LCT = 33/100 x 10/11 x (165,000 - 75,526)

LCT = 26,842.20

LCT on your BAS

LCT amounts calculated using the LCT or LCG tax codes will be reported on your BAS at label 1E. This is the amount of LCT payable. Label 1F on your BAS is for making LCT adjustments.

Using our example above, XYZ Company would include $15,000 GST and $26,842.20 LCT on their BAS. Unlike GST, no input tax credit is available for LCT, regardless of whether the luxury car is used within the business or for private purposes.

Learn about setting up and preparing activity statements.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.