- Created by AdrianC, last modified by RonT on Jul 30, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 27 Current »

https://help.myob.com/wiki/x/r-Y6Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

You can use AccountRight to record the receipt of a loan and to record the repayments. Because there's lots of loan types, interest rates, terms and conditions, you might need help from your accounting advisor to determine the best way to set this up for your loan.

To accurately track your loan balance, you'll need to know:

- the initial loan amount

- the value of your repayments, and

- the repayment breakdown (how much of the repayment reduces the principal, and how much relates to interest charges).

The example below describes setting up a loan where the loan amount is received by you. If your situation is different – for example, the loan amount isn't received by you but is used to directly pay out a creditor – you'll need to consult your accountant for the appropriate accounting and tax treatment. If you're lending money to an employee, see Wage advances and employee loans.

Let's step you through setting up a basic loan.

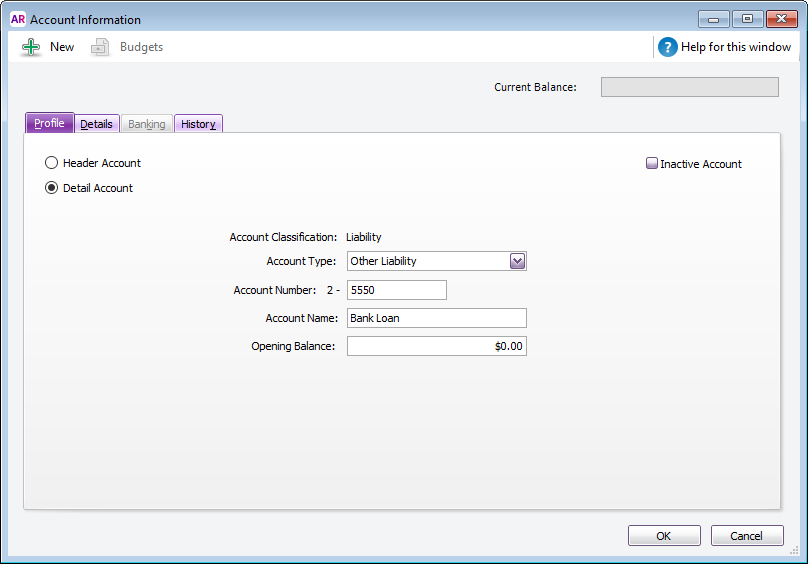

1. Create a liability account for the loan

You need a liability account to represent the loan. When the loan is received you'll allocate it to this account.

- Go to the Accounts command centre and click Accounts List.

- Click the Liability tab then click New.

- For the Account Type, choose Other Liability.

- Specify an Account Number that suits your account list.

Enter a suitable Account Name. Here's our example:

Will you be setting up a bank feed for the loan account? You'll need to set up the above liability account with the Account Type of Credit Card to be able to associate it with a bank feed.

- Click OK.

2. Record the receipt of the loan

When you receive the loan, use a Receive Money transaction to enter it into AccountRight. Here's how:

- Go to the Banking command centre and click Receive Money.

- In the Deposit to field, select the bank account that the loan money was deposited into.

- In the Amount Received field, enter the loan amount.

- In the Acct No. column, select the liability account created in the previous task.

- In the Tax/GST column, specify the N-T (No Tax/Not Reportable) tax/GST code. Here's our example:

- Click Record.

3. Record the loan repayments

Loan repayments can be recorded using Spend Money transactions. Our example below is for a fixed repayment with the interest portion allocated to an expense account. This allows the loan interest to be tracked separately. For your loan, you might need to seek clarification from your accounting advisor about the best way to enter the repayments.

- Go to the Banking command centre and click Spend Money.

- In the Pay from Account field, select the account you're making the repayment from.

- In the Amount field, enter the total value of the repayment.

- In the Acct No. column, select the liability account created earlier.

- In the Tax/GST column, specify the N-T (No Tax/Not Reportable) tax/GST code.

- Specify bank interest/charges on a separate line and use the applicable tax/GST code for your needs. Here's our example:

- Click Record.

As you record loan repayments, the balance of the liability account will be reduced to reflect a reduction in that liability.

If your loan repayments are fixed, save this Spend Money transaction as a recurring transaction.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.