- Created by ErikV, last modified by RonT on Feb 21, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 33 Next »

https://help.myob.com/wiki/x/6AIrAg

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

BASlink is a feature that helps you lodge your Business Activity Statement (BAS) or Instalment Activity Statement (IAS). If you're having trouble along the way, here's a series of FAQs to help you find a solution.

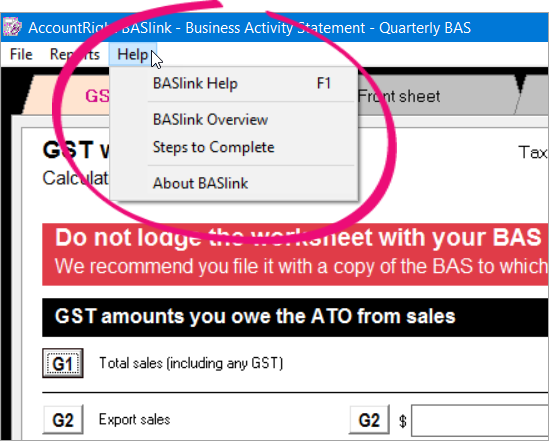

If your answer isn't on this page, try the BASlink help - display your worksheet and use the Help menu within BASlink.

You can now lodge activity statements online, straight from AccountRight. Get set up today.

General

I don't have an ABN. Do I need to report PAYG withholdings?

Yes. PAYG withholdings must be reported.

Does Superannuation and WorkCover need to be included on the BAS?

Superannuation is outside the scope of the GST and does not need to be reported. Although workcover is accrued in payroll, it does not need to be reported in any W fields. There is however GST on Workcover premiums that may be claimed as an input tax credit.

How do I filter BASlink if I am reporting GST on a quarterly basis and PAYG Withholdings on a monthly basis?

You need to specify this in the BASInfo area of BASlink. Click the BASInfo button, and then navigate to the GST reporting frequency field. Choose the Quarterly option from the drop down window. Then navigate to the Withholding reporting frequency field and choose monthly (medium withholder) for PAYG Withholdings. BASlink will then report correctly for GST and PAYG according to their different periods.

If I print out my BAS/IAS from BASlink can I send it to the ATO?

No. You must either manually fill out the BAS or IAS sent to you by the ATO or lodge your BAS/IAS electronically. The reason you cannot send in the printed BAS/IAS is that the ATO copy has a barcode on it and the ATO require this copy for processing.

Where do I find my backed up activity statements?

When you create a backup copy of your activity statement details, they are saved to the Data folder at this location:

C:\Users\<user.name>\Documents\MYOB\AccountRight\BASLink\Data

Setup

When I save my BASlink template, do I need to link everything again when I create a BAS report?

When saving the BAS template it will save all the codes and accounts that you have linked to the template. This means the next time you go into the template in BASlink it will update the 'G' and other fields on the BAS automatically provided BASlink is filtered correctly.

How do I save my BAS setup?

Your activity statement setup, including certain default values, will be saved when you exit BASlink by clicking the Save Setup & Exit button. This will save your BAS/IAS field setup in your BASlink setup folder using a combination of your ABN and Branch ABN or Tax File number as the file name. This setup will be used as a template when you next complete your activity statement.

Where is my BAS setup saved?

When you save your BAS/IAS field setup, it's saved as a .bas file in the Setup folder using a combination of your ABN and Branch ABN or Tax File number as the file name. The Setup folder is located here:

C:\Users\<user.name>\Documents\MYOB\AccountRight\BASLink\Setup

Will I have to set up my BAS on each computer I use AccountRight on?

If you use AccountRight on multiple computers, you'll need to set up your BAS/IAS fields on each computer. When you save the BAS/IAS field setup, it's saved as a .bas file in the Setup folder on each computer here:

C:\Users\<user.name>\Documents\MYOB\AccountRight\BASLink\Setup

When my BAS is set up, will the setup be available for all users?

Your BAS/IAS setup will be saved under the profile of whoever is logged into Windows on your computer. So if your users log into Windows with their own credentials, they'll each have to set up the BAS/IAS fields in AccountRight.

The Setup folder (where the setup file is saved) is based on the <user.name> of the person logged into Windows:

C:\Users\<user.name>\Documents\MYOB\AccountRight\BASLink\Setup

I have more than one company and I require a different activity statement setup for each. How can I do that?

If you use BASlink for more than one company and the setup of each company is similar, you can use the Save As command in BASlink. Go to the File menu choose Setup and click Save As. You need to name the file using the combination of the company's ABN and Branch ABN (or the Tax File Number if it is an Instalment Activity Statement setup file) in order for BASlink to automatically use the setup file for each company.

Can I copy my activity statement setup to another computer?

Yes. To copy the setup file to another computer, open the BASlink/Setup folder in Windows Explorer and copy the .bas file to an external storage device, like a USB drive. Copy the setup file to the other computer's BASlink/Setup folder.

C:\Users\<user.name>\Documents\MYOB\AccountRight\BASLink\Setup

Fields

How do I deal with situations whereby the GST is less than 10% of the transaction value?

In these situations, the transaction needs to be 'split up' into GST taxable and non-GST taxable lines. For GST taxable lines, the GST amount is always 1/10th (exclusive basis) or 1/11th (inclusive basis) of the line total. In this way, BASlink can correctly calculate GST collected and paid at G9 and G20 by dividing G8 and G19 by 11.

Example

A purchase is made for $10,000 whereby $5,000 is subject to a 10% GST and $5,000 is a GST-free supply. The total tax inclusive value of the purchase is therefore $10,500. When entering the purchase in your software, you need to split the transaction into two lines. Assuming the purchase is entered as tax inclusive, the first line should have $5,500 allocated to the GST tax code, so that $500 GST is calculated. The second line should have $5,000 allocated to the FRE (GST-free) tax code, so that no tax is calculated. In this way, the GST is stated as 1/11th of the taxable supply and BASlink can calculate the correct GST paid at G20.

What does the option in BAS info 'I use the Simplified Accounting Method' refer to?

Some retailers that deal with a range of GST-free, taxable and mixed sales who do not have an adequate point of sale (POS) system and an annual turnover less than $1 million ($2 million in the 1st year), can use one of the ATO's simplified accounting methods.

There are three simplified accounting methods, which relate to trading stock only. Businesses will still need to separately account for other sales such as the sale of capital equipment, and other purchases such as rent, phone and other operating expenses.

Should G11 and G14 include voluntary withholding purchases and purchases where customers don't provide an ABN?

All purchases need to be included at either G10 or G11. All purchases with no GST in the price need to be included at G14.

Why can't I link any tax codes to G2, G3 and G4 on the Calculation Sheet in BASlink?

All reportable income needs to be shown at G1. This income is then 'broken down' in G2, G3 and G4. If a tax code relating to G2, G3 and G4 is not linked in G1 you will prompted to add it to G1 when assigning a tax code to G2, G3 and G4.

How do I work out my instalment income at T1?

Instalment income at T1 is, as a general rule, the assessable gross ordinary income derived in the instalment period for the income year. Do not include the GST, WET or LCT you charge your customers, clients or tenants in your gross ordinary income. There are specific instructions for calculating instalment income for partners and beneficiaries of trusts.

Where do I link the N-T tax code in BASlink?

Any transactions with N-T (no tax) tax codes are outside the scope of GST and are not reported on the BAS. Examples of N-T items are depreciation, bank transfers, and stock movements.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.