- Created by MichelleQ, last modified by AdrianC on Jun 26, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 40 Next »

https://help.myob.com/wiki/x/8No6Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

You can view the basic details of reports you've sent to the ATO as part of Single Touch Payroll reporting in the Payroll Reporting Centre.

From the Payroll Reporting Centre you can:

- View Single Touch Payroll reports, per pay run.

- Send payroll reports after processing payroll.

- View errors that are preventing the report being accepted by the ATO.

- Download a PDF report showing what has (and hasn't) been sent to the ATO.

To view payroll reports

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

Reports are listed with basic information and their status.

If you've set up Single Touch Payroll reporting, done a pay run, and there are no reports in the reporting centre see our topic Where are my Single Touch Payroll reports?

If some employees aren't showing in the reporting centre check their employee basis. If the employee basis is set to Other, the employee's pay details won't be sent to the ATO.

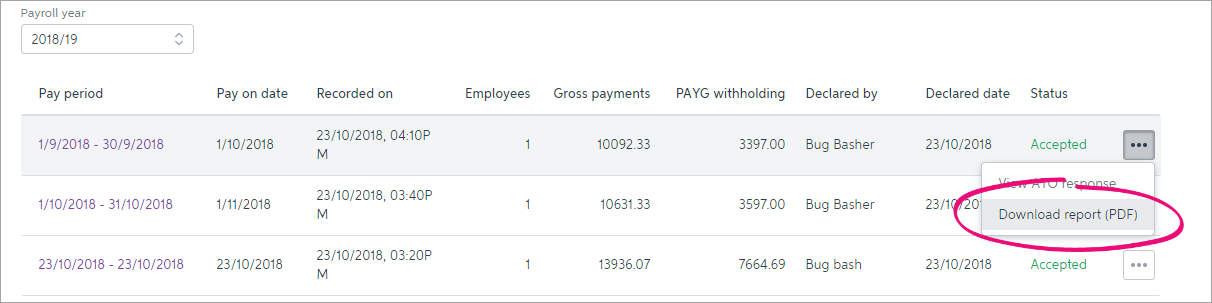

To download a report (PDF)

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- Click the ellipsis

button next to a report and choose Download report (PDF).

button next to a report and choose Download report (PDF).

The report downloads and displays.

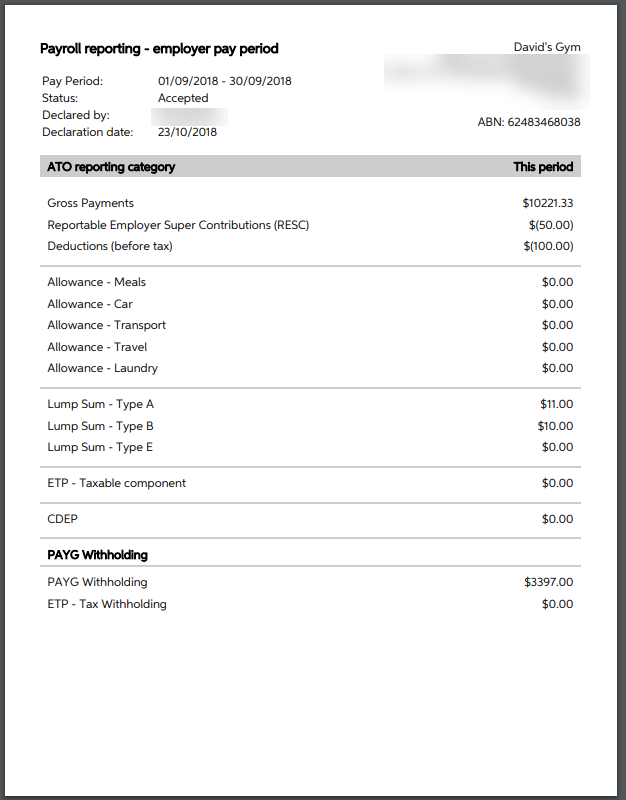

What the report shows

The report has 2 parts:

- employer pay period - this shows:

total of Gross payments

total of all reportable employer superannuation contributions (RESC)

total of all before tax deductions

both reportable and not reportable payroll categories

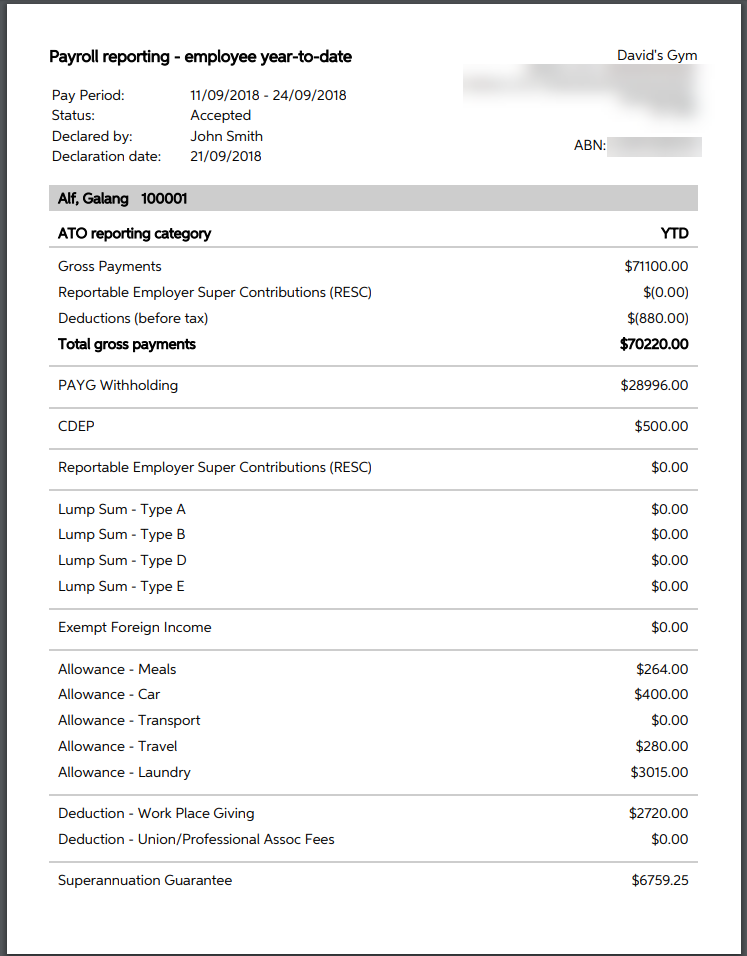

- employee year-to-date - this shows:

total of Gross payments (not sent to the ATO)

total of all reportable employer superannuation contributions (RESC - not sent to the ATO)

total of all before tax deductions (not sent to the ATO)

TOTAL gross (this is the figure that is sent to the ATO)

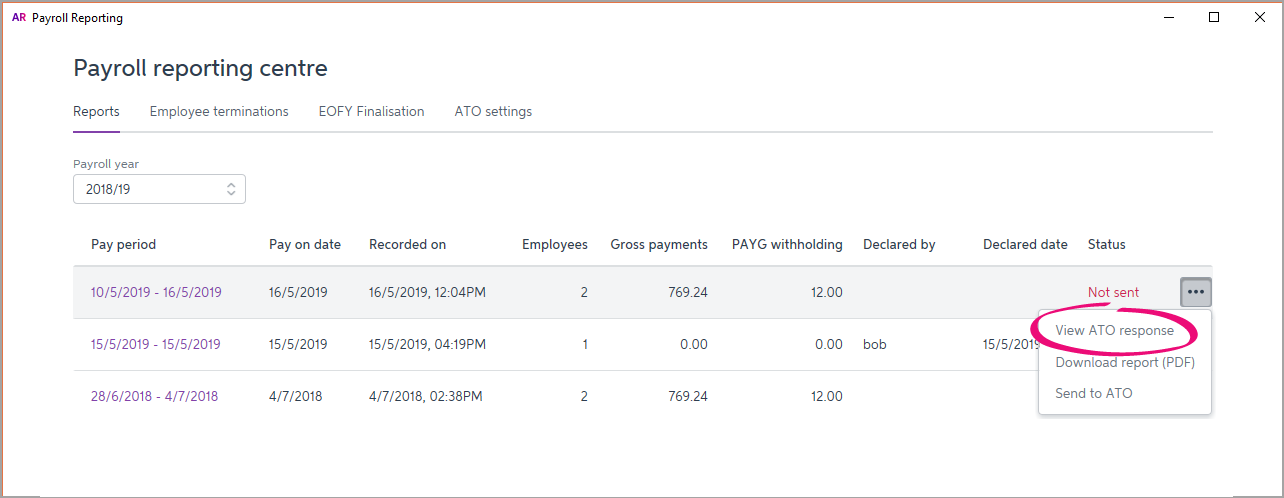

To view ATO response

If a report you've sent to the ATO isn't accepted, you can view the ATO's reponse to find out why.

From the Payroll menu, choose Payroll Reporting.

- Click Payroll Reporting Centre.

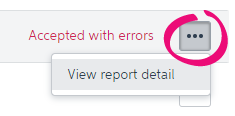

- Click the ellipsis

button next to a report and choose View ATO response.

button next to a report and choose View ATO response.

Details of the ATO's response are displayed.

Pay events and update events

Pay runs submitted to the ATO are either pay events or update events.

A pay event can only occur in the current payroll year, and will contain a dollar value. A regular pay run is considered a pay event, where both employee and employer year-to-date totals are submitted to the ATO.

An update event can only occur in the current payroll year, but it won't contain a dollar value. For example, if you change a paid amount from one payroll category to another—like changing a $20 bonus to a $20 commission. The pay amount won't change, but the details will. For update events, only the employee's year-to-date totals are sent to the ATO, but not the employer's year-to-date totals.

Report statuses

| State | Description | How to fix |

|---|---|---|

| Sending | The report has not arrived at the ATO for one of these reasons:

| Nothing to fix - reports will sit in Sending until the ATO receives them. This can take up to 72 hours during peak periods. |

| Not sent | The report has not arrived at the ATO for one of these reasons:

| If you haven't added yourself as a declarer:

If you clicked "Cancel" at the declaration:

|

Accepted | Report has been sent to and accepted by the ATO with no errors. | All good! |

| Rejected | The report has been sent but rejected by the ATO. Rejected reports will have a reason for the rejection, and what needs to be fixed for it to be accepted. The Rejected status will remain for the report. Once you've addressed the issue, updated payroll information will be sent to the ATO on your next pay run. | |

| Accepted with errors | Report has been sent to and accepted by the ATO, however there are some things that you'll need to fix before the next pay run. |

|

FAQs

What information is sent to the ATO?

Only your employees' year to date figures are sent to the ATO. Take a look at this quick video to learn more.

Also check this ATO information about viewing your reports for Single Touch Payroll via the Business Portal.

How do I fix or delete a report that's been sent to the ATO?

You can't delete or "undo" a report that's been sent to the ATO. Instead, the next time you record a pay and submit it to the ATO, the latest year-to-date totals will be submitted.

This means if you've reported a wrong amount to the ATO, reverse or delete the incorrect pay, record it again and submit it to the ATO.

Take a look at this quick video to learn more.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.