- Created by KimP, last modified by MartinW on Jan 23, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 30 Next »

https://help.myob.com/wiki/x/oC13AQ

Great! You've configured a common ledger.

The next thing is to check that the balances in your client's data file are the same as the balances in your ledger. Performing an opening review is a convenient function that compares your client's balances to yours and fixes any differences.

How it works

Account balances from your general ledger software are compared against the balances in your client's MYOB AccountRight or Essentials common ledger. If there's a variance between the account balances, the Perform Opening Review function posts an adjustment journal to the common ledger. Once posted, your balances will be in line with your general ledger balances.

First you review opening balances

Then you

Perform the opening balance review

There are three main tasks:

To selecting your accountants general ledger software and the balances to be updated, follow the steps below:

- Open your client's Client Accounting > Trial Balance (Workpapers) tab.

- On the TASKS bar, click Perform Opening Review.

- Select the general ledger product used for this client.

- If MAS, Accounts or AO Classic GL is selected, click the

button to search and choose the ledger.

button to search and choose the ledger. - If Other is selected, click the

button to browse and navigate to the .CSV import file containing the balances.

button to browse and navigate to the .CSV import file containing the balances.

- If MAS, Accounts or AO Classic GL is selected, click the

From the following options, select the balances to be used for comparison.

Option Description Closing balances for the previous year Compare the accounts and update balances for both the previous year and current year. Closing balances for the current year Compare the accounts and update balances for the current year only. - Click Next to continue to map the accounts. Alternatively, if you wish to continue this process later, click Save as Draft to save your selections and close the Opening Review wizard.

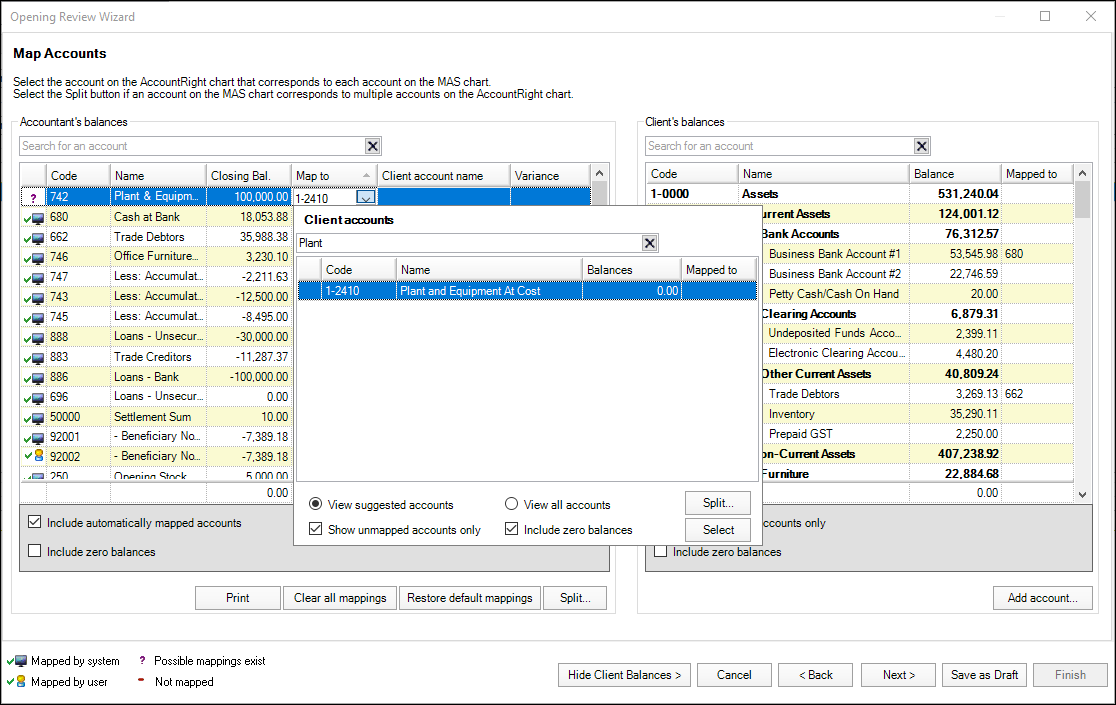

The Map Accounts screen lets compare the balances between the accounts in your selected ledger, and the accounts in your client's ledger to ensure they are aligned. Where the account balance varies between the accounts, an adjustment journal will be created to align the balances.

The system will map some of your general ledger accounts automatically, including those that have exactly the same balance as an account on the client's chart, where no other accounts exist with the same balance. The system may also suggest accounts you may wish to map to based on the description and balances of the accounts.

The Map Accounts window

The Map Accounts window displays the account balances that appear in the selected MAS, Accounts, AO Classic General Ledger or .CSV file to the left of the window, under Accountants balances. This is where you will map your accounts. To help you with this process, the accounts and balances that appear in your client's file are displayed to the right of the window under Client's balances. This can be hidden by clicking Hide Client Balances.

| Field | Description | |

|---|---|---|

| A | Mapped status | Displays the mapped status of the account where:

|

| B | Accountant's balances | Account code, name and closing balance from the selected MAS, Accounts, AO Classic General Ledger or .CSV file. |

| C | Map to | The mapped account code in your client's ledger that corresponds to the code in your accountant's ledger. |

| D | Client Account Name, Variance | The name of the account code mapped in your client's ledger and the difference between the balances in the accounts. This is the amount to be debited or credited to the common ledger. |

| E | Client's Balances | Your client's account code, name and closing balance. |

| F | Mapped to | The account code in your ledger that has been mapped to the client account. |

| G | Include zero balances | Displays all accounts, including those with zero balances. |

| H | Include automatically mapped accounts | Displays accounts that have been automatically mapped by the system. |

| I | Clear all mappings | Clears all mappings including automatic system mappings and any manual mappings made by you. |

| J | Restore default mappings | Clears any changes made to the mappings and restores the account mappings to its original state. |

| K | Split... | Map an Accountant’s balances account to two or more client accounts. |

| L | Add Account | Add a new account to your client's Account List. |

| M | Hide Client Balances > | Hides the Client's balances displayed to the right of the Accountant's balances. Where hidden, this button will change to Show Client Balances which, when toggled will re-display the client chart of accounts. |

Have a go at mapping the remaining accounts by following the steps below.

- In the Map Accounts screen, select an account from the Accountants balances by clicking on the blank cell in the Map to column for the account code.

From the Client accounts selection window, search for or select the account from your client's chart that corresponds with the account code in your general ledger software.

If you know the account code in your client's ledger that corresponds to the account selected, you can type the code straight into the Map to field. Then press the TAB key on the keyboard to go to the next row.

Repeat steps 1 and 2 until all accounts in the Accountant's balances have an account code in the Map to column.

Click Next to proceed to the next step or click Save as Draft to save the mapping and close the Opening Review wizard.

Now that you've mapped your accounts, review the changes to be made to the ledger and ensuring the adjustment journal to be posted to the common ledger is balanced.

The Confirmation window list the journal entry that will be posted to the client's AccountRight or Essentials file to align their current year balances with the balances in your general ledger.

If you have selected to review Closing balances for the previous year in task 1, comparative balances for the prior year will be adjusted. These prior year changes will not be posted to the AccountRight or Essentials ledger but will instead be stored separately for use by Client Accounting only. To view changes to be made in the prior year you'll also have a click View modified closing balances button.

Before completing the opening review, you'll need to ensure that the journal to be posted is in balance. Once you have reviewed the journal, click Finish to post all journals and update prior year balances or Save as Draft to save your changes and close the Opening Review wizard without posting any journals.

My balances and my client's balances are the same!

If your client's ledger balances in the prior year and past 5 years are the same as the balances in your general ledger, it's time to define Balance Forward Accounts.

My balances and my client's balances are different!

If your client's balances are different to yours, post a journal to bring them into alignment.

Use this table to pick the most effective way for you to update your client's file.

First print your Trial Balance and compare to either...

| Method | Description | Best if... |

|---|---|---|

| Perform opening review | Compares account balances from your current general ledger with the balances in your client's MYOB AccountRight or Essentials common ledger. This method posts to your client's ledger. |

|

| Modify prior year balances | Lets you adjust the prior year balances in the configured common ledger. This option doesn't post to the client company file. |

|

| Process manual journals | Manually prepare and post journals into the AccountRight or Essentials file to align the balances between your general ledger and your client's common ledger. |

|

Configuring the client (AE Help)

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.