- Created by RonT, last modified by MartinW on Aug 29, 2023

https://help.myob.com/wiki/x/Rb86Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Australia only

You must be reporting to the ATO via STP Phase 2

If you haven't already, you need to move to STP Phase 2 to stay compliant with the ATO. But we have you covered – see how easy it is to move.

You need to assign an ATO reporting category to each of the wage, deduction and superannuation pay items you use. This lets the ATO know how to treat each type of payment you're reporting through Single Touch Payroll (STP).

STP Phase 2

STP Phase 2 is the ATO's expansion of their payroll reporting requirements. This includes expanding the list of ATO reporting categories to better define the amounts paid to employees. For example, the ATO reporting category Gross payments has been split into more specific payment types, like overtime and bonuses.

To learn more about STP Phase 2, visit the ATO website.

If you set up STP since mid-December 2021, you'll likely be set up for STP Phase 2. You can see if you're reporting on STP Phase 2 via the STP reporting centre (Payroll > Single Touch Payroll reporting).

When you move to STP Phase 2, you'll need to confirm the ATO reporting categories you've assigned to your pay items. For example, pay items previously assigned to Gross Payments might now need to be assigned to a new specific reporting category, like overtime or bonus.

Which ATO reporting category should I assign?

As your business, award and employee agreements are unique, we can't tell you which ATO reporting categories you should assign to your pay items.

However, you can use the descriptions of reporting categories below to guide you.

For additional information and advice:

- consult your accounting advisor

- ask questions and learn from others at the community forum

check the employer reporting guidelines on the ATO website: STP Phase 1 | STP Phase 2

What is each ATO reporting category for?

Use this information to work out which reporting categories you need to assign to your pay items. The STP Phase 2 reporting categories will apply when your business is reporting via STP Phase 2.

| ATO reporting category (Phase 1) | ATO reporting category (Phase 2) | More information | ATO links |

|---|---|---|---|

| Gross Payments | Gross payments | Include pay items you use for paying salary and wages. For STP Phase 2, payments that don’t sit into any of the main categories, assign them to Gross payments (but check this with the ATO). | |

Allowance - Car | Allowance - cents per km | This includes payments you make to cover your employees’ work-related expenses. For allowances that don’t sit into any of the main categories, assign them to Allowance – Other (but check this with the ATO). If assigning Allowance - other as the ATO reporting category, make sure the name of the allowance adequately describes what the allowance is for, e.g. general, home office, non-deductible, transport/fares, uniform or private vehicle. This will help the ATO assist your employees to complete their tax returns. Learn more... | |

Lump Sum A - Termination | Lump Sum A - Termination | Lump sum payments, typically paid as employment termination payments, may include:

See the FAQs below for details on each lump sum payment type. For STP Phase 2: Lump Sum W has been added which is for return to work payments. Lump Sum E payments work differently for STP Phase 2. Tell me more Lump sum payments are a complex area. Chat to your advisor or check with the ATO for more guidance. | |

CDEP Payments | No longer required | The CDEP payment scheme has ended. For STP Phase 2 these payments are not reportable. | CDEP payments |

| Exempt Foreign Income | Exempt Foreign Income | This could be assigned to pay items such as salary, wages, commissions, bonuses and allowances that are exempt from Australian tax. | Exempt foreign employment income |

| ETP - Taxable component ETP - Tax free component | ETP - Taxable component ETP - Tax free component | These are pay items used to track the taxable and tax-free components of employment termination payments. ETPs are concessionally taxed up to a certain limit, or 'cap'. Certain types of termination payments are tax free up to a certain limit, for example, if the ETP is because of redundancy or early retirement. | Taxation of termination payments |

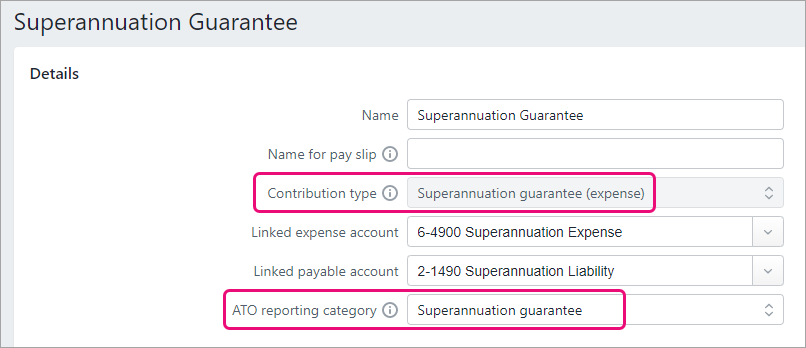

An ATO reporting category is required for each superannuation pay item. The ATO reporting categories you can choose from is based on the superannuation Contribution type.

Here's the available ATO reporting categories for superannuation.

| ATO reporting category (Phase 1) | ATO reporting category (Phase 2) | More information |

|---|---|---|

Superannuation Guarantee | Superannuation Guarantee | This information is reported to the ATO to ensure that employee super funds are receiving the correct amounts. Helping you stay compliant with ATO super reporting The ATO reporting category for superannuation pay items with a contribution type of Superannuation guarantee (expense) will be automatically set to Superannuation guarantee. |

| Reportable Employer Super Contributions | Reportable Employer Super Contributions | Used to assign superannuation pay items that are classified by the ATO as Reportable Employer Super Contributions (RESC). |

Salary Sacrifice and RESC | Use this to assign salary sacrifice super pay items. These are classified by the ATO as reportable employer super contributions (RESC). | |

| Not Reportable | Not Reportable | Use this to assign superannuation pay items which are not reportable to the ATO for STP purposes. To clarify if a super pay item is reportable, check with your accounting advisor or the ATO. |

| ATO reporting category (Phase 1) | ATO reporting category (Phase 2) | Description | ATO reference |

|---|---|---|---|

Deduction - Work Place Giving | Deduction - Work Place Giving | Assign pay items that are donations made under a workplace giving arrangement. | Workplace giving programs |

Deduction - Union/Professional Assoc Fees | Deduction - Union/Professional Assoc Fees | This might include pay items for:

| Union fees, subscriptions to associations and bargaining agents fees |

| ETP - Tax Withholding | ETP - Tax Withholding | Use this reporting category when an employment termination payment has been made to an employee. | Taxation of termination payments |

Salary sacrifice - other employee benefits | For deductions that are for benefits from an effective salary sacrifice arrangement, including those exempt from FBT. | Salary sacrifice arrangements | |

| Not Reportable | Not Reportable | All other deductions are usually considered not reportable. This includes things like loan or car payments. This is because they may not need to be itemised on an employee's tax return. If you're not sure if a deduction is reportable, check with your accounting advisor or the ATO. |

Child support deductions

You can't currently report your child support deductions to the ATO via STP from MYOB. This means you can assign Not Reportable as the ATO Reporting Category in your child support deduction pay items.

The ATO Reporting Category is automatically assigned for the PAYG Withholding pay item.

| ATO reporting category | Old Payment Summary field name | More information |

|---|---|---|

PAYG Withholding | Total Tax Withheld | This is automatically assigned and can't be changed. |

This category reports all tax withheld from the employee, including any extra PAYG that may be deducted.

Assigning ATO reporting categories

You need to assign ATO reporting categories to all pay items you've used in the current payroll year, and whenever you create a new pay items.

If you're setting up STP for the first time or moving from STP Phase 1 to STP Phase 2, your MYOB business is checked to find any pay items that don't have an ATO reporting category assigned—so you can then assign one. You can also manually check your pay items and, if required, assign an ATO reporting category.

To assign ATO reporting categories

- Go to the Payroll menu and choose Pay items.

- Click the Wages and salary, Superannuation or Deductions tab.

- Click a pay item to view its details.

- Choose the applicable ATO reporting category. See above for information to help you select it, or speak to your accounting advisor or the ATO.

- Click Save.

- Repeat for any other pay items you want to check or update.

FAQs

Which pay items are not reportable?

In most cases, pay items that don't need to be included on an employee's tax return, are not reportable. Depending on your circumstances. this may include pay items for post-tax deductions and deductions that are exempt from fringe benefits tax. For example, loan or car payments.

If you're not sure what reporting category to assign, talk to your accounting advisor or the ATO.

Why can't I choose an ATO reporting category for a pay item?

Some pay items that exist in MYOB by default, like Superannuation Guarantee, have the ATO reporting category set for you and cannot be changed. This ensures those critical pay items are reported correctly to the ATO.

How do I assign salary sacrifice superannuation?

When reporting payroll amounts using Single Touch Payroll, gross wage amounts are reduced automatically by deduction amounts that are marked as a before-tax deductions. This includes salary sacrifice superannuation deductions.

- For STP Phase 1 the ATO reporting category Reportable Employer Super Contributions can be used for Salary Sacrifice (deduction) superannuation pay items.

- For STP Phase 2 the ATO reporting category Salary Sacrifice and RESC can be used for Salary Sacrifice (deduction) superannuation pay items.

If you're not sure what reporting category to assign, talk to your accounting advisor or the ATO.

What are the types of lump sum payments?

Here's a brief description of each type of lump sum payment. For more details, or to clarify if a payment you're making is a lump sum, check with your accounting advisor or visit the ATO website.

| Type | Description |

|---|---|

| Lump Sum A - redundancy | Payments of unused long service leave accrued after 17 August 1993 or unused holiday pay and other leave-related payments, where the amount was paid in connection with a payment that includes (or consists of) either – a genuine redundancy payment – an early retirement scheme payment – the invalidity segment of an ETP or super benefit. |

| Lump Sum A - termination | Payments of unused long service leave that accrued after 15 August 1978, but before 18 August 1993, or unused holiday pay and other leave-related payments that accrued before 18 August 1993. |

| Lump Sum B | Payments for unused long service leave that accrued before 16 August 1978. |

| Lump Sum D | The tax-free component of a genuine redundancy payment or an early retirement scheme payment. |

| Lump Sum E | An amount of back payment that accrued, or was payable, more than 12 months before the date of payment and is $1200 or more. Learn more about lump sum E payments |

| Lump Sum W | A return to work amount that's paid to induce an employee to resume work. For example, to end industrial action or to return from working for another employer. |

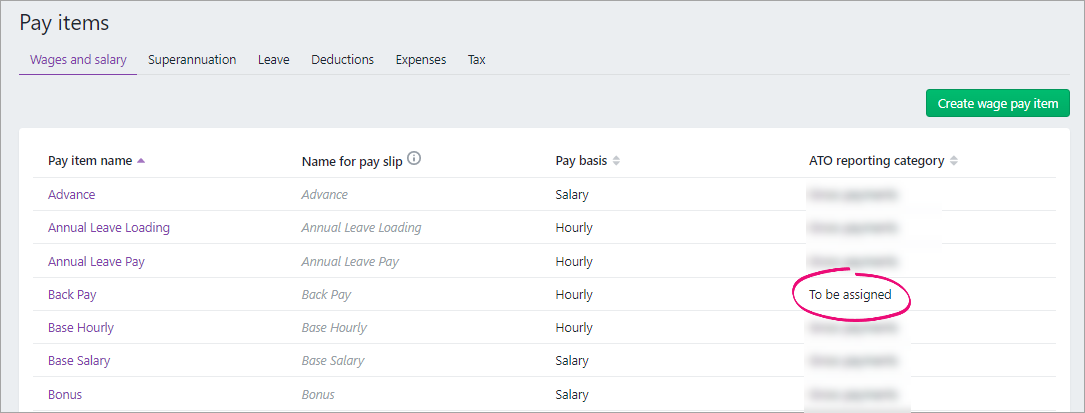

Where can I see a list of assigned ATO reporting categories?

When you view your list of pay items (Payroll menu > Pay items), you'll see which ATO reporting categories have been assigned on the Wages and salary, Superannuation and Deductions tabs.

This is a handy way to see if any ATO reporting categories are yet to be assigned.

Open the STP reporting centre and look in the top-right corner (Payroll menu > Single Touch Payroll reporting).

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.