- Created by admin, last modified by AdrianC on Dec 11, 2017

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 21 Next »

This information applies to MYOB AccountRight version 19. For later versions, see our help centre.

https://help.myob.com/wiki/x/a0rnAQ

ANSWER ID: 9160

AccountRight Plus, Premier and Enterprise, Australia only

Long service leave is a period of leave an employee can take after working for the same business for a long period of time. Different rules and legislation apply in each state of Australia, so check the rules that apply to your business (the Fair Work website is a good place to start).

Set up long service leave categories

You'll need to create an entitlement category to track long service leave owed, and a wage category to track the amounts paid to employees.

- Go to the Payroll command centre and click Payroll Categories.

- Click the Wages tab.

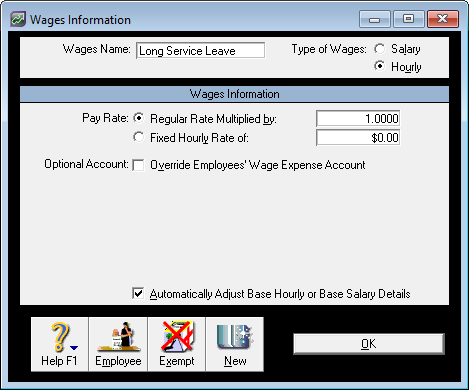

- If a Long Service Leave wage category already exists, open the category. Otherwise, click New and name it Long Service Leave.

- If it isn't already selected, select Hourly as the Type of Wages.

- Select Regular Rate Multiplied by 1.0000 in the Pay Rate section.

- Select the option Automatically Adjust Base Hourly or Base Salary Details. Here's our example:

- Click Employee, select the employees who are entitled to long service leave, then click OK.

- Click OK.

- Go to the Payroll command centre and click Payroll Categories.

- Click the Entitlements tab.

- Click New and name the category Long Service Leave Accrual.

- For the Calculation Basis, choose how you want to calculate the leave accrual.

If your employees are paid:Hourly: Choose Equals [x] Percent of [Gross Wages]. Click Exempt to select any categories that shouldn’t be included in the calculation, such as overtime. Then click OK.

Use this formula to calculate the correct percentage:

(Total hours entitled / Total number of working hours over eligibility period) x 100 = %Example 1: Say your employees work a 38 hour week (7.6-hours x 5 days). After 10 years of continuous service they’re entitled to 1 week of leave for every 60 weeks they’ve worked. So, after 10 years of continuous service, they’re entitled to 8.6667 weeks of long service leave.

To calculate the leave accrual percentage: Leave hours entitled: 38 hours x 8.6667 weeks = 329.3346 Hours worked over 10 years: 38 hours x 52 weeks x 10 years = 19760 (329.3346 ÷ 19760) x 100 = 1.6667%

Employees who remain linked to this entitlement will continue to accrue leave at the rate of 32.9340 hours per year.

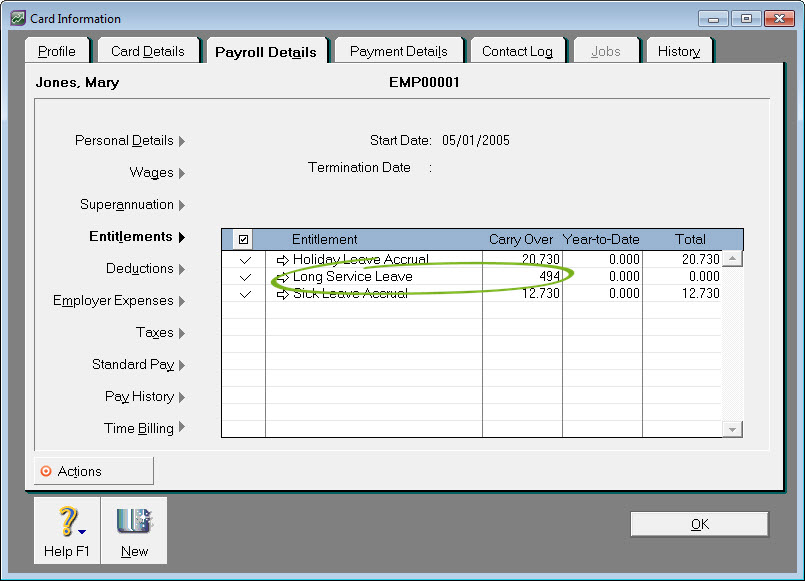

Example 2: Say your employees work a 38 hour week (7.6-hours x 5 days). After 10 years of continuous service they’re entitled to 13 weeks of leave (494 hours). They also continue to accrue leave at the rate of 1.3 weeks per year.

To calculate the leave accrual percentage: Leave hours entitled: 38 hours x 13 weeks = 494 hours Hours worked over 10 years: 38 hours x 52 weeks x 10 years = 19760 (494 ÷ 19760) x 100 = 2.5%

Employees who remain linked to this entitlement will continue to accrue leave at the rate of 49.4 hours per year.

Salary: Choose the Equals [x] Hours per [Year] option.

Enter the number of hours the employee accrues in long service leave each year. These examples might help you calculate the correct rate for your business.Example 1: Say your employees work a 38 hour week (7.6-hours x 5 days). After 10 years of continuous service they're entitled to 1 week of leave for every 60 weeks they’ve worked. So, after 10 years of continuous service, they're entitled to 329.3346 hours (8.6667 weeks) of long service leave.

In this case you would enter 32.9335 as the rate per year.

Example 2: Say your employees work a 38 hour week (7.6-hours x 5 days). After 10 years of continuous service they're entitled to 13 weeks of leave (494 hours). They also continue to accrue leave at the rate of 1.3 weeks per year.

In this case you would enter 49.4 as the rate per year.

If you want to show the hours the employee is entitled to on the employee pay advices, select the Print on Pay Advice option.

Select the Carry Entitlement Over to Next Year option.

In the Linked Wages Category field, select the Long Service Leave wage category.

Click Employee and select the employees who are currently entitled to long service leave and then click OK.

Click OK.

Process a pay with long service leave amounts

When an employee chooses to take their long service leave, enter the hours they are taking in the Hours column of the Long Service Leave wage category.

The hours they are entitled to take will automatically be reduced by the hours you enter for the wage category. Also, because you chose the option Automatically Adjust Base Hourly or Base Salary Details when setting up the wage category, and hourly or salary values on the pay will be adjusted accordingly.

FAQs

There are two ways you can enter the hours an employee is already entitled to take.

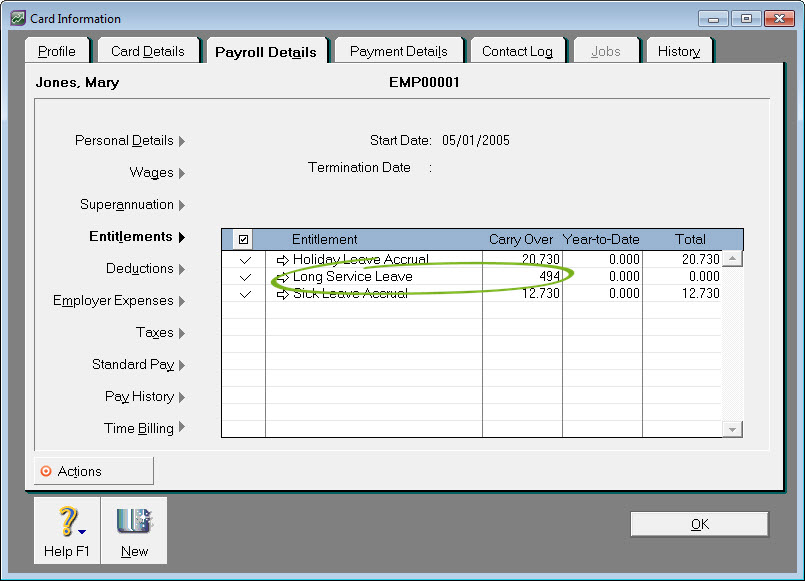

- In their card (Payroll Details tab > Entitlements > Carry Over column):

- On their pay, in the Hours column of the Long Service Leave entitlement:

If you select employees who are not currently entitled to long service leave, and you’ve chosen the Print on Pay Advice option, their pays will show the leave hours that are accruing.

If you don't want this, it might be better to only link employees to the Long Service Leave entitlement when they are actually entitled to take leave.

There are two ways you can enter the full hours the employee is entitled to take.

- In their card (Payroll Details tab > Entitlements > Carry Over column):

- On their pay, in the Hours column of the Long Service Leave entitlement:

You'll need to create additional entitlement categories. For example, create one entitlement for salary employees, and another for hourly employees.

When employment ends before an employee has worked the total number of years needed to get the full long service leave entitlement, they can sometimes get paid out part of their long service leave. This is known as pro-rata long service leave.

Whether or not you're required to pay pro-rata long service leave depends on the regulations in your state or territory. Check the Fairwork website for more information.

To pay pro-rata long service leave:

- Set up the wage category as described above.

- Enter the pro-rata long service leave hours the employee is entitled to be paid against the Long Service Leave wage category on the employee's final pay.