- Created by MichelleQ, last modified by JohnW on Mar 23, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 35 Next »

https://help.myob.com/wiki/x/0UCEAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Before you can report payroll and super information to the ATO, you need to assign an ATO reporting category to your payroll categories. This includes wages, allowances, deductions and superannuation categories. The ATO category indicates the type of payment you're reporting (is it gross wages or an allowance?)

While it's similar to how categories were assigned on payment summaries, there are important differences. For example, some reporting categories have been renamed and you now need to report superannuation amounts.

Below is a summary of the new ATO reporting categories. To help you assign the right category, we've included a comparison to the previous payment summary reporting fields.

Before you get started, make sure you've checked your payroll details for Single Touch Payroll reporting.

Need more help assigning ATO reporting categories?

Note that we can only provide general information. If you're unsure of what's appropriate for you, we recommend talking to your advisor or the ATO.

See the ATO guidelines for more information.

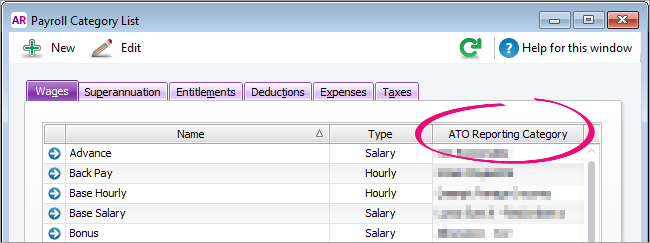

- Go to the Payroll command centre and select Payroll Reporting.

Select View Payroll Categories. A list of your Wages categories appears.

The ATO Reporting Category column shows the category assigned.The default category assigned is Not Reportable. This category is rarely used, so make sure you update all payroll categories.

- Double-click a category to open it.

- Select the appropriate category from the ATO Reporting Category list.

- Click OK.

- Repeat for all wages payroll categories.

- Select the Superannuation tab and repeat the steps to assign categories.

- Repeat for all categories in the Wages, Superannuation, Deductions and Tax tabs.

Don't forget to assign categories to your superannuation categories!

| New ATO reporting category | Old Payment summary field comparison | More information |

|---|---|---|

| Gross Payments | Gross Payments | |

Allowance - Car | Allowances 1 through to 9 | Certain types of allowances and deductions need to be separately itemised like they are on Payment Summary. However, under Single Touch Payroll reporting, each item needs to be grouped and reported by in a specific category. Amounts in these payroll categories may be used to prefill your employees' tax returns. Withholding for allowances (ATO website) |

Lump Sum A - Termination | Lump Sum Payments A (Termination) | |

CDEP Payments | CDEP Salary or Wages | |

| Exempt Foreign Income | Exempt Foreign Income | |

Coming soon | ETP - Taxable component ETP - Tax free component ETP - Tax Withheld |

| New ATO reporting category | Old Payment Summary field name | More information |

|---|---|---|

Superannuation Guarantee | New | This is the first time employers have reported this information to the ATO. This in now requried to make sure employee super funds are receiving the correct amounts. |

| Reportable Employer Super Contributions | Step 5 in the Payment summary assistant | You don't need to add this as a negative amount to Gross wages as it's now calculated by the ATO based on information reported via Single Touch Payroll each pay. |

Did you previoulsly report salary sacrifice amounts on payment summaries?

You don't need to assign the Gross wages category to salary sacrifice amounts. Salary sacrific is now calculated by the ATO based on Single Touch Payroll reporting information.

| New ATO reporting category | Old Payment Summary field name | More information |

|---|---|---|

Deduction - Work Place Giving | Work Place Giving 1 | |

Deduction - Union/Professional Assoc Fees | Deduction 1 - Union Fees |

Any other deductions, including salary sacrifice (exempt from FBT) are Not Reportable.

Did you previoulsly report salary sacrifice amounts on payment summaries?

You don't need to assign the Gross wages category to salary sacrifice amounts. Salary sacrific is now calculated by the ATO based on Single Touch Payroll reporting information.

| New ATO reporting category | Old Payment Summary field name | More information |

|---|---|---|

PAYG Withholding | Total Tax Withheld |

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.