How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Easy EOFY

End of financial year doesn't need to be stressful. In MYOB Essentials, there's not much you need to do, we'll close off the financial year and update your software, so you don't have to. Unlike desktop accounting software, you don't need to back up your data at end of year – it's always up to date in the cloud.

But even though EOFY is easy in MYOB Essentials, you should take a few moments to make sure your accounts are in order, and everything's ready for your accountant to take care of tax time.

Get started by completing your usual End of period tasks. Once they're done, watch this video to some of the things you might want to do (and a couple that you need to do) for the end of the financial year:

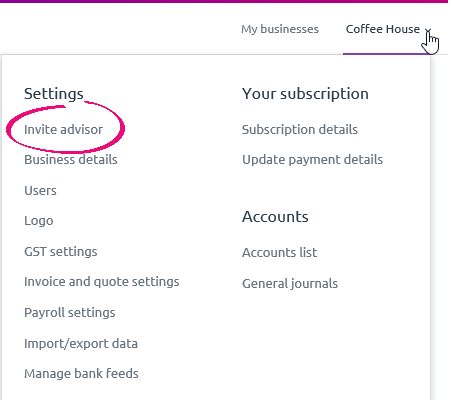

Invite your accountant

If you haven't already, invite your accountant to your MYOB Essentials business.

This will let them log in and work directly with your data, so they can do your tax and make any adjustments that are needed.

Report to the ATO

If you've paid employees this year using Single Touch Payroll, you'll need to finalise your payroll information by 31 July. This lets the ATO know that all your pays for the payroll year are complete.

If you paid employees but you haven't set up Single Touch Payroll, you'll need to prepare PAYG payment summaries (previously called group certificates) before 14 July. You'll also need to send this information to the ATO before 14 August. You can use MYOB Essentials to create and electronically lodge your payment summaries.

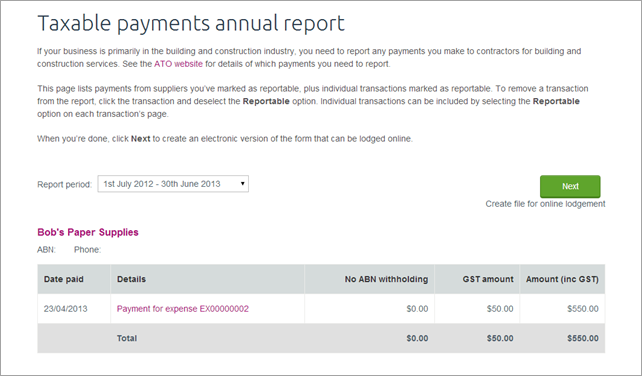

Report payments to contractors

There's a growing number of industries who need to lodge a Taxable Payments Annual Report (TPAR), detailing the payments they've made to suppliers.

See Reportable contractor payments for information about what needs to be reported, and Producing the Taxable payments annual report for details of how to create the report.

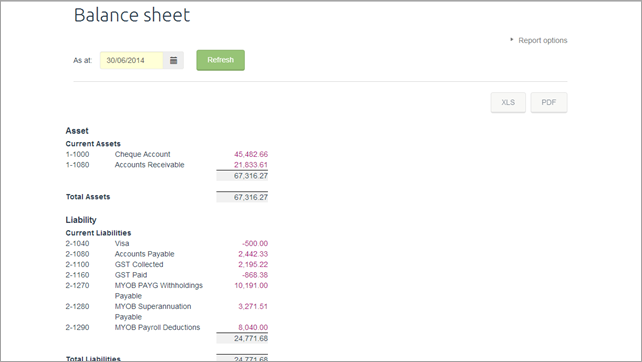

Run reports

Your Profit & Loss and your Balance Sheet let you know how your business has performed throughout the year (which you've probably been checking regularly). You might like to print a copy for yourself.

- Profit and Loss tells you how much profit your business has made in the last year, divided into income, expenses and net profit.

- Balance Sheet tells you your business's net worth up to the end of the financial year. It's divided into assets, liabilities and equity.

See Business reports to learn how to produce these reports.