- Created by Suchi Govindarajan, last modified by LouiseB on May 04, 2020

https://help.myob.com/wiki/x/YR_EAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

In MYOB Client Accounting, you use workpapers to calculate and substantiate balances within accounts. If balances calculated during workpaper preparation are different to the client’s balance, you correct the balances by adding adjustment journals and posting the journals to MYOB Ledger. Any accounts added to the client’s ledger are also exported at this time.

When posting the journals and new accounts, the Include previously posted journals option can be used to post all journals including those that have been posted previously. This option can be used if a new company file has been copied to your system, that is, a company file which does not have the previously posted journals.

If an Assets register is integrated with an underlying ledger, you can add Assets journal details as an unposted journal in the Workpapers trial balance table. The unposted journals appear in the Workpapers trial balance sheet. The journal can be viewed but not edited until you have posted the Assets journal.

Open the workpapers period. See Opening an existing period.

On the TASKS bar, click Post journals and accounts. By default, only journals that have not already been posted will be included.

To post all journals including those which have been posted previously, click the Include previously posted journals checkbox. Do not use the Include previously posted journals option if posting to the same client company file that has previously been posted to. This will result in duplicate journal entries displayed in the client general ledger.If you've got an Essentials ledger and see a message like this, you won't be able to post a journal unless you change the journal date or change the ledger's lock date in MYOB Essentials.

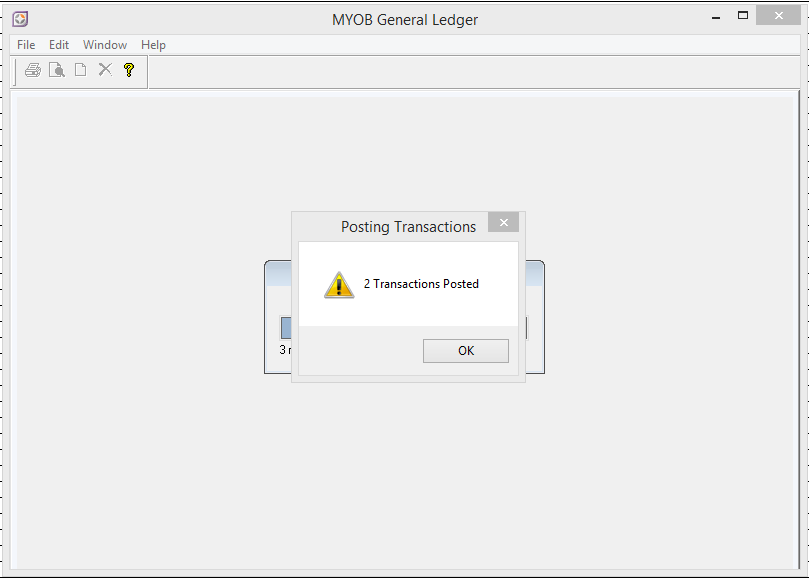

Click Yes. A Post Journals and New Accounts confirmation window appears, confirming that the journals and new accounts were posted successfully.

- Click OK.

Once posted, the closing balances of the affected journals are adjusted by the amounts in the journals.

- Go to the client’s Client Accounting > Trial Balance (Workpapers) tab and click a period in the Select Period section.

- On the TASKS bar, click Open Period. The table for the period appears. See Opening an existing period.

- On the TASKS bar, click Create Journal Export File. The Confirm Exporting Journals dialogue appears.

- Click Yes. The Export Journals window appears.

- Browse to the location for the exported journal file and click Save.

- Click OK. The exported journals file is created.

- Import the journal file to MAS, Accounts or AO GL:

If you use MAS or Accounts, see your ledger's product help.

If you use a version of MYOB AO Classic earlier than v16.0.4, or your AO Classic isn't integrated with your ledger, see the product help for your version.

If you use MYOB AO Classic v16.0.4 or later (Australia) or v16.0.2 or later (New Zealand) integrated with your ledger, click Post in Client Accounting. The Post option lets you export the file to your local machine and post the results back to your AO Classic general ledger.

A confirmation dialogue appears.

For AO Classic users, check that the Employee Code is the same in MYOB AO Classic and MYOB AE. If the Employee Code is different, you'll need to change the code.

To check the Employee Code in AO Classic

Go to Tools > Options > Employees tab and, in the Name table, select your name. Check that what's in the Employee Code field matches the code in AE.To check the Employee Code in AO Classic

On Contacts drop-down, select Employees. Search for your name and note what's in the Code column.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.