You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 2 Next »

https://help.myob.com/wiki/x/k63MAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Each user must add themselves as a declarer before they can send payroll information to the ATO.

Before they can do this, make sure you add the user to your file and that they have an MYOB account.

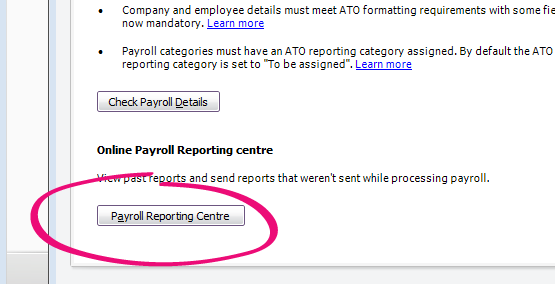

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

If this button says Connect to ATO, you may need to go through the full connect to the ATO process.

From the Overview page click Start.

- Choose your role.

If you are not a registered tax agent or BAS agent, choose Someone from the business. Click Continue. Declaration information

Enter the company’s ABN and your personal details. This is sent to the ATO with the payroll information. Click Continue.Notify ATO

Only one person from the business need to notify the ATO. If your company is already using STP, you won’t need to do this step. Click I’ve notified the ATO.

| Steps | ||

|---|---|---|

1. Your role |

|

If you are a registered agent, there are a few extra steps you'll need to complete to set up. We recommend getting your client to go through these steps first, before you do this. |

| 2. Declaration information | ||

Each person who processes payroll must enter their details. This is so we can identify who can sign the declaration when sending payroll reports to the ATO. New staff members will be prompted to enter their details when they go to Payroll > Payroll Reporting after you have connected to the ATO. Don't forget to check your ABN | ||

| 3. Add clients to portal |

If this hasn't been done already. This is done outside of MYOB in the tax or BAS agent portal. | |

| 4. Notify ATO | Only one person from the business needs to notify the ATO. You'll need your unique Software ID which is provided in the software, during this step. Learn how to notify the ATO. |

If you're a tax or BAS agent you must notify the ATO that you're using MYOB for payroll reporting for this business. You'll need your unique Software ID which is provided in the software, during this step. Learn how to notify the ATO. |

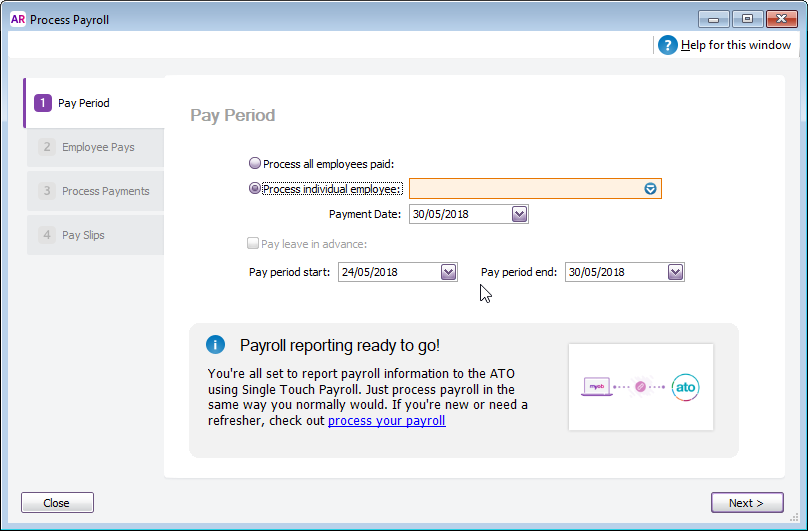

What happens after I've connected to the ATO?

Once you've connected to the ATO, you're all set up for Single Touch Payroll reporting. Your payroll information will be automatically sent to the ATO the next time you process payroll.

You'll know you're set up when you see the following message in the Pay Period window (Payroll > Process Payroll).

When you click Record to record a pay run, you'll be prompted to declare and submit the information to the ATO. You'll only be able to do this if you've completed the Connect to the ATO steps.

If you started reporting before 1 July 2018 you'll still need to use the Payment Summary Assistant to produce payment summaries and send the Payment Summary Annual Report to the ATO (via the EMPDUPE file).

You won't need to prepare or send payment summaries from the 2018/19 payroll year.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.