You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 32 Next »

https://help.myob.com/wiki/x/CzznAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

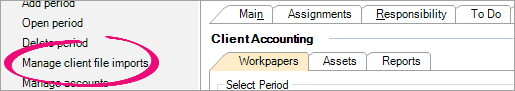

Transactions can be imported into Client Accounting using the Manage client file imports wizard. You can find this function on the Tasks bar of your client's Client Accounting > Trial Balance (or Workpapers) tab.

You can only import transactions via Client Accounting if your configured ledger is an MYOB Ledger. If you're using something different, you can still use the import functions in your configured ledger's software.

The Manage client file imports wizard accepts the following file types:

- .MYE

- .TXT

- .CSV

Importing an .MYE or .TXT file

If you choose to map your accounts, previous mappings of client data to your ledger are stored, so that for subsequent imports it is only necessary to map the accounts that have been added since the last import.

- From AE/AO, open the client and go to the Client Accounting > Trial Balance (Workpapers) tab.

- On the TASKS bar, click Manage client file imports. The Manage Client File Imports window appears.

- Select either .MYE or .TXT according to your exported file type.

- At the Select file to import field, click the ellipses (

) button and browse to the location of the export file.

) button and browse to the location of the export file. - Click Next.

Choose whether you want to map your client's account codes to your ledger's accounts, or to import your client's accounts:

Option Description The chart of accounts in the file being imported is different to the chart in the ledger – I want to specify how to map the accounts to the ledger If your client's chart is the same as your chart of accounts, you can choose whether to select this option.

When this option is not selected, all transactions import with the client’s account code. Any accounts that don't exist in your chart are automatically added.

If your chart of accounts is different from your client's chart, select this option. This will let you map your client's accounts to your ledger accounts.

Consolidate imported transactions into single monthly or annual transactions for each account Consolidates transactions into a single monthly or annual transaction for each account. To import all transactions, leave this checkbox unticked.

Only imported transactions can be viewed. If you choose to import consolidated transactions, you'll only be able to view one imported transaction per month or year (as selected).

You can import up to 16,000 transactions. If you have more than this, select this checkbox to consolidate your transactions.

If you've selected this checkbox, select to import either:

Monthly – imports one transaction per month for each account

Annually – imports one transaction per year for each account.

- Click Next.

If you've selected the first option, continue to Map Accounts. Otherwise, continue to Stage 4.

In the Map Accounts window, click in the Map to column for each account and choose an account to import your client's transactions to. The Account name, Account type and Balance are updated automatically.

chart that correspond to each account on the accountant's chart.

If required, adjust the ledger accounts to align the balances with the equivalent accountant's accounts.

- Preview the accounts and make sure all accounts are mapped correctly.

- When you're ready to submit the transactions, click Finish.

Importing a .CSV file

A CSV file contains either a chart of accounts, or chart of accounts and transactions.

When importing a CSV file, an XML configuration file in the Deploy folder controls the mapping between the CSV file columns and ledger fields.

The CSV file you're going to import needs to have no more than 38,000 journal entries. If you've got more, either:

- separate the CSV file into multiple files and import each file separately, or

- consolidate prior period data to decrease the total entries.

You can watch us stepping through this procedure in the Import prior year balances chapter of the Adding data to MYOB Ledger video.

- Go to the Client Accounting > Trial Balance (Workpapers) tab.

- On the TASKS bar, click Import client file or Manage client file imports depending on your version.

An import wizard appears. - Select the .CSV radio button.

- Click the Select file to import field's ellipsis [...] button, and browse to and open the CSV.

In the Select template dropdown, select the type of mapping template that matches the client’s source file.

The default options are Default Template and Quickbooks 2014 Template. If other options are listed, they have been customised for your site. If you’re not sure which one to use, contact IT or MYOB Support.Click Next.

If you want to map the client’s chart of accounts to the ledger chart of accounts, select The chart of accounts in the file being imported is different to the chart in the ledger – I want to specify how to map the accounts to the ledger checkbox.

Do not select this checkbox if the client’s chart of accounts is the same as your chart of accounts.- If you want consolidated transactions so that you have one transaction per account on a monthly/annual basis, select the Consolidate imported transactions into single monthly or annual transactions for each account checkbox and select the Monthly or Annually radio button.

- Click Next. The Map Accounts window appears. Some accounts are mapped by the system, but you need to map any unmapped accounts indicated by a question mark [?] icon.

- If any accounts with a question mark [?] icon, click the blank Map to cell and select the account to map to.

Click Next. The Preview window appears.

- Click Finish. A message asks if you want to post all the file data to the ledger.

- Click Yes. The accounts are posted to the ledger and an import summary message appears.

- Click OK.

Using the default MYOB template

To successfully import third-party transactions, the file containing the exported transactions needs to follow the default import format. Below are the default template specifications for the contents of the import file. The file needs to match these specifications to be able to import the transactions. These are normally in CSV file format, which you can create using Microsoft Excel.

The column names in your CSV file must be in the first line of your CSV file.

Some ledger fields are mandatory and some are optional, as shown in the following table.

| Column name | Maps to | Mandatory/optional |

|---|---|---|

| account code | AccountCode | Mandatory |

| account name | AccountName | Optional |

| account type | AccountType | Optional Note: The following values are valid: |

| account type group | AccountTypeGroup | Optional |

| tax code | TaxCode | Optional The valid code values (and their definitions) are:

|

| transaction reference | TransactionReferenceId | Optional |

| transaction description | TransactionDescription | Optional |

| transaction date | TransactionDate | Optional (mandatory if TransactionAmount is mapped) The following formats are both valid:

|

| transaction amount | TransactionAmount | Optional Note: The file should be balanced: Sum of Amount = $0 Sum of Amount for each unique Date = $0 No special characters are allowed ($ or ',') Signage is allowed (+, -) |

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.