- Created by Unknown User (vilma.zubak), last modified on Mar 04, 2016

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 17 Next »

https://help.myob.com/wiki/x/9xiEAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Portals created for each of your clients makes collaboration easy, allowing you to share documents and keep your clients up-to-date.

Before setting up your client portals, consider ...

- How you'll map your existing clients to a portal?

- Which of your clients do you want to see the documents that you publish to a portal? That is, security around documents for each entity.

- If you'll grant your client full access to the portal or contributor access only.

User types within a client portal

You're able to add the following types of users to your client portals:

| full access | a user with full access to the portal who can see all documents and associated tasks |

| contributors | users who are contributors have restricted access:

|

Client portal examples

The following examples will give you some ideas on how to set up your client portals.

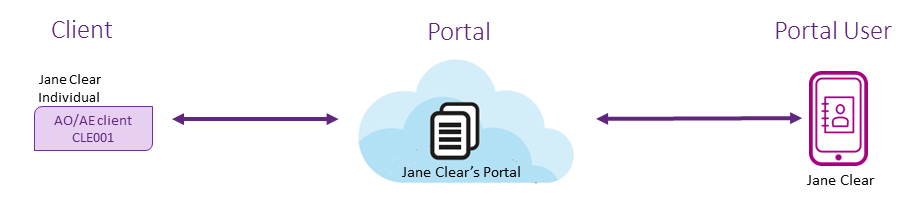

Jane Clear is an individual for whom you prepare an annual tax return and provide some financial planning advice. In MYOB Portal, you would create a portal with Jane as the sole user.

Ben and Cecila Abbot, a married couple, operate a business as a partnership. Each are familiar with the financial situation of the partnership and each other's financial details. As their accountant, you would set up a client portal for their partnership, Abbot Portal, with both Ben and Cecila as portal users.

The Darwell Family Group consists of 4 members - Lisa (Mum), Paul (Dad) and 2 children, Naomi and Sam. All of the family group are part of the Darwell Company. When you're thinking about setting up portals for the Darwell Family, you'd set up one client portal with all the members of the family group for the company and name the portal, Darwell Company. And you'd set up a separate portal for Mum and Dad for their individual tax and accounting needs and possibly one each for the siblings so that all their individual tax and accounting requirements are kept separate from the rest of the family group. Sam generates an independent income and has other assets apart from the company, which would require creating a separate portal. Naomi is still a minor and has no independent income that would necessitate a separate portal at this stage. Therefore, for the Darwell Family Group, 3 separate client portals would be created, as shown below.

Jane is refinancing her business loan and her bank has requested that she provide them with a number of documents in order to secure the loan. As her accountant, you're able to add the bank as a contributor to Jane's portal so that they can access the documents that they need. The bank won't have access to the whole portal, only to the documents that you share with them. This will save you time and resources in photocopying the documents and mailing them to the bank; and the bank can access the documents immediately speeding up the loan process. This example is shown below.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.