- Created by admin, last modified by AdrianC on Jul 09, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 48 Next »

https://help.myob.com/wiki/x/WyQkAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Your business details, like name, address and contact info, are stored on the Business details page. The details entered here will also appear on your quotes, invoices and statements.

You might have entered some business details when you started out with MYOB Essentials, but these can be updated at any time by an MYOB Essentials administrator.

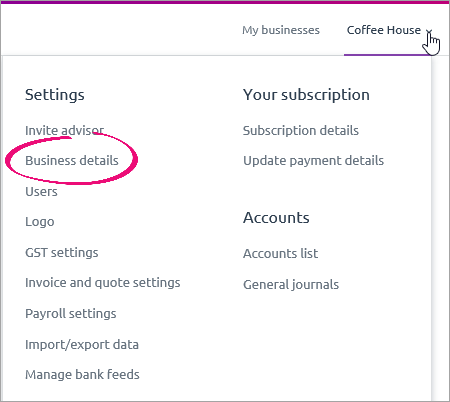

To enter or edit your business details

In MYOB Essentials, click your business name and choose Business details.

The Business details page appears.

In the first section of the page

Enter your Business name, Trading name, ABN/ACN and ABN Branch (Australia) or IRD/GST number (New Zealand), Phone Number, and Email address. All of these fields are mandatory. You can also enter the Fax Number and Website URL of the business. Don't have an IRD/GST number? See the FAQs below.

What is the Client code?

If you export information for your accountant, check if they require your Client code to be entered here in MYOB Essentials.

(Australia only) If 50% or more of your business activity is in the building and construction industry, select the Taxable payments reporting option. See Reportable contractor payments for more information.

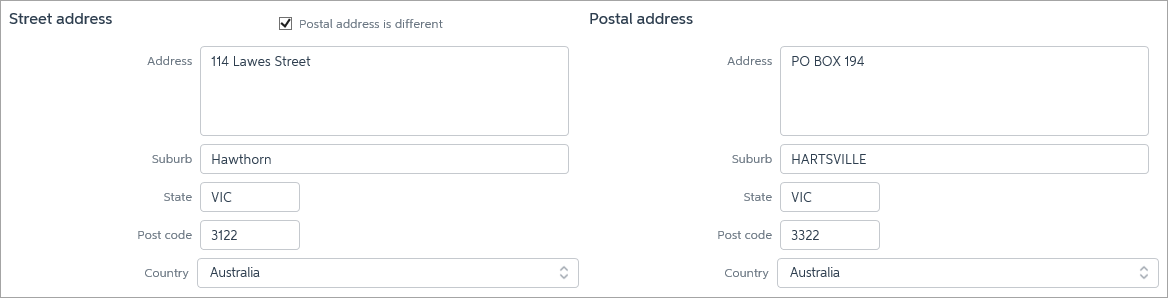

In the Street address section

- Enter your business’s Address, Suburb, State, Post code and Country.

If your business’s postal address is not the same as your business address, select the Postal address is different option. The Postal address section will appear so you can enter your postal details.

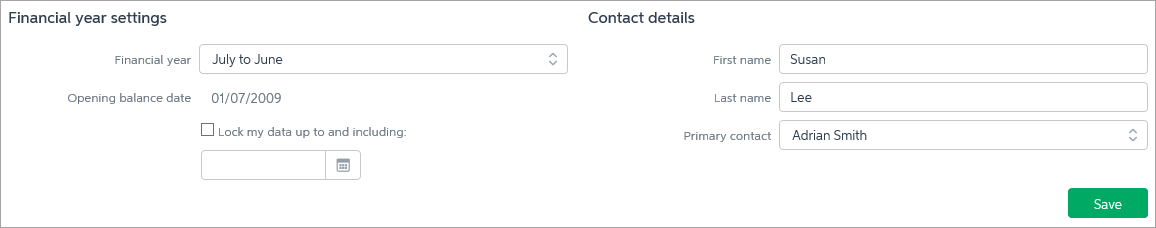

In the Financial year settings and Contact details section

Choose your Financial year period from the list.

Need to change your Opening balance date?

Your Opening balance date is shown here. Your opening balances and opening balance date can be viewed and changed from the Accounts List page.

If you've completed your month-end tasks and want to lock a period of transactions, select the Lock my data up to and including option and choose a date.

- Enter your First name and Last name. You can also set the Primary contact for your business.

- Click Save when finished.

Can't click Save? Make sure you're an administrator and that you've completed all mandatory details (mandatory fields will be highlighted yellow).

FAQs

How do I change my MYOB Essentials login email address?

- Sign in to my.MYOB (Australia | New Zealand) with your current email address and password.

- Go to the My Account menu at the top of the screen and choose Change Login.

- Update your login.

Can't change your login via my.MYOB?

An MYOB Essentials administrator will need to create a new user and specify the new email address. An invitation will then be sent to the new email address. Once the new login has been set up, you can delete the old user login.

I've updated my address - why is my old address is still showing on invoices or statements?

When you set up your invoice and quote settings, you may have chosen to upload a full width header image to show at the top of your invoices. This image may include your old address. If so, create a new image with your current address and upload the new image.

Learn more about uploading a full width header image to your invoices.

How do I change from an MYOB Essentials trial to a subscription?

You can subscribe or change your subscription from the Subscription details page.

See Subscribing to MYOB Essentials for more information.

What if I don't have an IRD/GST number?

The IRD/GST number is a required field in MYOB Essentials for NZ businesses. If you don't have an IRD number, you can enter a dummy number in this field, like 11111114. Or you can enter your personal IRD number. If you're not sure what to enter, seek advice from Inland Revenue about your options.

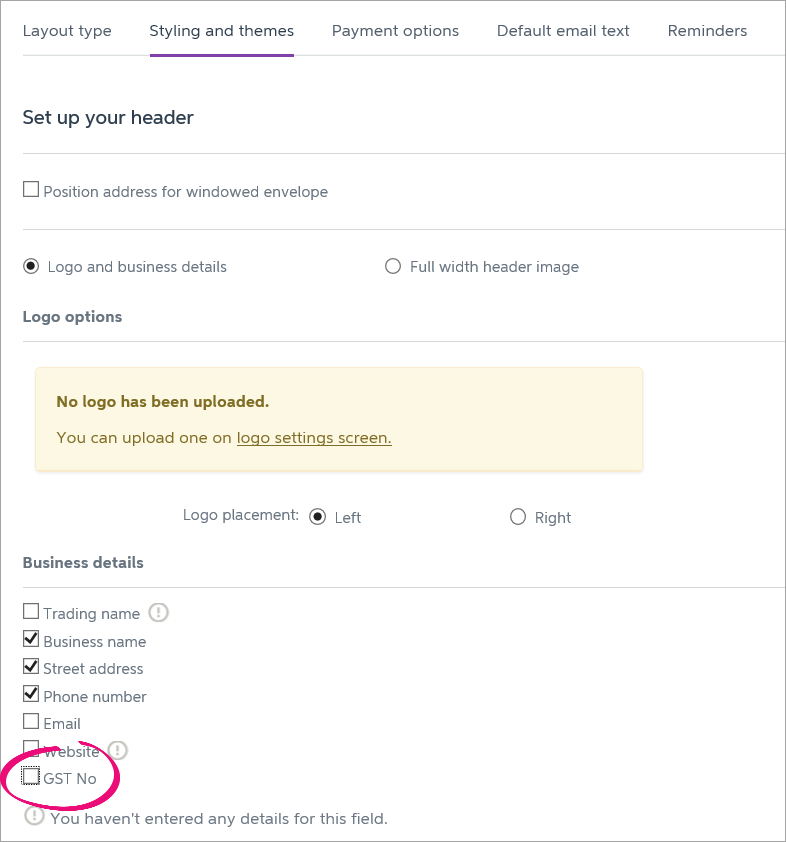

If you don't want the entered IRD number to appear on your invoices and quotes, you can remove it.

- Click your business name and choose Invoice and quote settings.

- Click the Styling and themes tab.

- Under Business details, deselect the option GST No.

- Click Save.

What if I have a Withholding Payer Number (WPN)?

You can only enter an ABN/ACN into the Business details in MYOB Essentials. If you only have a WPN, you won't be able set up your business in MYOB Essentials.

If you're trying to set up MYOB Essentials so you can lodge your payroll information to the ATO via Single Touch Payroll, you'll need an ABN. If you don't have one you'll need lodge your payroll information via a tax agent.

All business are different, so for specific advice on your needs you can ask the experts on the community forum or contact an MYOB Partner who will be happy to help.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.