- Created by RonT, last modified by AdrianC on Jul 11, 2022

https://help.myob.com/wiki/x/wOU6Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

New Zealand only

- The Ministry of Justice may send you a letter requesting money be deducted from an employee's pay

- The letter provides payment amounts, the start date, and remittance details

- Court fines must be paid directly to the Ministry of Justice (NOT to the IRD)

- Learn more about court fines at justice.govt.nz

To deduct court fine payments from an employee's pay, you'll need to set up a deduction in MYOB Essentials. You then assign the deduction to the employee and specify the total amount to be paid and how much is to be deducted each pay. When it's paid in full, the deductions stop automatically. This is known as a reducing balance deduction. Learn more about reducing balance deductions.

Let's step you through the setup and what the deduction looks like on a pay.

1. Set up a court fines deduction pay item

- Go to the Payroll menu and choose Pay items. The Pay items page appears.

- Click Create deduction. The Create new deduction window appears.

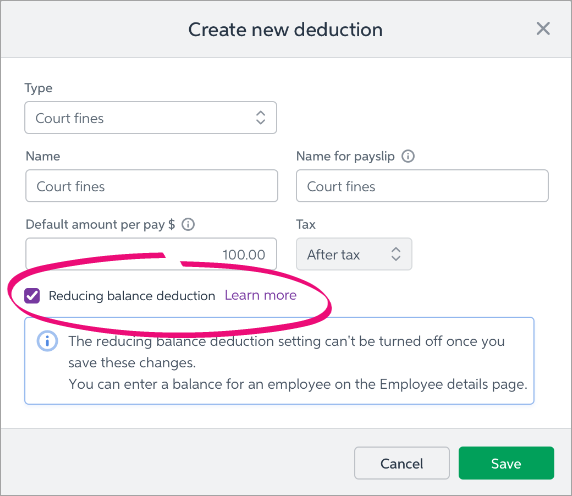

For the deduction Type, choose Court fines.

Enter the deduction Name.

If you'd like a different, more personalised, name to show on payslips for this deduction, enter a Name for payslip, such as "Court fines - Steven".

(Optional) Enter the Default amount per pay to be deducted. If required, you can set a custom amount for different employees (see Assign the pay item to an employee below for details).

Select the option Reducing balance deduction. Once saved, you won't be able to deselect this option.

Enter the Default amount per pay to be deducted. If required, you can set a custom amount for different employees (see Assign the pay item to the employee below for details).

Skip the Tax field – it's automatically set to After tax and can't be changed.

Here's our example of a court fines deduction pay item:

- Click Save.

You can now assign the deduction to one or more employees - see the next task for details.

Assign the deduction to an employee

To include the deduction in an employee's pay, you need to assign it to them. Here's how:

- From the Payroll menu, choose Employees.

- Click the employee's name.

- Click the Pay items - earnings & deductions tab.

- In the Deductions section, click the dropdown arrow next to the Add deduction... field.

- Choose the court fines deduction you're assigning.

- Whether or not you set a default amount per pay when you set up the deduction, you can enter a value in the Amount per pay ($) field. This amount will only apply to this employee.

- Enter the Balance owed ($). This is the total amount of the court fine to be deducted over time.

- Click Save.

Next time you process a pay, the court fine deduction will be listed for the employee. See the next task for details.

Process a pay with the deduction

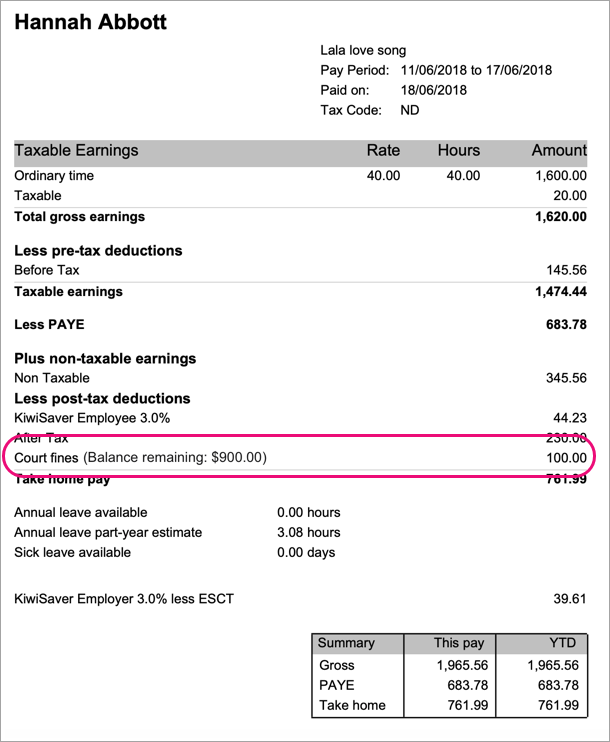

After you've assigned the court fines deduction to an employee, it'll appear in their pay until the balance owed reaches zero.

Let's take a look:

- Go to the Payroll menu and choose Enter Pay.

Select the employee to be paid then click Start Pay Run.

The deduction is shown.Protected net earnings (New Zealand)

Court fines deduction amounts cannot be changed in the pay run. Based on the employee's pay, the deduction amount may automatically reduce to protect minimum earnings. Learn more about protected net earnings on the IRD website.

- Continue processing the pay as normal. Here's what it looks like on the employee's payslip:

Amounts deducted are allocated to your payroll deductions account, ready to be paid to the applicable governing body.

FAQs

What happens to the deducted money?

Money deducted from employee pays needs to be paid to the applicable third party. For example, court fines are paid to the Ministry of Justice. Check with the third party regarding their accepted payment methods.

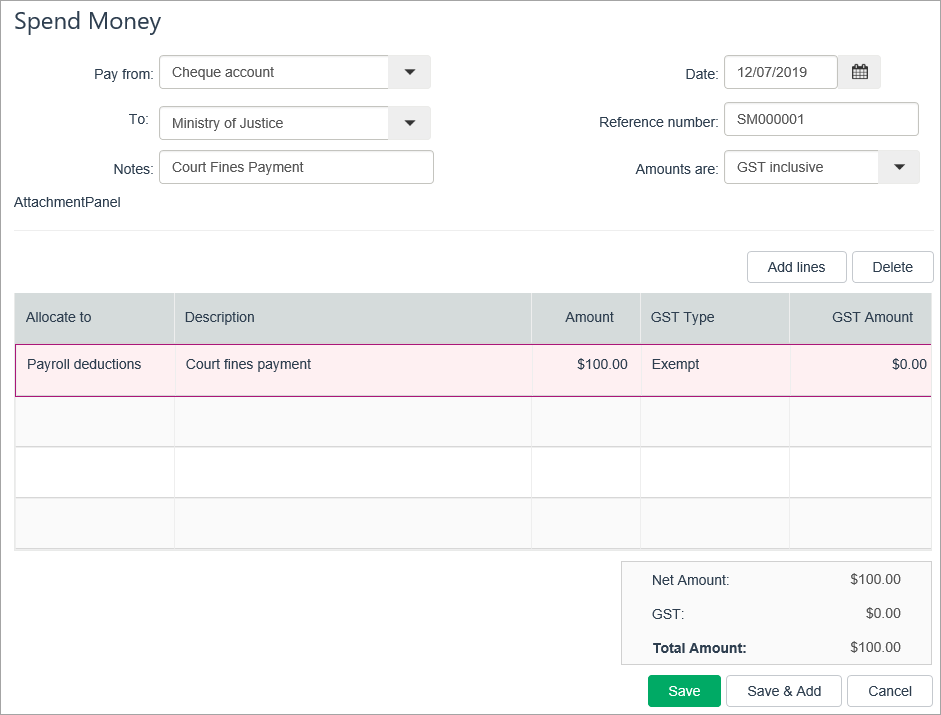

You can make a record of these payments in MYOB Essentials using a Spend money transaction (Banking menu > Spend money).

Here's an example spend money transaction for a court fines payment. Note the following:

- In the Pay from account we've chosen the MYOB Essentials bank account the payment is coming from.

- In the To field we've chosen who the payment went to (we set up a supplier record for this purpose).

- In the Allocate to field we've chosen the MYOB Payroll Deductions account.

Do reducing balance deductions affect reporting?

Reducing balance deductions don't affect reporting in any way. The only places the balances are shown are:

- the Employee details page

- the Pay run page

- the employee's pay slip

So reducing balance deductions are reported the same way as any other deduction.

What happens when the balance owed reaches zero?

Deductions automatically stop at $0. The final deduction will reduce to ensure it doesn't exceed the balance owed.

For example, the balance remaining is $50 but the deduction amount is $100, the deduction amount will reduce to $50 so that the balance will reach $0.

The only way the balance can go into negative is by someone processing a manual deduction.

For example:

- Sam has a $100 deduction per pay and the balance is $400.

- After 4 pay runs, the balance reaches $0.

- At the 5th pay run, in spite of the balance being $0, I decide to deduct a further $100 and I enter this manually on the pay run.

- After this pay run, the balance becomes -$100 and the balance on the employee details page will show -$100.

- When I do the 6th pay run, the deduction on the pay run will again show $0 (because there is nothing to be deducted) and the employee details page still shows -$100 because that is the balance.

Can I change the account my deductions are allocated to?

Deductions withheld from pays are allocated to a liability account in MYOB Essentials called Payroll deductions. This is a system account which cannot be changed.

You can find this account by clicking your business name and choosing Accounts list, then scrolling down to Liability > Current Liabilities.

What if the deduction amount varies between employees?

You can set a different deduction amount for each employee when assigning their the court fine deduction pay item. See Assign the pay item to an employee above for details.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.