How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Article ID: 25429784

ARTICLE LAST UPDATED: Apr 14, 2022 09:53

We've updated this page with 2021 PLS validation messages.

There are a number of PLS rejections that the ATO has identified as a known issue. This includes XML03 errors and other rejections. For the full list, see List of PLS/SBR issues

To fix your rejected tax return, follow these 3 steps:

Find the error code in your rejection report as shown below.

To view the rejection report

- Open the tax return

- From the Menu bar select Lodgment > Electronic > PLS reports.

Errors are grouped into 3 categories, and each has its own prefix:

| Category | Prefix |

|---|---|

| Authentication errors | CMN.ATO.AUTH |

| General errors | CMN.ATO.GEN |

Form errors examples:

| CMN.ATO.<form type> |

Click the category tab below to find your error code.

Code: CMN.ATO.AUTH.006

Message: The software provider has not been nominated to secure your online (cloud) transmissions.

Details: You'll see this error if the Agent ABN or the Practice ABN in Tax and the ABN registered in the ATO access Manager for the Software ID aren't the same. This can happen if you have multiple agents or you used the company or business ABN in Tax.

To fix the issue:

- Make sure that both the ATO Access Manager and MYOB Tax have matching ABNs

- Complete the onboarding process again using the Authorise Agents option on the Lodgment Manager homepage.

Once the ABN has been confirmed in ATO Access Manager and MYOB Tax, you can continue lodging.

Code: CMN.ATO.AUTH.007

Message: You do not have the correct permissions to submit this request or retrieve this file. Contact your AUSkey administrator to authorise your AUSkey for the relevant registered agent number.

Details: Review your permissions in Access Manager or contact your AUSKEY administrator. Check that the client identifiers on your client record in your software are correct:

- Is the ABN correct for the TFN?

- Is the TFN correct for the client name?

- Is the ABN correct for the client name?

To fix the issue:

Check the following and relodge the return:

- In ATO Access manager under Access/Permissions, check if the agent number is added, it has full permissions and can Prepare and Lodge returns of that type.

- Check if your client's ABN is active on abr.business.gov.au. If it's no longer active, remove the ABN in the tax return—Return Properties > General tab.

- Check on the ATO Tax Agent Portal that the:

- client is listed under the tax obligations subsection. If it's missing, add it.

- ABN, TFN and Client Activity Center (ABN Branch Number) are the same as those entered in MYOB Tax. Enter the ABN Branch Number—Return Properties > General tab > Division number.

- Check that the tax return is assigned to the correct agent—Return Properties > Staff tab.

If it's still an issue, delete and re-add the client on the ATO tax agent portal.

MYOB Internal Notes

Insert PR# 143199671430

Code: CMN.ATO.AUTH.008

Message: Your nomination with the online (cloud) software provider does not contain the correct Software ID.

Details: Your nomination with the software provider might not have the correct Software ID in Access Manager. To resolve, log on to Access Manager (AUSkey required), select ?my nominated software provider? and update the nomination, or call the ATO.

Provide the following details:

- Software provider name and/or their ABN

- Software ID

You are not authorised to lodge on behalf of this client.

Code: CMN.ATO.AUTH.011

Message: The client you transmitted is not associated with the agent number you supplied and cannot be authorised.

Details: A link between your client and your agent number does not exist for the selected task. You'll get this error if the details in the tax return don't match the ATO records.

Check that you've added this client to your registered agent number. You might also check that you've entered the right client identifier, also that you're using the right registered agent number, then try again.

For example the:

- taxpayer's ABN in the tax return—Return Properties > General tab does not match the one in the ABN register abr.business.gov.au for the same taxpayer

- name on the CU form doesn't match the details on the ATO Portal or in abr.business.gov.au.

To fix the issue:

Edit the details in the tax return to match the details in the ATO records. Remember that text is case sensitive. If you're still getting the error, contact the ATO

MYOB Internal Notes

Insert PR# 156182856583

SR # 156027383950

| Code | Message | Details |

|---|---|---|

| CMN.ATO.GEN.EM0001 | An unexpected error has occurred, try again. If the problem persists, contact the ATO. | This means that the ATO has identified an error, but is not able to provide the correct rejection message. You'll see the specific error message when you re-lodge the tax return. If you don't receive a specific error message, contact the ATO Intermediaries and lodgments service on 13 72 86. For more information see Tax agent phone services (Fast Key Code) guide. |

| CMN.ATO.GEN.EM0001 | Lodgment failed. Contact the ATO. Error code 90180 | If you are still getting this error, contact the ATO. |

| CMN.ATO.GEN.EM0004 | Error detected. Errors have been detected and form has not been processed. Review errors and update where required. | This error indicates an issue with the form lodged. A second message explaining the reason usually follows |

| CMN.ATO.GEN.EM0008 CMN.ATO.GEN.EM0014 | Authorisation to access taxpayer details failed. Confirm client to agent relationship and resubmit. | You'll see this error if some of your client's details in the CU form don't match the ATO records. It could be your client's name, date of birth or TFN. These fields must match exactly to the ATO records. For example, if there was an extra space in the client's name in the ATO records but not in your CU form, the return will be rejected. For trust returns, find the name on abr.business.gov.au and enter the name in the return exactly as you find it on the abr website. |

Code: CMN.ATO.GEN.XBRL03

Details: The value specified for an item does not match the item type

This error occurs in a 2020 Trust tax return where there is a NRAS tax offset at Item 51 F

To fix the issue

Call MYOB Support.

Code: CMN.ATO.GEN.000411

Message: Suburb/Town/City cannot contain state code

Details: You'll see this issue on the Rental schedule (B).

To fix the issue:

Remove any State code in the Suburb/Town field. For example, in the suburb EAST VIC PARK, remove the VIC.

Code: CMN.ATO.GEN.000417

Message: Non-Individual name cannot end with "T/A", "T/A P'ship", "T/A Pship", "T/A P/Ship" or "T/A Partnership"

To fix this issue:

We've added an F3 validation check to item 36: Business name of main business.

Code: CMN.ATO.GEN.000459

Message: Title is invalid

You'll see this error when you select the title RtRev Bishop.

Code: CMN.ATO.GEN.200001

Message: An unexpected error has occurred. Contact the ATO

Details: You'll see this error if the Practice ABN and/or the Tax Agent ABN do not match with the registered name.

To fix the issue:

- Check if the practice ABN is registered and active on abr.business.gov.au.

- Check the TAN is present and valid on tbp.gov.au.

- If the TAN is registered, check the name used for the TAN matches the name listed against the practice ABN on abr.business.gov.au.

- If all of the above is correct, check that the ABN entered in the return is also correct.

If this is still an issue contact the ATO.

MYOB Internal Notes

Insert PR# 145489765503

Code: CMN.ATO.GEN.410063

Message: Given name must contain at least one alphabetical character.

To fix the issue:

Remove any hyphens in the Given name and relodge.

Code: CMN.ATO.GEN.410218

Message: First given name must be entered if Other given names is entered.

You'll see this error in the Interest and dividends paid (BT) schedule when the person's first given name is blank but you've entered a value in Other given names.

To fix the issue:

Enter a name in the First given name field as this field is mandatory and relodge.

Code: CMN.ATO.GEN.500125

Message: Branch code must not be provided for Role Type IT

To fix the issue:

Enter the ABN Branch code in the CUREL and CUADDR forms and relodge.

Agent Reports

Code: CMN.ATO.ODRPT.EM1001

Message: Only one 'Whole of Agency' report can be requested per day

You can only request the ASLR once a day. If you reschedule it, you'll get this error.

Activity statements

Code: CMN.ATO.AS.EM023

Message: You must select a reason for the variation at T4.

Select a reason from the drop list at T4 and relodge.

Code: CMN.ATO.AS.EM024

Message: Access to the activity statement is not available. Contact the ATO.

Details: This could be due to:

- you not being authorised to have access

- the record is restricted

- the ABN you've provided is not recognised by the Tax Office

- the TFN you've provided is not acceptable, or

- your proof of identity is not accepted.

To check that these details are correct, contact the ATO on 1300 139 373. You'll need to supply the following information:

- name

- address

- TFN or ABN

- account or client account number (if applicable)

- the activity statement period.

This error occurs with a revised activity statement when the original AS was lodged via ELS and now the PLS form type is wrong in the amended activity statement.

In this instance, contact the ATO to get the correct PLS form type.

To fix the issue:

Make sure you've entered the correct ABN or Branch code if relevant, or TFN when generating a Single Request in the Activity Statement Obligations homepage. You might also check your permissions to lodge activity statements in the ATO Access Manager

Code: CMN.ATO.AS.EM059

Message: Complete PAYG-W prior to submitting the activity statement.

Details: Our records show that you have not entered data for PAYG-W which you are required to report on. You will be expected to complete the obligation prior to submitting the activity statement. If you believe you are not registered for this obligation, contact the Tax Office on 1300 139 373

To fix the issue:

Enter a zero at labels W1 to W5 and relodge.

Code: CMN.ATO.AS.EM060

Message: <Field> was reported as <amount> and will be corrected to <amount>

You'll see this error if the amounts in the activity statement do not match the ATO data.

To fix the issue:

Edit the activity statement to match the amount shown on the rejection message and re-lodge.

Amounts are not automatically corrected.

Code: CMN.ATO.AS.EM063

Message: The activity statement you are trying to lodge has been either lodged, cancelled or discontinued.

Details: Access to the activity statement is not available. Contact ATO.

You could check with the client to see if it has been lodged, cancelled or discontinued. If it's been lodged, then update its status to lodged.

- Follow the menu path Lodgment > Update > I P T C F Forms.

- Make sure the Single Return option is selected.

- Click OK. The Lodgment Update window displays showing the current status of the return.

- At the Status field, click the drop-down arrow and select Lodged.

Company tax return

Code: CMN.ATO.IDS.440147

This error occurs in the International Dealings Schedule.

Solution: We've addressed these issue in hotfix 52701915.

Deductions schedule

Code: DDCTNS.000215 - other work related expenses amount must be provided.

This error happens because the motor vehicle expenses (mve) worksheet is automatically allocated to Item D5 incorrectly.

Solution: We've resolved this issue in hotfix 52701915.

FBT 2022

Code: CMN.ATO.GEN.XML03

Text": "A field contains invalid data (such as letters in numeric or date field).",

Description: This rejection happens if you've entered more than 2 digits or special characters in the area code field in the phone number.

Solution: We're aware of this and working on a solution.

Make sure you enter only 2 digits such as 04, 61, and no special characters like +

Code: CMN.ATO.GEN.XML03

Text: "A field contains invalid data (such as letters in numeric or date field)."

Value '0' was either too large or too small for PositiveInteger."

Description: This rejection happens if you've entered a zero in a field but requires a number greater than zero.

Solution: The rejection report will show which field requires a number greater than zero. Enter the details and re-lodge.

INCDTS worksheets

Code: CMN.ATO.INCLDTS.000014

Summary: When a positive Superannuation income stream tax withheld amount is present and the answer to the question "Are you under 60 years of age and a death benefits dependant, where the deceased died at 60 years or over?" is 'no' (false), a positive amount for Superannuation income stream taxable component taxed element, Superannuation income stream taxable component untaxed element, Superannuation income stream tax free component, Superannuation income stream lump sum in arrears taxable component taxed element, Superannuation income stream lump sum in arrears taxable component untaxed element or Superannuation income stream lump sum in arrears tax free component must also be provided

Solution: To fix the issue, call support and quote the rejection error number.

Support notes

You may need to edit the output file to fix the issue. Talk to Daljit, Adeel or Ben

Code: CMN.ATO.INCDTLS.000365

Summary: Other foreign income instance is incomplete

The error happens in the Distributions from Trust worksheet where there's a zero in the foreign income section but the foreign income schedule has not been completed.

Solution: If there's no foreign income applicable for the tax return:

- Delete the code from the distributions from Trusts worksheet and

- Delete the 'for' schedule from preparation > delete schedules.

Code: CMN.ATO.INCLDTS.000375

Summary: Business income statement industry production type must not be provided.

The error happens when there's industry production type in the business income statements and payment summaries (bip) worksheet.

Solution: To fix the issue, remove the code from industry production type and relodge.

Consolidated trust distributions (ctd) are automatically created when you create a Distributions received from Trusts worksheets (dit) or Distributions received from Managed Funds (dim).

Code: CMN.ATO.INCDLTS.000391

Summary: Trust credits from income and tax offsets details is complete.

Code: CMN.ATO.INCDLTS.000392

Summary: Credit for tax paid by trust must be provided.

These errors happen on the Consolidated trust distributions (ctd) worksheets, where the Reason the trustee paid tax from trusts field is completed when not required.

The Consolidated trust distributions (ctd) worksheet is total of all the trust distributions (dit) and distributions received from managed fund worksheet (dim).

Solution: We've addressed these issue in hotfix 52701915.

Code: CMN.ATO.INCDTLS.000381

This occurs in the Distributions received from Trusts (dit) worksheet.

Summary: Non-primary production net income from trusts amount details are incomplete".

Detail: "Where Non-primary production net income from trusts (less capital gains, foreign income and franked distributions) is present, both the Non-primary production managed investment scheme amount and the Non-primary production remaining trust amount must be provided".

Enter a value 0 or greater at Label Share of label U Income related to financial invest.

Solution: We've addressed these issue in hotfix 52701915.

Code: CMN.ATO.INCDTLS.000384

This occurs in the Distributions received from Trusts (dit) worksheet.

Summary: Franked distributions from trust amount details are incomplete.

Detail: "Where Franked distributions from trusts is present, both the franked distributions from trusts relating to investments and franked distributions remaining amount from trust must be provided."

Enter a value 0 or greater at label Franked distribs relating to invest. in Label C.

Solution: We've addressed these issue in hotfix 52701915.

Code: CMN.ATO.INCDTLS.000391, CMN.ATO.INCDTLS.000392

This occurs in the Consolidated trust distributions (ctd) worksheet.

Solution: We've addressed these issue in hotfix 52701915.

Individual tax return

CMN.ATO.IITR.100031

This error incorrectly occurs when you validate the tax return in MYOB.

Solution:

We're aware of this issue and working on a solution. As a workaround, lodge via paper.

CMN.ATO.IITR.730083 -Gross interest amount must be provided.

This error occurs in the interest income worksheet where there are 2 or more ATO pre-fill data and an incorrect total is integrating into Item 10 in the tax return.

This is a refreshing issue.

Solution:

- Go to the interest worksheet.

- Click the blank TFN withholding field (the non-ATO pre-fill field) and press tab.

- Press F6 to close out of the worksheet.

Code: CMN.ATO.IITR.730085 - TFN amounts withheld from gross interest in incorrect.

This error occurs in the interest income worksheet if the TFN amount withheld has cents.

We're investigating this issue.

Workaround: As a workaround, remove any cents from the TFN amount withheld field and re-lodge.

Code: CMN.ATO.IITR.730086 - Exempt foreign employment income amount is incorrect

This error occurs in the Foreign employment income Non-Payment Summary (fem) worksheet.

We're investigating this issue and working on a solution.

| CMN.ATO.IITR.730088 - Assessable foreign source income amount is incorrect. | This error occurs when there are multiple distributions from managed fund (dim) worksheets with foreign income (with decimal places). | We're aware of this issue and working on a solution. |

| This error occurs when there deductions in the foreign pension and annuities (fpa) worksheet. | We're aware of this issue and working on a solution. As a workaround,

| |

| This error occurs when there's an amount at Item 19 CFC income or Transferor trust income | We're aware of this issue and working on a solution. | |

| This error occurs when the taxpayer is a part-year resident and has a foreign rental property rented for the full financial year. | We're aware of this issue and working on a solution. As a workaround, enter the amounts directly in the foreign income worksheet (for) and do not use the foreign rental schedule |

Code: CMN.ATO.IITR.730088, CMN.ATO.IITR.730354, CMN.ATO.IITR.730356 and CMN.ATO.IITR.730355

This error occurs at item 20 Foreign source income and foreign assets or property:

- Label D Net foreign pension or annuity income WITH an undeducted purchase price

- Label L Net foreign pension or annuity income WITHOUT an undeducted purchase price.

Solution: We've addressed this issue in hotfix 52701915.

CMN.ATO.IITR.730089 - Assessable foreign source income must be provided.

This error occurs when there's foreign income worksheet in the Distributions from Managed fund worksheet.

This is a refreshing issue.

Solution:

- Open the Distributions from managed fund worksheet.

- Tab through the fields.

- Press F6 to close out of the worksheet.

CMN.ATO.IITR.730094 - Other net foreign source income - dividend income or managed investment scheme income from foreign companies - including from foreign partnerships amount must be provided.

This error occurs if you've completed the franking credit amount in the Trans Tasman tab in the foreign income (for) worksheet.

Solution: We're investigating this issue. In the meantime, call support for a fix.

Code: CMN.ATO.IITR.730095 or CMN.ATO.IITR.730097 or CMN.ATO.IITR.310076

This error occurs when there's foreign income in the distributions from managed fund worksheet.

Solution: We're investigating this issue.

CMN.ATO.IITR.730096 - Other foreign source income amount must be provided. Where any Other foreign income gross amounts are present in the attached Income Details schedule, the Other foreign source income amount must be provided

This error occurs if there's a foreign tax paid but no foreign income.

Solution: We're investigating this issue. In the meantime, call support for a fix.

Code: CMN.ATO.IITR.730199

The Dividends - Franked amount must equal the sum of all Dividends franked amounts reported for the individual in the attached Income Details schedule

This is a rounding issue in the Dividends worksheet.

Solution: Round down any amount with cents in the Franked amount field and re-lodge.

CMN.ATO.IITR.730215 - Gross rent amount is incorrect

CMN.ATO.IITR.730217 - Summary: Interest deductions amount is incorrect

CMN.ATO.IITR.730219 - Capital works deductions amount is incorrect

CMN.ATO.IITR.730221 - Other rental deductions amount is incorrect

These errors occur in the multi-property rental schedule.

If the rental property has 100% in the ownership % field and there's default private %.

We're aware of this issue and working on a solution.

In the meantime, as a workaround, you can enter 99.99% in the ownership % and lodge the return.

Code: CMN.ATO.IITR.730239

This error occurs in the Business income and payment summaries (bip) if the payment type is 001 or 002.

Solution: This has been logged as an issue with the ATO. We'll update as soon as we hear from the tax office.

Code: CMN.ATO.IITR.730251

The Dividends - Franking credit amount must equal the sum of all Dividends franking credits reported for the individual in the attached Income Details schedule

This is a rounding issue in the Dividends worksheet.

Solution: Round down any amount with cents in the Franking credit amount field and re-lodge

Code: CMN.ATO.IITR.730269

If either Australian residency start date or Australian residency end date are provided, both must be provided.

This issue occurs if the taxpayer is a part-year resident and you've completed Item A2 - Part-year tax-free threshold.

Solution: We're investigating this issue.

Code: CMN.ATO.IITR.730271

This issue occurs if the taxpayer is a part-year resident and you've completed Item A2 - Part-year tax-free threshold.

Solution: We're investigating this issue.

Code: CMN.ATO.IITR.730285

Other income type category 1 - Amount is incorrect (cate 1 integrate).

This issue can occur when there's

- an expense for pest control in the multi rental property schedule

- D15 other deductions claim code type O.

Workaround:

To fix the error:

- where there is a rental expense in pest control, remove the expense amount from pest control and enter in Sundry expenses.

- where there is an amount at D15, don't use claim type O. If no other code is relevant, contact the ATO to get information on the correct code.

Solution: We're investigating this issue.

Code: CMN.ATO.IITR.730359

This error occurs if there's is more than Foreign employment non payment summary

Solution: This issue is fixed in MYOB Tax version 2020.1, Download the version from my.myob.

Code: CMN.ATO.IITR.730377

Country of residence for tax purposes when interest was paid or credited must be provided.

This error occurs for a part-year resident.

If the interest income worksheet was pre-filled by ATO prefill and Country of residence for tax purposes when interest was paid or credited field is blank.

Solution: We're aware of this issue and working on a solution. In the meantime as a workaround, complete the Country of residence for tax purposes when interest was paid or credited field in the interest worksheet.

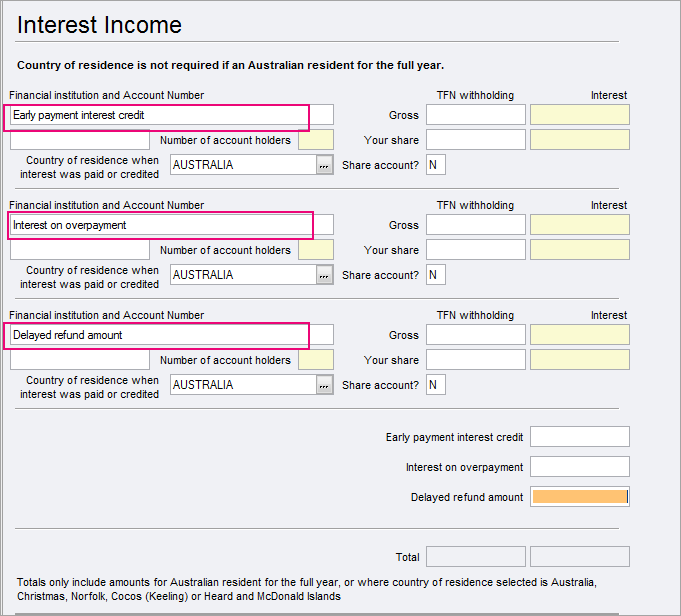

Code: CMN.ATO.IITR.730378

Country of residence for tax purposes when interest was paid or credited must be provided.

This error occurs for a part-year resident.

In the interest income worksheet, where there are amounts at

- Interest on overpayment

- Early payment interest credit

- Delayed refund amount

Solution: We're aware of this issue and working on a solution.

In the meantime as a workaround,

- Create separate records for each amount in the labels.

Enter the country of residence: Australia.

CMN.ATO.IITR.730379- TFN amounts withheld from gross interest must be provided.

This error occurs in the interest income worksheet where there are 2 or more ATO pre-fill data and an incorrect total is integrating into Item 10 in the tax return.

This is a refreshing issue.

Solution:

- Go to the interest worksheet.

- Click the TFN withholding field and press tab.

- Press F6 to close out of the worksheet.

Code: CMN.ATO.IITR.730412 - Share of net income from trusts less capital gains, foreign income, and franking distributions amount is incorrect.

This error occurs in the distribution of managed fund (dim) worksheet where there is a negative amount (with cents) in the Non-primary production income from managed fund field.

We're aware of this issue and working on a solution

In the meantime, as a workaround remove any cents from the Non-primary production income from managed fund field in the managed fund (dim) worksheet.

Code: CMN.ATO.IITR.730425 - Where credit for tax paid by trustee amounts or any Total credit for tax paid by trustee from managed fund amount or any Your share of credit for tax paid by Trustee from managed fund are present in the attached Income details schedule. Share of credit for tax paid by trustee amount must be provided.

This error occurs in the distribution from trusts (dit) worksheet where there is an amount at TFN withheld field but the Credit for tax tax paid by Trustee field is blank.

We're aware of this issue and working on a solution

In the meantime, as a workaround enter a zero Credit for tax tax paid by Trustee field.

Code: CMN.ATO.IITR.730456

This error occurs in the Distributions from Managed fund worksheet where there are cents at Current year capital gain from managed fund field.

Solution: We're looking into this issue and working on a solution. In the meantime, as a workaround remove any cents in the Capital gains label in the Distributions from Managed fund worksheet.

Code: CMN.ATO.IITR.730457

Summary: Total current year capital gains must be provided

This error occurs in the Distributions from Managed fund worksheet where there's zero at Current year capital gain from managed fund field.

Solution: We're looking into this issue and working on a solution. In the meantime, as a workaround enter zero at Capital gains label in the Distributions from Managed fund worksheet.

Code: CMN.ATO.IITR.EM0015

Message: Date of birth does not match ATO records

Details: To update your ATO records for the name, gender or date of birth, search for Updating your details with us on ato.gov.au.

This message indicates that the client's date of birth does not match the ATO records.

To fix this issue:

Check and confirm the client's date of birth and change it in your database. This will ensure the correct date is used in the return.

Code: CMN.ATO.IITR.EM0043

Message: A tax return for this period has already been lodged

If you receive this message, check the ATO Tax Agent Portal to see if the return is lodged. If it shows as Lodged, update the status to Lodged.

- Follow the menu path Lodgment > Update > I P T C F Forms.

- Make sure the Single Return option is selected.

- Click OK. The Lodgment Update window displays showing the current status of the return.

- At the Status field, click the drop-down arrow and select Lodged.

Code: CMN.ATO.IITR.EM0065

Message: Part year tax-free threshold date must be within Income Tax year

Details: Where Part year tax-free threshold date has been entered, the date must be between the period start and period end dates of the Individual tax return (IITR) lodged.

To fix the issue:

Check what you've entered at label A2 and relodge.

Code: CMN.ATO.IITR.EM60022

Message: Number of months eligible for the tax-free threshold must be within the income year.

To fix the issue:

Check the dates and relodge.

Interposed entity election

Code: CMN.ATO.IEE.410051

Message: Election Commencement Time must not be present if Income Year Specified in the election is not equal to Income Year of lodgment.

You'll need to contact the ATO to fix this.

Rental schedule (non-individual returns)

Error: CMN.ATO.RS.000143

Description: Field incorrect format. Exceeds maximum digits and/or contains illegal characters.

Solution: We've addressed this issue in hotfix 52701915. For returns created prior to installing the hotfix, make sure the value at the Number of weeks property was available for rent is not more than 52.

Self Managed fund tax return

Code: CMN.ATO.SMSFAR.436691

Message: Taxable income/loss calculation incorrect. If the answer to the question Did the fund have any other income that was assessable? is False, the taxable income or loss must equal zero income minus all deductions.

Taxable income or loss is not equal to the Total deductions amount when there is an amount greater than zero at Total assessable income.

| Code | Summary | |

|---|---|---|

| CMN.ATO.SMSFAR.437130 | Limited recourse borrowing arrangements amount greater than zero must be supplied | If there is an amount greater than zero reported at Borrowings for limited recourse borrowing arrangement, an amount greater than zero must be reported at Limited recourse borrowing arrangements. |

| CMN.ATO.SMSFAR.437131 | An amount greater than zero is required at Limited recourse borrowing arrangements | A response is required to the question If the fund had an LRBA, were the LRBA borrowings from a licensed financial institution?, if there is a value greater than zero reported at Limited recourse borrowing arrangements. |

| CMN.ATO.SMSFAR.437132 | Response required at Limited recourse borrowing arrangements (LRBA) question | A response is required to the question Did members or related parties of the fund use personal guarantees or other security for the LRBA?, if there is a value greater than zero reported at Limited recourse borrowing arrangements. |

| CMN.ATO.SMSFAR.437133 | An amount greater than zero is required at Limited recourse borrowing arrangements | An amount greater than zero is required at Limited recourse borrowing arrangements, if there is a response at questions, If the fund had an LRBA, were the LRBA borrowings from a licensed financial institution? or Did members or related parties of the fund use personal guarantees or other security for the LRBA? |

Trust tax return

You'll see this when you do an F3 validation in the software.

Error: CMN.ATO.TRT.432863

Details: If the type of trust is '232' (testamentary trust), then the assessment calculation code for each Statement of Distribution must be 25, 26, 27, 28, 29, 30, 34, 35, 125, 126, 127, 128, 129, 134, 138, 139 or 140 and the assessment calculation code in the distribution statement where no beneficiary is entitled, if present, must be 36 or 37.

Solution: We're investing a fix for this issue.

| Code | Message | |

|---|---|---|

| CMN.ATO.TRT.432639 | The Share of other refundable tax offsets plus the sum of Exploration credits is not equal to Other refundable tax offsets | In ELS, the corresponding test V2824 allowed a variance of +/- $5. PLS doesn't allow for a variance. |

| CMN.ATO.TRT.432640 | Tax offset amount is equal to zero or not present | The error occurs if zero is entered at 51G Other refundable tax offsets. To fix the error If there is no exploration credit, delete the Exploration credits worksheet (exc). |

2020 Client Update forms

Error: Http status code: 400-BadRequest. Message: Payload issue. Contact Support

This error occurs when lodging a 2020 CU form. The form is stuck as Transmitting.

We've fixed this issue on 20 July 2020.

When you've fixed the issue, press F3 to validate and complete the form. Then relodge the return.

From the Lodgment Manager homepage, edit the status of the form to be Lodged or In progress. This will remove the return

Open the tax return,

- Follow the menu path: Lodgment > Update > I P T C F forms.

- Select the default Single Return and click OK.

- Click the drop-down list at the Status field, select the required status and click OK.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.