- Created by Rachael Mullins, last modified by AdrianC on Jan 18, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 57 Next »

https://help.myob.com/wiki/x/Db3MAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

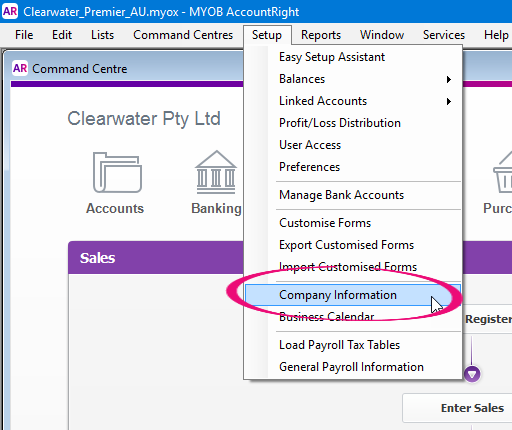

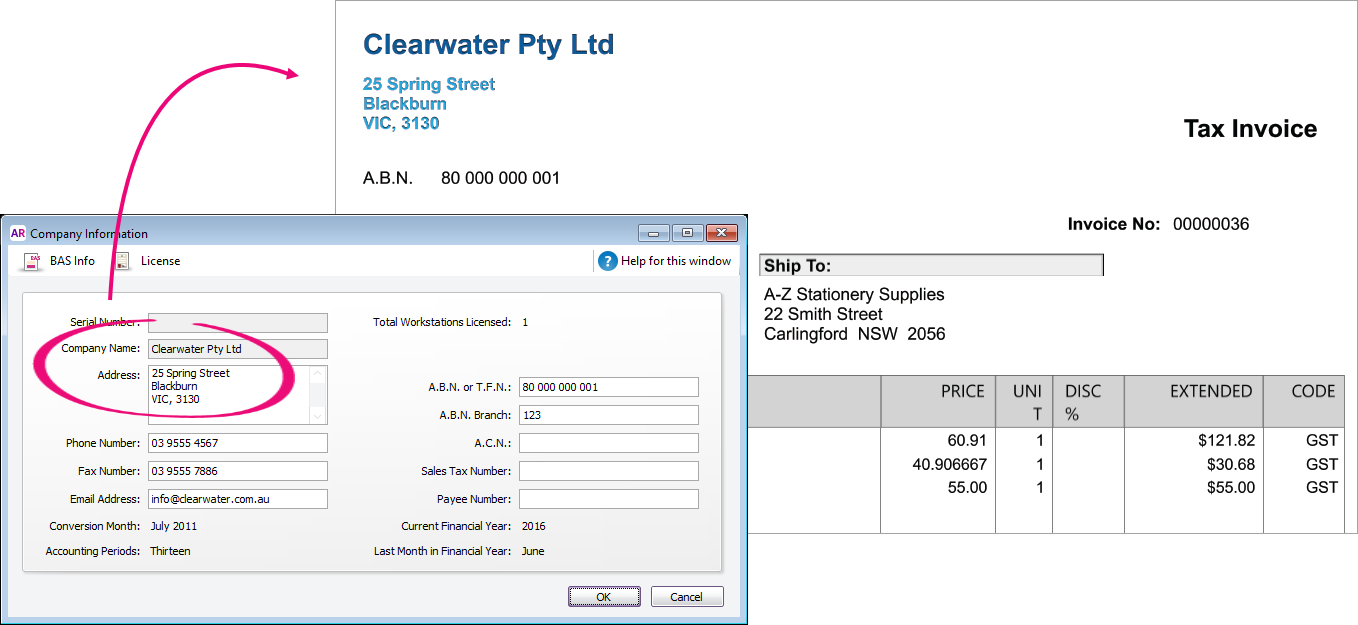

Your business name and contact details can be changed in AccountRight's Company Information window, accessible from the Setup menu.

Information entered in the Company Information window will appear on your reports and forms. If you want to show different name or contact details, you can customise the forms or reports and remove the default details that appear. See Personalising forms and Customising reports.

| To change the... | Do this... |

|---|---|

| Company name | You can change the name in the Company Information window (maximum 40 characters, including spaces). Depending on whether your company file is stored online or locally, there's some additional steps to complete. See Manage libraries for more details. If you need to change the name that’s on file with MYOB, you can do this using my.myob. |

| Serial number | Perhaps an MYOB Partner has created the file for you and entered their serial number by mistake. If you haven’t activated the file you can just change the number in the Company Information window. But if the file is activated, you need to go to the Help menu and choose Change Serial Number (you need to be online to complete this). See Your AccountRight serial number. |

| Financial year or last month | You can’t change these details in the Company Information window. You can make those changes when you close the financial year (File menu > Close a Year > Close a Financial Year). See End of financial year tasks. |

| Conversion month | The conversion month can't be changed. This month was selected when creating the company file, and all opening balances you enter will be for the start of the selected month. If you need to change your conversion month, create a new company file and specify the correct conversion month.. You can't enter transactions dated before the conversion month, except for pre-conversion sales and purchases. These transactions can be entered from the Setup menu > Balances >

|

| A.B.N. and T.F.N. details [Australia only] | If you need to change your ABN details after creating your company file, you can do it here. If you submit Instalment Activity Statements and you don't have an ABN, you need to enter your TFN (Tax File Number). An A.B.N Branch is sometimes referred to as a GST branch. Learn more about GST branches on the ATO website. |

| Payee Number [M-Powered Invoice users only, Australia] | The Payee Number is provided to you by MYOB if you're using M-Powered Invoices. It's a unique number that identifies payments for your business, so don't change it unless advised by MYOB. If you need to know your Payee Number, please contact MYOB on 1300 555 123. |

Old details still showing on forms?

If you've changed some details in the Company Information window but the old details are still showing on your forms, such as your invoices, it means the details have been added to the form in a text box. To change it, you'll need to open the customised form and edit the text box.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.