How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

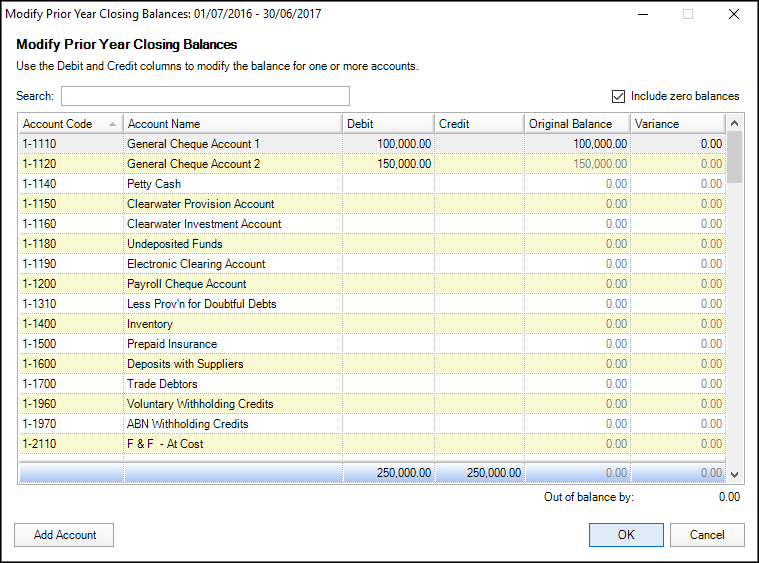

Use the Modify Prior Year Closing Balances feature to adjust the prior-year balances stored in a configured ledger, without posting to the underlying configured ledger.

The Modify Prior Year Closing Balances feature:

- creates any new accounts in the file

- updates any modified descriptions in the file

- saves all modified balances for the selected year to the AE/AO database.

Changes to prior-year balances affect only the selected year. If you have multiple years to update, you'll need to update each year separately.

If you have multiple years to update, you'll need to do this separately as any changes to prior-year balances affect only the selected year. For example, if you modify the balance of the inventory account, you may have to make corresponding adjustments to the same or other accounts in subsequent years.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.