- Created by admin, last modified by AdrianC on Sep 18, 2019

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 19 Next »

https://help.myob.com/wiki/x/Q6tqAg

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

You can view an employee’s pay history on the Pay history tab of their employee record. This tab lists all of the employee’s pays, showing the pay period, gross earnings, hours and days worked.

Click the PDF icon ![]() in the Payslip column to print or view the employee’s payslip for the required pay period, or click Email to email the payslip to the employee. Note that you’ll need to enter the employee’s email address on the Employee details tab of their employee record before you can email their payslip to them.

in the Payslip column to print or view the employee’s payslip for the required pay period, or click Email to email the payslip to the employee. Note that you’ll need to enter the employee’s email address on the Employee details tab of their employee record before you can email their payslip to them.

If you need to enter an employee's pay history (what you've paid them prior to using MYOB Essentials), here's how:

Entering pay history prior to using MYOB Essentials

If you've started using MYOB Essentials part way through the payroll year, you can enter employee pay history by recording pays for each month that's already passed in the payroll year. For example, if you've started using MYOB Essentials in December, you can record monthly pays for each employee for July - November.

To enter these pays, you'll need to know the pay details (wages and other earnings, tax and super) for each employee for each month you're entering, then manually enter these values into the pay.

When you start a new pay run:

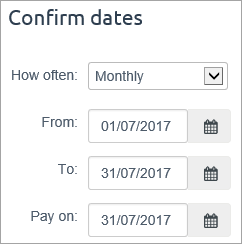

- Change the How often field to Monthly.

- Enter the start and end of the month in the From and To fields.

- Enter the last day of that month in the Pay on field.

Here's the date selection for an historical pay for July:

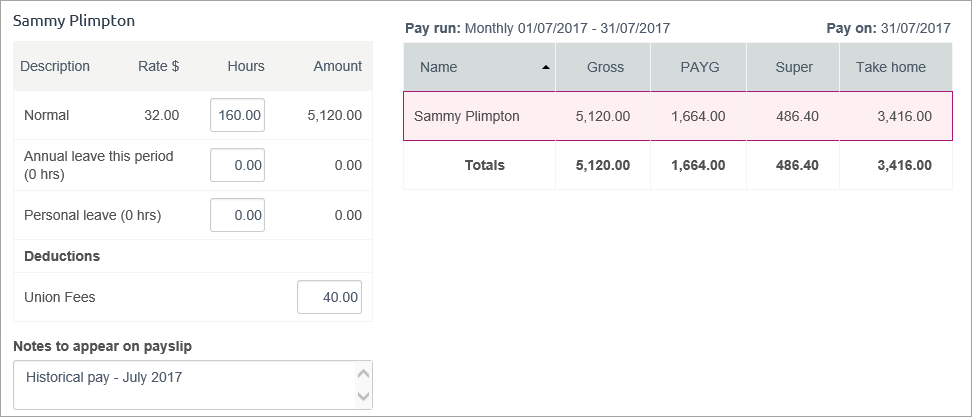

Continue processing the pay and entering the values to be recorded for that month. Here's an example:

Repeat for each historical month to be entered.

Opening leave balances

If an employee has leave owing from before you started using MYOB Essentials, see Set up leave for how to record their opening leave balances.

If you want to keep a record of the employee’s pay history before you started using MYOB Essentials for leave management purposes, you can enter this information manually.

- On the Pay history tab, click Enter pay history prior to using MYOB Essentials.

- In the fields at the bottom of this screen, choose the employee’s pay frequency.

- Enter the pay period dates.

- Enter the employee's pay history for the pay period, including:

- gross earnings (not including non-taxable allowances)

- hours worked

- days worked

- PAYE

- take home pay

- Click Add.

- Repeat from step 2 for each pay period you want to record in MYOB Essentials.

Deleting pays

You can delete payslips by clicking in the Del column for the pay period you want to delete. A message appears, displaying information you should consider when deleting this transaction. Make sure you click Save after deleting the pay.

Note that you can’t delete pay transactions that have been automatically reconciled by MYOB Essentials, or transactions that fall within a locked period. If the transaction is one of several that been matched to a bank transaction, you’ll need to unmatch the transaction before continuing.

To delete an entire pay run, you’ll need to delete the pay for each employee included in the pay run.

You can also delete employee pays on the Transaction history page, by selecting the bank account you use to pay employee wages and then deleting the individual transactions for each employee in the pay run.

For all the details see Deleting a pay run.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.