- Created by BrianQ, last modified by AdrianC on Feb 10, 2017

https://help.myob.com/wiki/x/c4BW

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Not available in AccountRight Basics

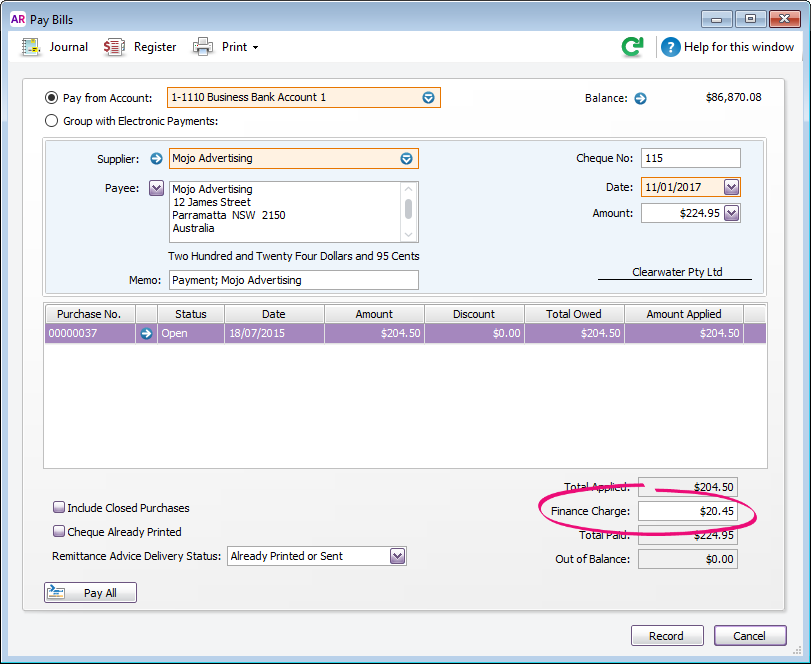

Finance charges are amounts added to an outstanding balance as a penalty for late payment. If your supplier has added a finance charge to your account, you can record the charge in the Pay Bills window.

Setting up finance charges

Before you can record finance charges, you need to select an account for tracking late payment charges. Go to the Setup menu, choose Linked Accounts, and then Purchases Accounts. Select the I pay charges for late payment option and select an expense account to record the late payment charges.

Recording finance charges

When you pay the finance charge, type the amount in the Finance Charge field of the Pay Bills window.

Finding finance charges

Although the history of finance charges is not tracked, you can use Find Transactions to locate a supplier's finance charges.

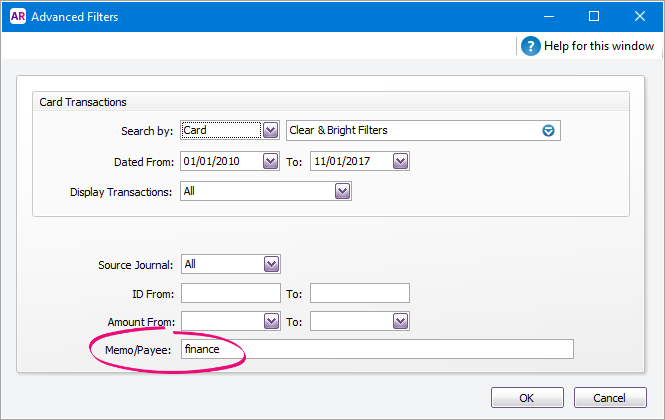

From any command centre, click Find Transactions then click the Card tab.

- Click Advanced.

- In the Search by field, select Card then select the supplier.

- Specify an applicable date range.

- In the Memo/Payee field, enter Finance.

Here's our example:

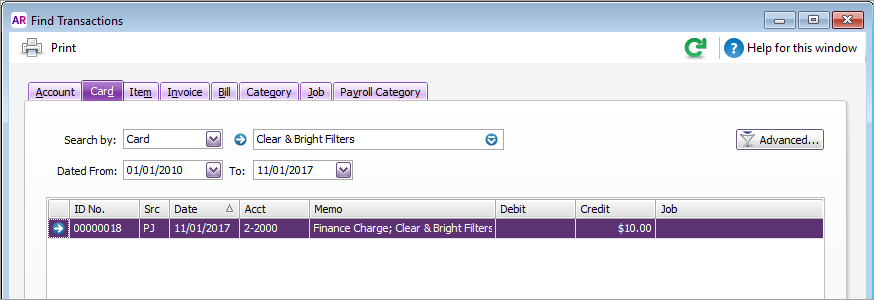

- Click OK. All finance charges for the supplier within the specified date range will be listed.

Deleting finance charges

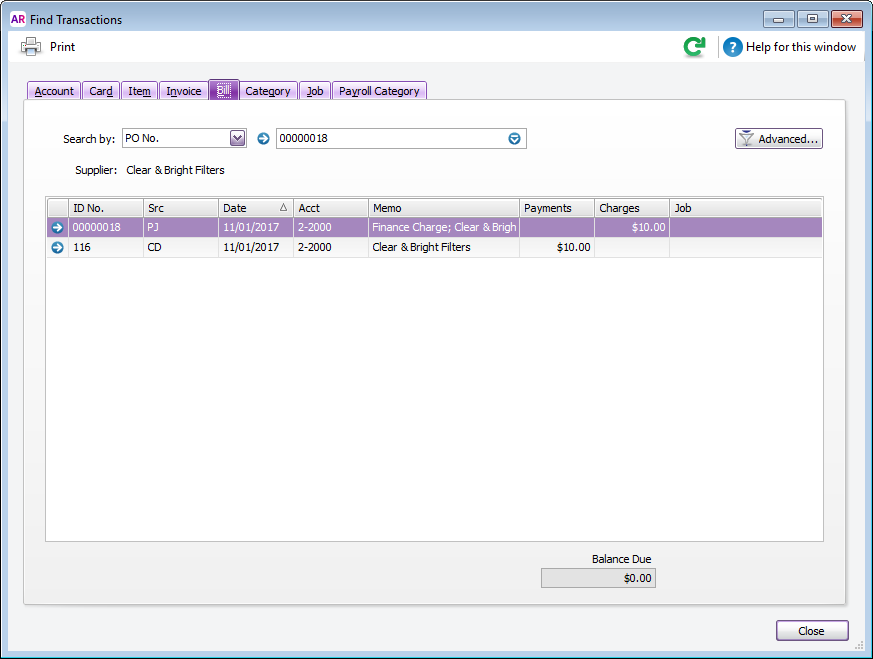

When you enter a finance charge in the Pay Bills window, two transactions are recorded for the finance charge—a bill in the purchases journal and a payment in the disbursements journal.

The option to delete or reverse transactions is determined by a software preference (Setup > Preferences > Security > Transactions CAN'T be Changed; They Must be Reversed).

To delete a finance charge, you must first delete the payment then delete the purchases journal.

- Locate the finance charge to be deleted (see steps above).

- Click the zoom arrow to open the finance charge bill.

- Click History (next to the Applied to Date field). Two transactions will be displayed—the finance charge purchases journal (PJ) and the finance charge payment (CD).

- Click the zoom arrow next to the payment (the CD transaction). The Pay Bills window appears.

- Go to the Edit menu and choose Delete Payment.

- Click OK to the confirmation message. The Find Transactions window reappears.

- Click the zoom arrow next to the finance charge bill (the PJ transaction).

- Go to the Edit menu and choose Delete Purchase.

The original purchase is now returned to an open status ready for payment to be applied via the Pay Bills window.

Reversing finance charges

Reversing a finance charge will create a supplier debit for the value of the finance charge.

The option to delete or reverse transactions is determined by a software preference (Setup > Preferences > Security > Transactions CAN'T be Changed; They Must be Reversed).

To reverse a finance charge:

- Locate the finance charge to be reversed (see steps above).

- Click the zoom arrow to open the finance charge bill.

- Go to the Edit menu and choose Reverse Purchase. A new transaction containing corresponding negative amounts to that of the original finance charge appears.

- If you want, alter the date and memo.

- Click Record Reversal. A supplier debit will be created for the value of the finance charge.

- Settle the debit by either applying it to an open bill or receiving a refund.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.