- Created by MichelleQ, last modified by BrianQ on Jun 27, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 79 Next »

https://help.myob.com/wiki/x/xNs6Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier (v2018.2 and later), Australia only

If you've been using Single Touch Payroll reporting, you need to finalise your payroll information by 31 July. This replaces the old payment summary process.

When you finalise:

- you're letting the ATO know that you've completed all pays for the payroll year

- the status of the employee's income statement in myGov changes to Tax ready so they can pre-fill and lodge their tax return.

- Enter all pays up to 30 June (pays recorded in July which include June pay dates aren't included in the finalised year)

- Fix any incorrect pays

- Back up your company file

Finalising your Single Touch Payroll information is done in just a few clicks.

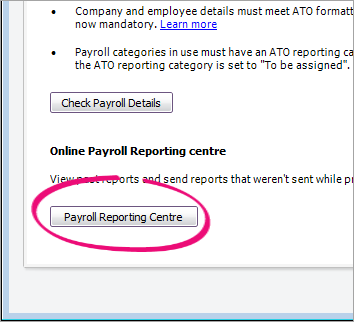

- Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If this button says Connect to ATO, it means the company file hasn't been set up for Single Touch Payroll, or you haven't added yourself as a declarer for STP.

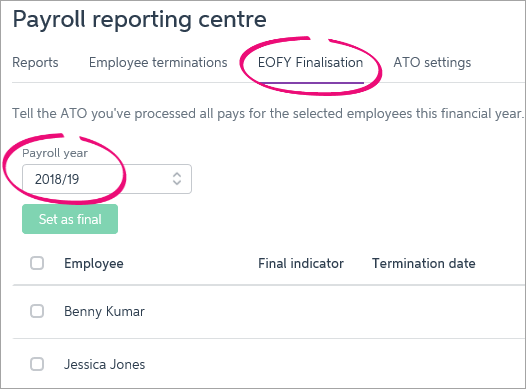

- Click the EOFY Finalisation tab and choose the Payroll year you're finalising.

- If you need to report fringe benefits for an employee (what is this?):

- Click the ellipsis

button for the employee and choose Enter RFBA.

button for the employee and choose Enter RFBA. Enter in both the:

Reportable fringe benefits amount $

Reportable fringe benefits amount exempt from FBT under section 57A $

The combined value of these must be above the thresholds set by the ATO.

- Click Add amounts.

- Click the ellipsis

- Select each employee you want to finalise, then click Set as Final.

- Enter the name of the Authorised sender and click Send.

Each employee that has been finalised will have the Final indicator ticked. You can let these employees know that they can now sign in to myGov to complete their tax returns.

Year to date reports

There are two reports available on the EOFY Finalisation tab which show year to date amounts sent to the ATO for the payroll year.

- Summary of payments—this report shows a summary of all ATO reporting category amounts sent to the ATO for an employee (gross payments, PAYG withholding, allowances, etc.). It might look like it, but this report is not a payment summary.

- YTD verification report—this consolidated report shows the total of all ATO reporting category amounts sent to the ATO for all employees.

To run the Summary of payments report

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- Click the the EOFY Finalisation tab.

- Choose the Payroll year. Your employees' consolidated Gross Payments (YTD) and PAYG withholding (YTD) amounts are displayed.

- Click the ellipsis

button for an employee and choose Download report(PDF).

button for an employee and choose Download report(PDF).

The employee's Summary of payments report appears as a PDF, ready for you to review, save or print.

To run the YTD verification report

- Go to the Payroll command centre and click Payroll Report.

- Click Payroll Reporting Centre.

- Click the EOFY Finalisation tab.

- Choose the Payroll year. Your employees' consolidated Gross Payments (YTD) and PAYG withholding (YTD) amounts are displayed.

- Click YTD verification report.

The Payroll reporting - Year-to-date verification report appears as a PDF, ready for you to review, save or print.

FAQs

What if I've terminated an employee before setting up Single Touch Payroll reporting?

If you terminated an employee during the 2018-19 financial year before you started using Single Touch Payroll, you might need to prepare a payment summary. This depends on whether the employee’s final pay was an Employment Termination Payment (ETP) or not.

If the final pay:

- included an Employment Termination Payment (ETP), you won't be able to report this to the ATO through Single Touch Payroll. Instead, you'll need to provide them with a payment summary. See prepare payment summaries.

- didn't include an ETP, (for example, their final pay only included unused leave), you'll need to reinstate the employee before you can finalise their payroll details. See Finalising payroll for employees terminated before using STP.

Why is an employee missing from the EOFY Finalisation list?

Only employees who have been paid in the current payroll year appear in the EOFY Finalisation list. If an employee isn't listed, check that:

- the employee's Employment Basis is set to Individual or Labour Hire. You'll find this setting in the Payroll Details tab > Personal Details of the employee's card. Employees set as Other won't appear in the list.

- at least one pay been recorded for the year, after setting up STP.

If you've checked these things and an employee still isn't showing, record a $0 (zero dollar) pay for employee. Remove all hours and amounts from the pay. When the $0 pay is recorded, you'll be prompted to declare and send the details to the ATO. The employee's YTD amounts are then sent to the ATO and the employee will appear in the finalisation list.

How do I undo a finalisation?

Yes, you can undo an employee's finalisation. When you do, the employee's income statement in myGov will no longer be Tax ready so they won't be able to pre-fill and lodge their tax return.

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- Click the EOFY Finalisation tab.

- Choose the Payroll year.

- Click the ellipsis

button for the employee and choose Remove finalisation.

button for the employee and choose Remove finalisation. - Enter the name of the Authorised sender and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY Finalisation tab.

- When you're ready, you can finalise the employee again.

Why are my ETP amounts duplicated?

We've received reports that ETP amounts are being duplicated for some employees. Please see our community forum post for more information on this issue and the steps to resolve.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.