You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 22 Next »

https://help.myob.com/wiki/x/X2rnAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Need to pay an employee in advance or loan them some money? Easy - just set up a wage category to pay the money and a deduction category to record repayments.

Both these payroll categories will be linked to an asset account (which you'll need to create), so you can track all amounts advanced, repaid and outstanding.

Let's step you through it.

Set up the payroll categories and asset account

You'll need to set up the following:

- an asset account

- a payroll wages category

- a payroll deductions category

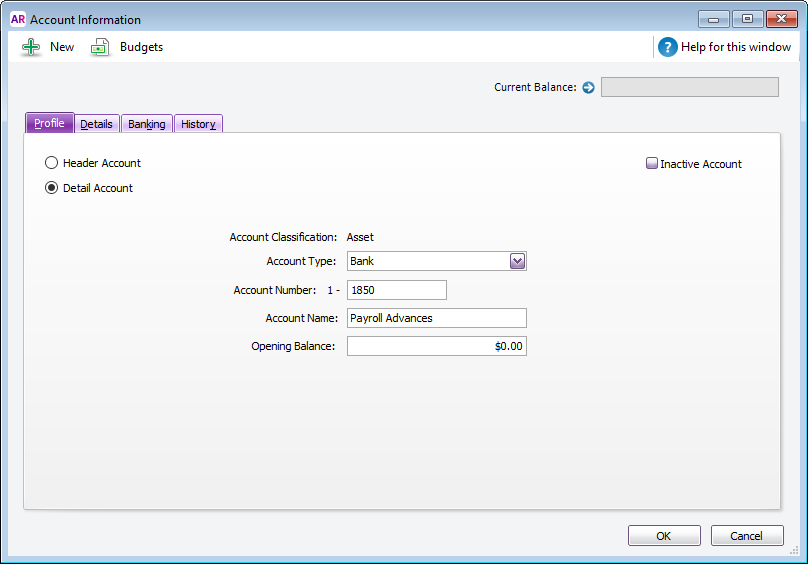

- Create an asset account with the Account Type set to Bank. This account will be used to keep track of how much you have advanced, and how much is repaid.

Give the account a name that makes it easy to find. We've used Payroll Advances in the following example, you can choose any name you like.

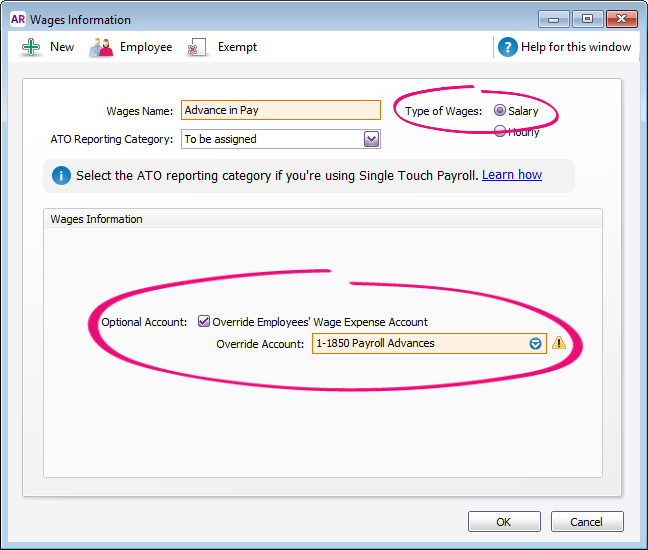

- Create a wages category. This category will allow you to include the advance on the employee's pay.

- Give the category a name that makes it easy to find. We've used Advance in Pay in the following example, you can choose any name you like.

- Select Salary for the Type of Wages.

- If you report payroll information to the ATO through Single Touch Payroll, select the applicable ATO Reporting Category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

- Select Optional Account and choose the asset account created above. Ignore the warning about the type of account you've selected.

- Click Employee and select the employee who is being paid the advance.

- In our example we'll click Exempt and select the PAYG Withholdings category so the advance is tax-free. Check with your accounting advisor or the ATO for clarification on your tax obligations.

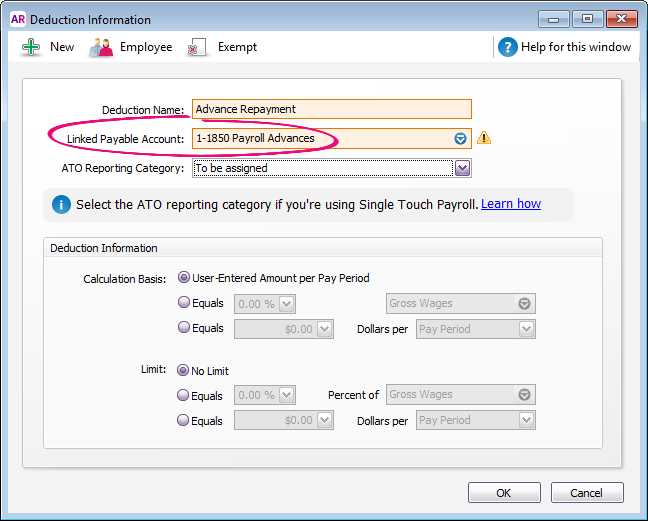

- Create a deductions category. This category will allow you to withhold the advance from the employee's future pay.

- Select the asset account created above for the Linked Payable Account. Ignore the warning about the type of account chosen.

- If you report payroll information to the ATO through Single Touch Payroll, select the applicable ATO Reporting Category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

- Set the Calculation Basis to User-Entered Amount per Pay Period.

- Click Employee and select the employee who is being paid the advance.

Pay the advance or loan

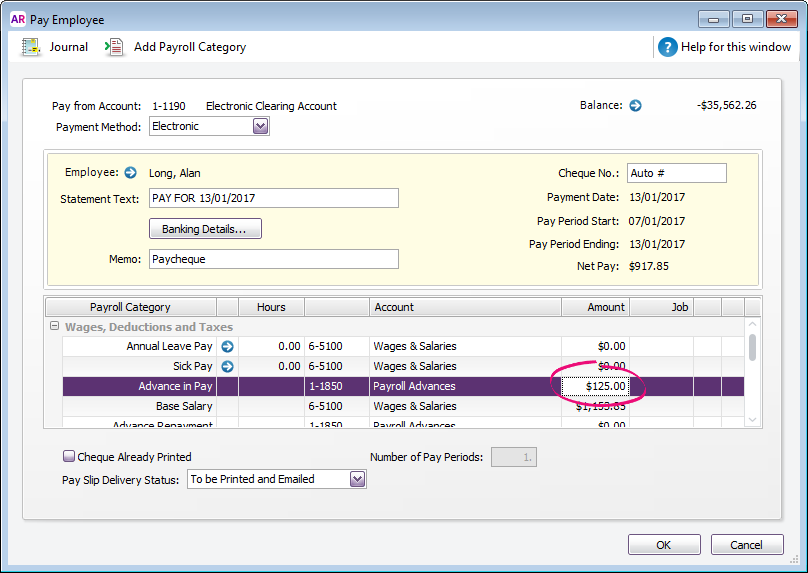

When you process your payroll, enter the amount being advanced against the Advance in Pay wages category.

If you exempted the wages category from PAYG Withholding, the addition of the advance won't affect the amount of tax withheld.

Record repayments

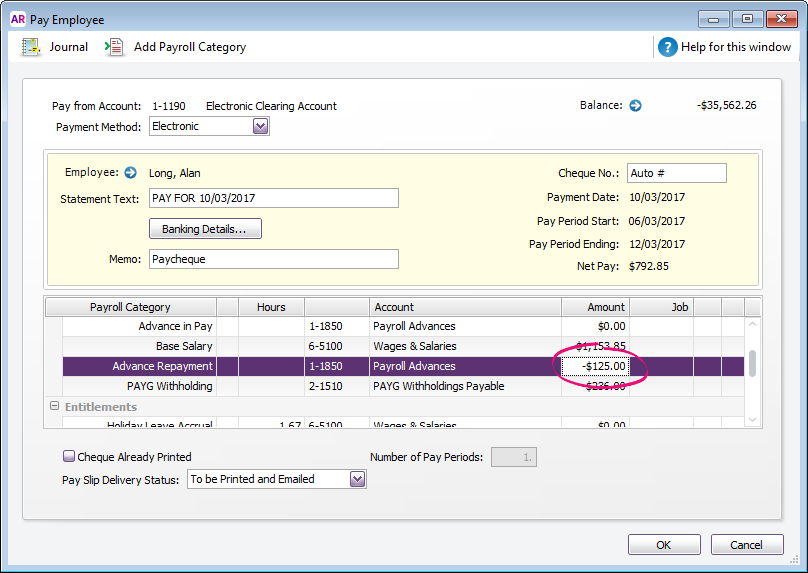

When you process your payroll, enter the amount being repaid against the Advance Repayment deductions category as a negative value.

Track how much has been advanced and repaid

Run the Payroll Activity Detail report for employees who have been paid wage advances (Reports > Index to Reports > Payroll > Employees > Activity Detail).

- The value of the Advanced in Pay wage category will show how much has been paid in advance.

- The value of the Advance Repayment deduction category shows how much has been repaid.

Do you use the Pay Liabilities feature?

Because the advance repayment is set up as a deduction, it'll show on the Pay Liabilities window. You can remove it by processing a normal pay liability transaction, but in the Pay from Account field, select the Payroll Advances asset account. This will remove the amount from the Pay Liabilities window without affecting your account balances.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.