Assets perform several calculations to make up the journal entry for the sale. The calculation of profit or loss on the sale of an asset may differ.

For example, consider the following scenario:

BMW 3 Series Sedan | Taxation details | Accounting details |

|---|---|---|

Current financial year | 2018 | 2018 |

Date asset began depreciating | 27/03/2014 | 27/03/2014 |

Original cost | $ 67,950 | $ 67,950 |

Motor vehicle cost limit at the year of purchase (AU only) | $ 57,466 | N/A |

Opening written down value (OWDV) | $ 22,645 ** | $ 26 801 |

Depreciation rate / method | 25% diminishing value | 25% diminishing value |

Date of sale | 02/11/2017 (125 days held this FY) | 02/11/2017 (125 days held this FY) |

Consideration | $ 25,000 | $ 25,000 |

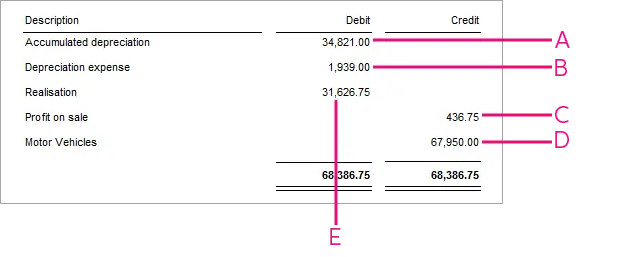

Taxation journal explained

| Description | Formula | Example |

|---|---|---|---|

A | Write back accumulated depreciation | Original cost – opening written down value (OWDV) Motor vehicle (MV) cost limit – OWDV (for vehicles subject to cost limit) | 57,466 – 22,645 = 34,821 |

B | Apply depreciation for the current year, up to the date of sale (NZ) In the year a Taxation Asset is sold, no depreciation for that year is applied. | OWDV * rate * days held / days in the year | 22,645 * 0.25 * 125 / 365 = 1938.78 |

C | i). Calculate closing adjusted value (CAV)

| OWDV – Accumulated depreciation for days held this financial year | 22,645 - 1938.78 = 20,706.22 |

ii) Calculate adjusted termination value (if applicable) | [(MV cost limit + second element costs) / total cost of car] * termination value | [(57466 + 0) / 67950] * 25000 = 21,143 | |

iii) Calculate the assessable profit or loss on sale for tax purposes | Adjusted termination value – closing adjusted value | 21,143 - 20706.47 = 436.75 ** | |

D | Write back original cost of the asset. | ||

E | Balance the journal by offsetting the net to the Realisation account. |

** subject to rounding

Accounting journal explained

| Description | Formula | Example |

|---|---|---|---|

A | Write back accumulated depreciation. | Original cost – opening written down value (OWDV) | 67950 – 26801 = 41,149 |

B | Apply depreciation for the current year, up to the date of sale | OWDV * rate * days held / days in the year | 26801 * 0.25 * 125 / 365 = 2294.62 |

C | Calculate closing adjusted value (CAV), then calculate the profit or loss on the sale. | OWDV – Accumulated depreciation for days held this financial year Consideration – closing adjusted value | 26 801 - 2294.62 = 24,506.38 25,000 - 24506.38 = 493.62 |

D | Write back the original cost of the asset. | ||

E | Balance the journal by offsetting the net to the Realisation account. |