- Created by admin, last modified by AdrianC on Apr 01, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 38 Next »

https://help.myob.com/wiki/x/GhL0Ag

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

This topic is based on information provided by Work and Income, so check their website to keep up to date, find frequently asked questions and other information.

If the steps below don't suit your business needs, check with your accounting advisor.

The New Zealand Government has announced a wage subsidy to those impacted by COVID-19. To see if your business qualifies for the subsidy, check the Work and Income website.

Employers are expected to make their best efforts to retain employees and pay them a minimum of 80% of their normal income for the subsidised period.

Your employees will need to pay tax on their wage subsidy payment as it’s paid to them as part of their normal wages. This means it's subject to the usual deductions, like PAYE, Student Loan, KiwiSaver and ACC.

The government will pay the wage subsidy as a lump sum covering 12 weeks per employee.

The amounts of the subsidy are:

- $585.80 (for employees who work 20+ hours), or

- $350.00 (for employees who work less than 20 hours)

This is a Gross amount and supplemented with the employee’s wages up to 80% of what they would normally earn.

To keep it clear for your employee’s and yourselves, we recommend setting up a new pay item for the subsidy payment.

For more information, see the NZ Government’s Employer COVID-19 wage subsidy and leave payment information sheet.

Example:

An employee normally earns $1000 for a 38-hour week.

Under the COVID-19 wage subsidy, the employer will now be required to pay their employee $800 per week, which is 80% of their normal wage.

Of the $800 payment, $585.80 will consist of the government subsidy.

To track this in Ace Payroll, set up a COVID-19 allowance and assign it to your employees.

OK, let's step you through it.

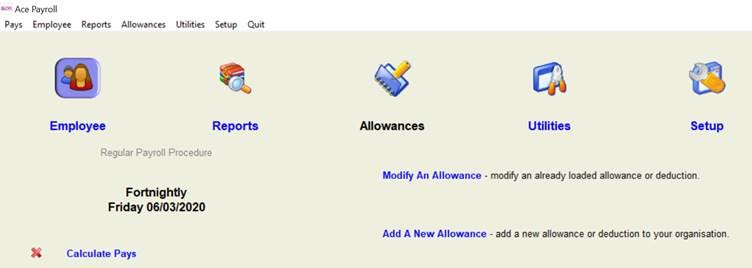

- From the front screen click Allowances, then Add A New Allowance.

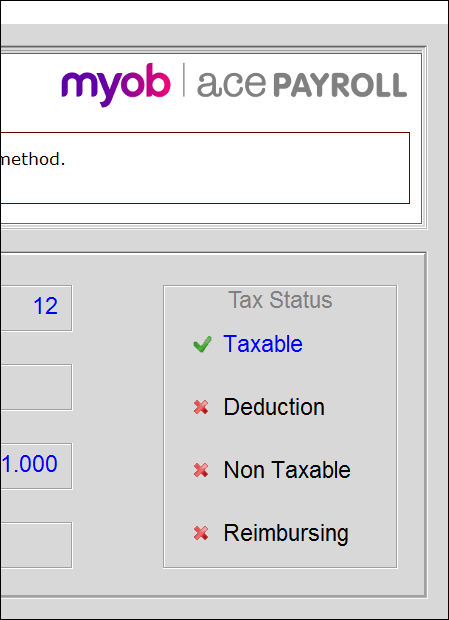

- Click Description and name the allowance Covid-19. This name will appear on payslips.

- Leave the Calculation Method set to Fixed Unit Value $1.000.

- Set the Tax Status as taxable.

- Click Go.

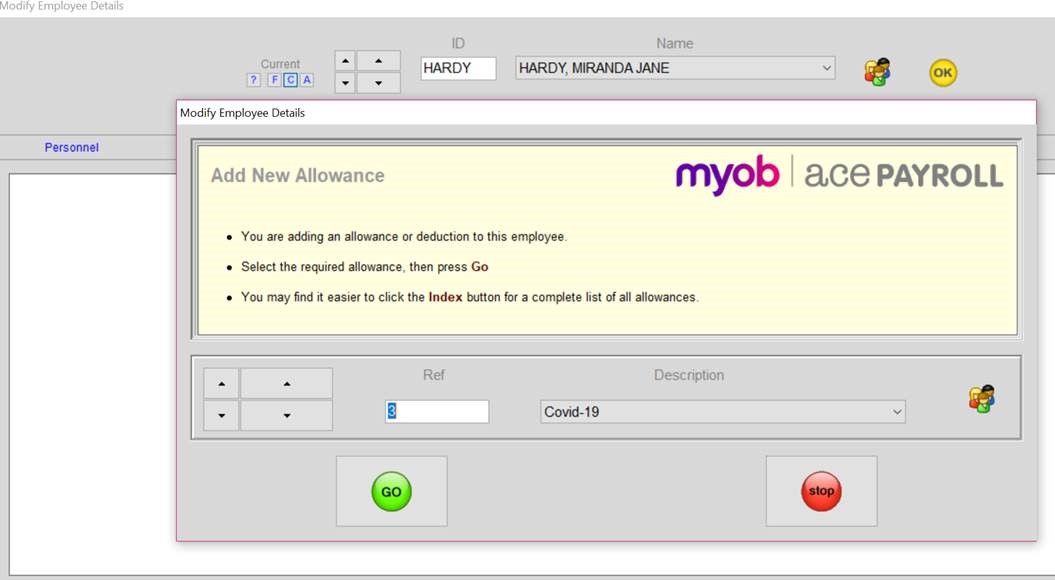

- From the front screen, click Employee > Modify Employee Details > Allowances.

- Click Add to open the Add New Allowance window.

- Select the required allowance from the drop-down menu, then click GO.

Enter the specific rate at which you are paying the employee:

For those that work more than 20 hours the wage subsidy is $585.80

For those that work less than 20 hours the wage subsidy is $350

- Click GO.

- Repeat from step 2 to add the allowance to other employees.

When you process an employee's pay, the COVID-19 allowance will pay automatically. But if you need to pay a top up to ensure they receive 80% of their normal wage, here's how to work this out and show it separately on their pay.

- Work out what 80% of the employee's normal gross pay is and subtract the COVID-19 subsidy amount.

For example, if the employee normally earns $35 per hour for 40 hours per week:- $35 X 40 = $1400

- 80% of $1400 = $1120

- $1120 - $585.80 = $534.20

- Work out how many hours this amount represents, for example $534.20 divided by the hourly rate (534.20/35 = 15.2628)

- Enter these hours against the applicable pay or leave type. Based on your business needs, this might be entered against ordinary hours or holiday pay (for example). If you wanted to track the top up amounts separately, you could also add a new allowance for the top up amount following the steps above you used to add the subsidy allowance.

- Repeat for each employee and finalise the pays as normal.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.