- Created by admin, last modified by AdrianC on Jan 23, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 30 Next »

https://help.myob.com/wiki/x/Si13AQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

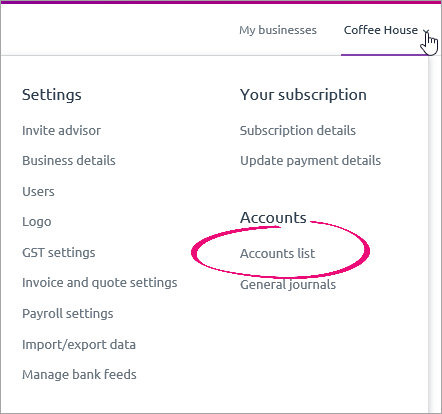

In the Accounts List page (accessible by clicking your business name and choosing Accounts list) you can view, add, edit and delete accounts (or, make them inactive). You can also enter opening balances for new accounts, and view account tax rates.

Setting up your accounts list? Learn about Importing an accounts list and entering opening balances.

Watch this video to learn more about managing your accounts list.

Accounts

Accounts provide a means for grouping similar transactions. For example, if your business pays rent for the use of its premises, you would create a rent account and then allocate all rent payments to that account. Accounts also include your bank and credit card accounts.

Account numbers

Each account is identified by a unique five digit number. The first digit indicates the account’s classification (for example, accounts starting with 6 are expense accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.

Account types

Each account must be assigned an account type before it can be used to track your business’s financial activity. You can choose from 12 different account types:

- Banking, Current Assets, Fixed Assets (asset accounts)

- Credit Card, Current Liabilities, Long Term Liabilities (liability accounts)

- Equity (equity account)

- Income, Other Income (income accounts)

- Cost of Sales, Expense, Other Expense (expense accounts)

Each account type serves a specific purpose. If you’re unsure about which type you should assign to a new account, ask your accounting advisor.

Note that an account type can't be changed if it has a current balance. For information on changing an account type, see Adding, editing and deleting accounts.

Accounts list

The accounts you use for your business are grouped in an accounts list (also known as a chart of accounts). When you registered and set up MYOB Essentials, an accounts list was selected for you based on the business type you specified. You also reviewed this accounts list during setup.

If any of the existing accounts that came with MYOB Essentials don’t meet your business needs, you can edit them so that they do. You can also make an existing account inactive, add a new account, and in certain circumstances, delete an account.

FAQs

What are the default accounts lists for each business type?

All accounts lists provided by MYOB Essentials include the same set of standard accounts, plus some extra accounts tailored for the specific business type. For example, a business that sells products will have a Cost of Sales account for Raw Materials, and a business involved in agriculture will have an expense account for Pesticide.

System accounts

System accounts are required by MYOB Essentials, and will be created even if you choose not to use one of the accounts lists provided by MYOB Essentials. You can’t delete these accounts.

- Asset accounts: ABN withholding credits, Accounts receivable

- Liability accounts: ABN withholdings payable, Accounts payable, GST collected, GST paid, PAYG withholdings payable, Payroll deductions, Superannuation payable

- Equity accounts: Income tax, Historical balancing, Retained earnings, Current year earnings

- Expense accounts: Discounts given, Superannuation expense, Wages & salaries, Discount received.

Standard accounts list

All accounts lists provided by MYOB Essentials include the following accounts, plus additional accounts depending on the business type:

Account type | Accounts included |

|---|---|

| Asset |

|

Liability |

|

Equity |

|

| Expense |

|

Other Income |

|

Other Expense |

|

Additional accounts for each business type

In addition to the standard set of accounts, the accounts list for each business type includes the following accounts:

| Business type | Includes... |

|---|---|

I sell products |

|

I sell services |

|

I sell products & services |

|

I work in building & construction |

|

I work in agriculture |

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.