- Created by StevenR, last modified by AdrianC on Mar 16, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 39 Next »

https://help.myob.com/wiki/x/TYOhAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Time to prepare your next BAS or IAS? We’ll save you time by using the information in your AccountRight company file to fill in some of the details. Once you’ve filled in the other required fields on your statement you can lodge your activity statement online, and get confirmation from the ATO within seconds.

Before you can lodge your activity statements online, you need to have already:

- nominated MYOB as your software provider, and

- set up your activity statement fields.

If you haven't completed these setup steps yet, see Get ready to lodge activity statements online .

Currently only the GST and PAYG Withholding fields can be automatically filled based on information in your AccountRight company file. So if you need to complete other fields, like the T fields, have those amounts and details ready to fill in before you start preparing the form.

To prepare your activity statement online

- Start AccountRight and open your online company file.

- Click Prepare BAS/IAS in the Accounts command centre.

- In the Lodge Online tab, click Prepare Statement.

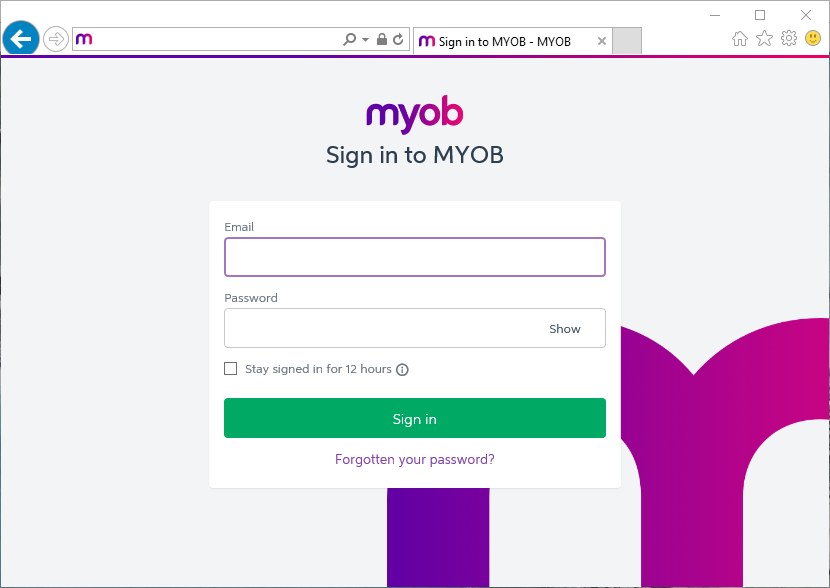

- Sign in to your MYOB account, as you normally do when accessing your online AccountRight company files.

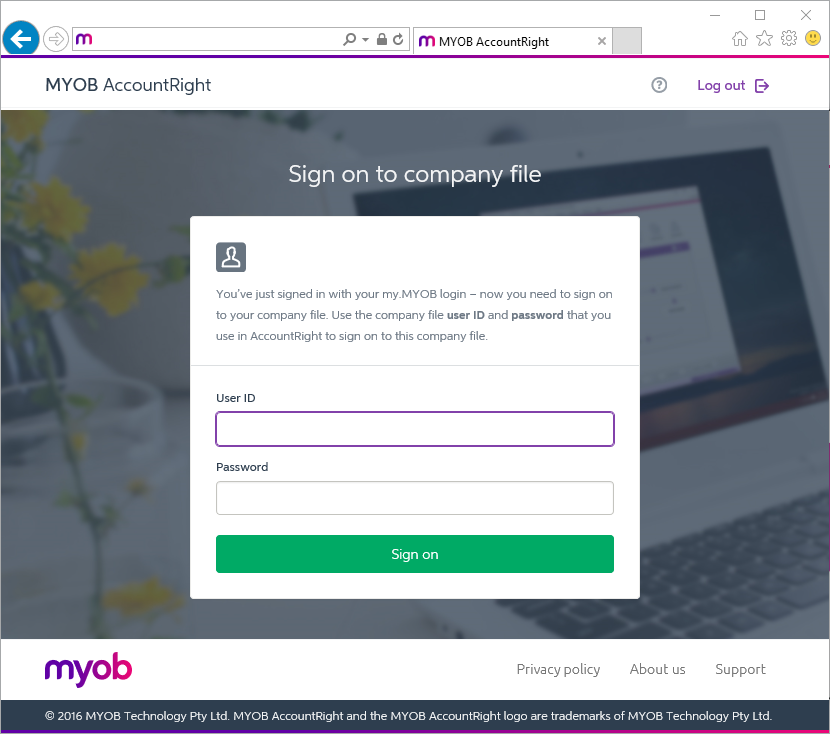

- If prompted to enter your User ID and password, enter the user account details you normally use when opening this company file.

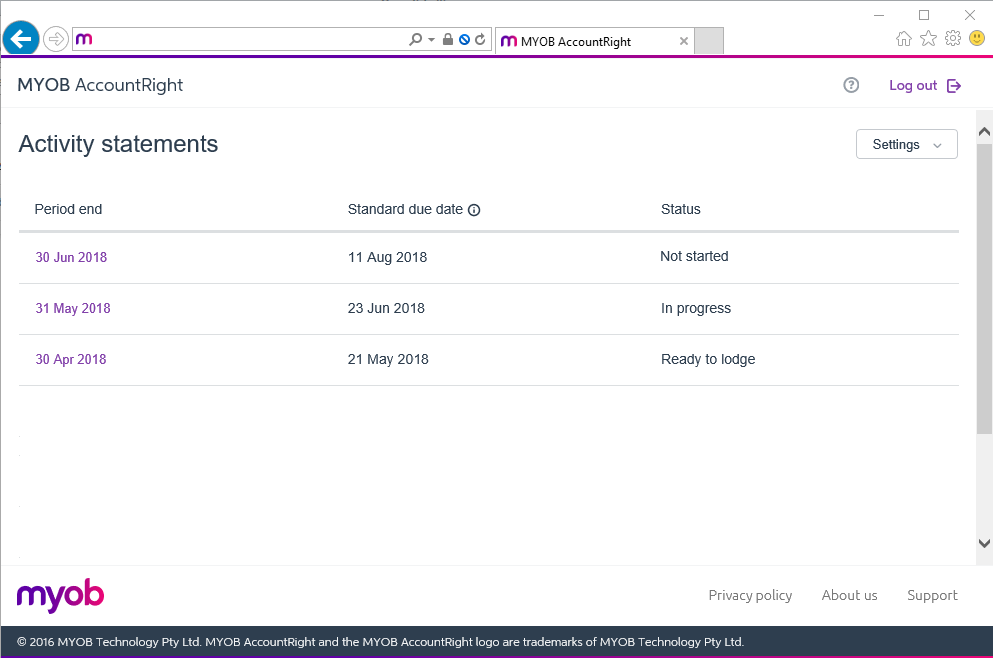

- When the online activity statement dashboard appears, click the statement you want to work on. (For a description of each status, see the FAQs below)

The details will be retrieved from the ATO, and the form to complete will appear.

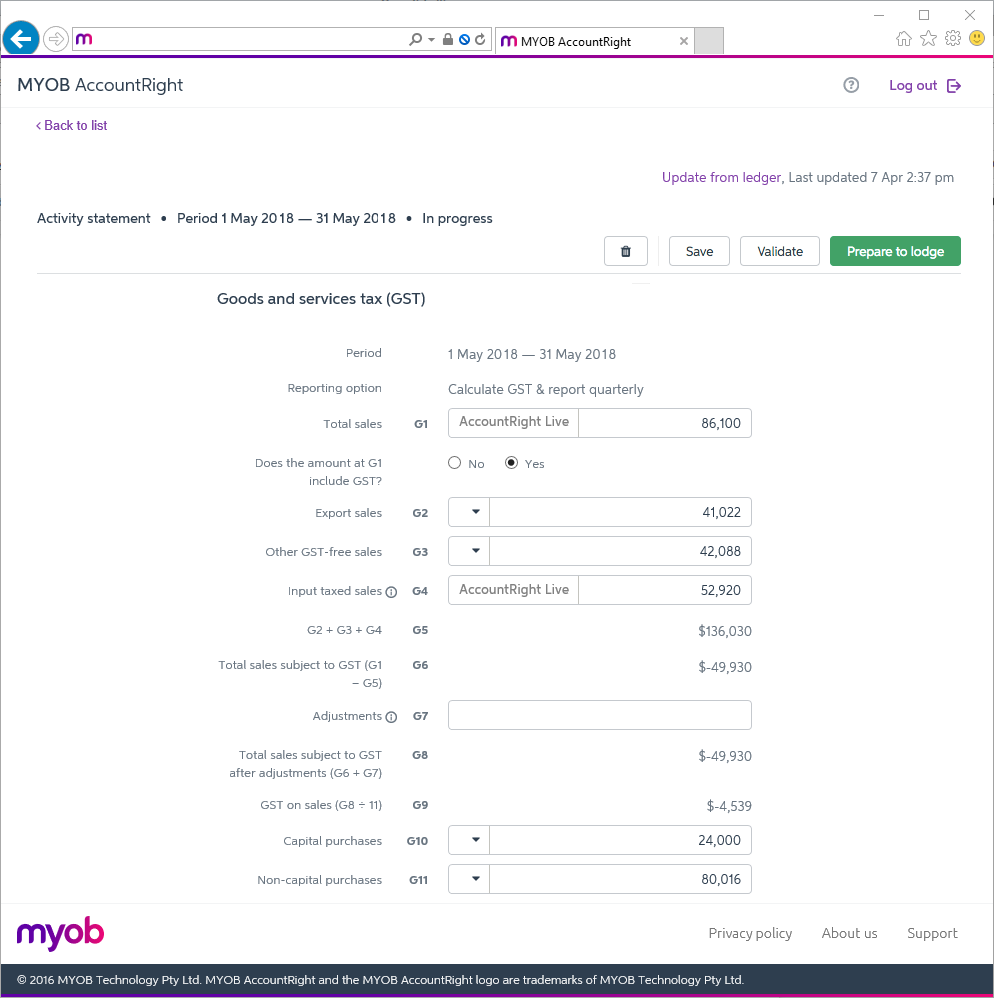

(BAS only) If the Reporting option (above the G1 field) hasn't been selected for you (this information comes from the ATO), select the appropriate option for this statement. If the Reporting option is wrong but can't be changed, contact the ATO for clarification.

Using Simpler BAS?

Note that 1A and 1B don't show here as they don’t have setup options. See Simpler BAS reporting for more information.

- Review the details that have been filled in for you, based on your AccountRight tax code setup. Look for fields that show the AccountRight label next to them.

If you adjust the amounts, the label will change to Adjustment.

To view the original amount that was based on your AccountRight company file’s details, click the Adjustment label. If you want to use that original amount again, click the amount. Your manually adjusted amount will be replaced, and the label will show AccountRight again. Enter all other amounts that you need to report, by typing directly into the relevant fields.

Can’t finish in one session? No problem, your activity statement is automatically saved as you go. You can close the statement and continue working on it later.

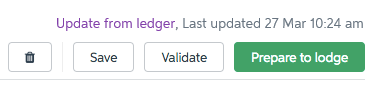

Click Validate to do a quick check that you've entered the mandatory information and that the formatting is correct.

If there are no errors, and you're ready to lodge the form with the ATO, click Prepare to Lodge. The information you supplied will be validated by the ATO, and if all is OK, a "Validated successfully" message will appear at the top of the activity statement.

If you're an agent lodging on behalf of a client, download the successfully validated form now and send to your client for review and approval.

You can return to this statement to complete the lodgement after receiving your client’s approval.

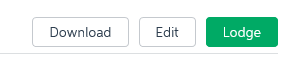

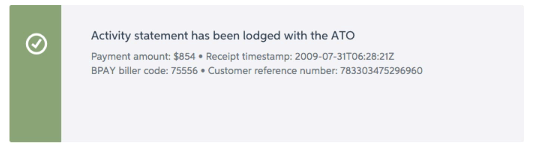

If no further changes are required to the form, and you want to lodge the form now, click Lodge, review the declaration and then click Lodge again.

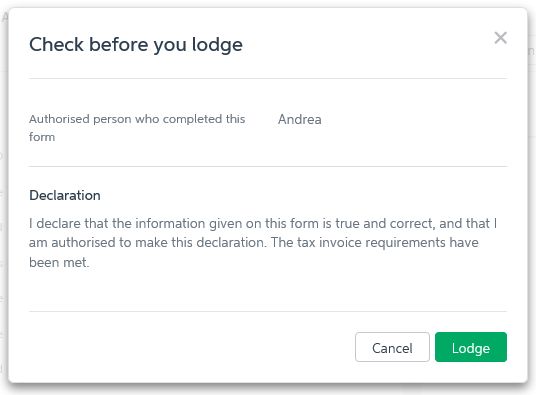

You'll see a notice from the ATO advising you that the form has been lodged. Note the BPAY biller code and customer reference number so you can make your payment later.

You should now download a PDF of the statement you just lodged for your own records.

Next steps

When you make the required payment to the ATO, or receive your refund, you need to record the transaction in AccountRight. For tips on how to record the transaction, see Recording your ATO payment or credit.

Online activity statement FAQs

What does each activity statement status mean?

The activity statement dashboard lists all the activity statements that can be prepared online, or that have already been completed. Each activity statement shows a status - here's what they mean.

| Status | What it indicates |

|---|---|

Not Started | An activity statement is available for you to work on, but you haven't opened it yet. |

| In progress | You’ve started working on the activity statement. Your activity statement is automatically saved as you go, so if you've made any changes, your activity statement is "in progress". |

| Completed | You’ve finalised the return (by clicking Finalise) and the ATO has validated the information you want to submit. |

| Submitted | You’ve chosen to lodge the activity statement to the ATO, but the ATO hasn't provided a response to let you know it's been successfully received or rejected. You don’t need to do anything, refresh the page after a couple of minutes, or check back later to see if the ATO has accepted your activity statement. |

| Lodged | Your activity statement has been successfully lodged to the ATO. If you need to make a payment, open the activity statement to see your payment reference numbers and other details to use. |

| Rejected | Your activity statement was rejected by the ATO. Open the activity statement to see the reason why it was rejected. Make the necessary changes and relodge the activity statement. |

What if the ATO services are down, can I still lodge a statement?

If the ATO services are offline, you can still sign in to the online activity statement dashboard and edit any statements that are already in progress, but you won’t be able to lodge or finalise any statements until the ATO is back online.

Can I access the statements I’ve lodged if my file is not online?

No, if you’re working on a checked-out file, or you permanently take your file offline, you will not be able to sign on to the online activity statement dashboard.

If you no longer want to work online, make sure you have downloaded a PDF of each activity statement that’s been lodged online before you take your file permanently offline, so you have a document you can refer to if required.

How do I amend a lodged statement?

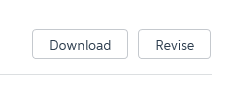

If after lodging your activity statement, you want to make a change to the details you submitted, select the form that's been lodged from the online activity statement dashboard, and when the form appears, click Revise .

You can then make your changes and lodge the form again. Note that you can only make changes if you're within the adjustment period allowed by the ATO.

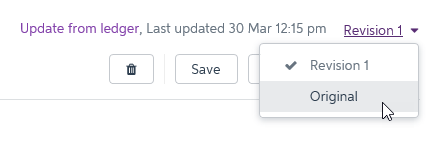

Want to see the previous revisions?

If you’ve revised the activity statement, you can click the Revision link in the Review page to revert the statement details to a previous revision.

Can I delete a statement and start again?

Yes! Click the bin button to delete a statement that you’ve started but haven’t lodged yet.

If you’re revising a statement that’s already been lodged, clicking the bin button will delete the revision you’re currently viewing.

How do I set up the activity statement fields for FBT, Fuel Tax Credits, or PAYGI?

Currently only the GST and PAYG Withholding fields can be linked to tax codes in your AccountRight company file. So if you need to complete other fields, like the T fields, you'll need to fill in those values manually when completing your online activity statement.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.