- Created by MatthewW, last modified by SamA on Jan 24, 2024

https://help.myob.com/wiki/x/Y6tnAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

When an employee works extra hours, they can either be paid overtime or they can take the equivalent time off at a later date. This often depends on company policy. In a company, this is sometimes done informally, and at other times it's managed quite formally.

This page explains all the steps to paying time off in lieu:

Creating an entitlement for time in lieu.

Creating the required pay items for time in lieu.

To learn more about pay items in MYOB Advanced People, check out our support article about creating a pay item.

- Adding the pay items to an employee's pay details.

- Paying time off in lieu in a current pay.

To learn more about how entitlements work in MYOB Advanced People, check out our support article about creating an entitlement.

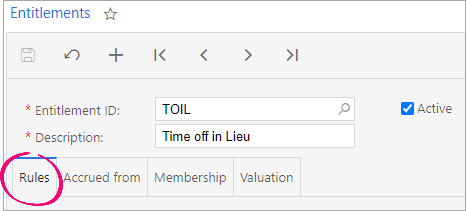

- Go to the Entitlements screen (MPPP3300).

- On the toolbar, click the Add New Record plus icon (

).

). - In the Entitlement ID field, enter

TOIL. - In the Description field, enter

Time off in Lieu. - Click the Rules tab.

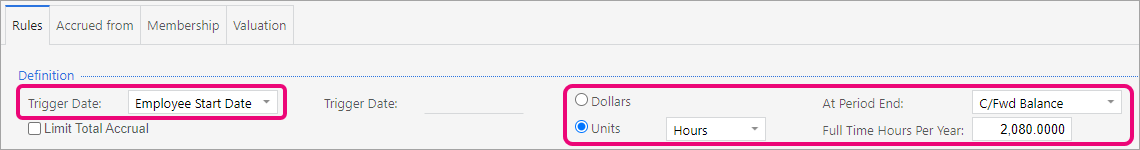

- In the Definition section:

- From the Trigger Date dropdown, select Employee Start Date.

- Select the Units option.

- From the Units dropdown, select Hours.

- From the At Period End dropdown, select C/Fwd Balance.

- In the Full Time Hours Per Year field, enter

2080.

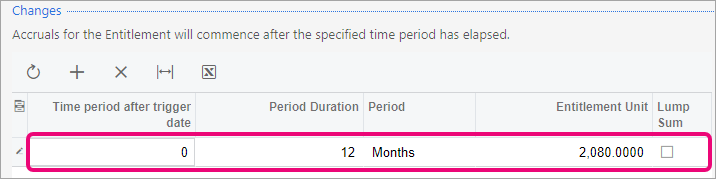

- In the Changes section:

- Click the Add Row plus icon (

).

). - In the Period Duration field, enter

12. - In the Entitlement Unit field, enter

2080.

- Click the Add Row plus icon (

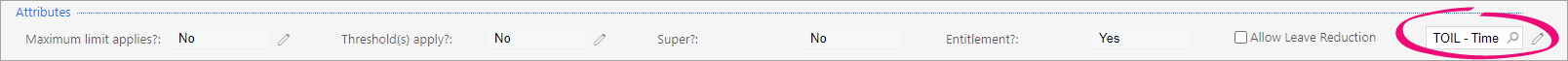

- In the Properties section:

- Select the Leave option.

- Select the Entitlement may be paid/taken in advance option.

On the toolbar, save the entitlement by clicking the Save icon (

).

).When following the procedure for creating the TOIL calculation pay item, you'll come back to this entitlement to edit settings on the Accrued from tab.

- Go to the Pay Items screen (MPPP2210).

- On the toolbar, click the New Pay Item plus icon (

).

). - In the Description field, enter

TOIL Taken. - In the Payslip label field, enter

TOIL Taken. - In the Type field, enter

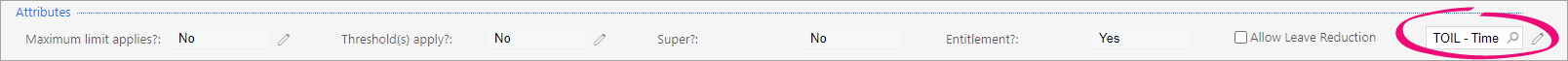

ENTITLEMENT PAYMENT. - In the Attributes section, in the search field, enter the entitlement you created for time off in lieu.

- Click the Calculation Method tab.

- From the Method dropdown, select Rated.

- Click the Additional Info tab.

In the Analysis section, complete the General Ledger Purpose field.

The typical practice is to journal the leave accrual (debit the expense, credit the liability account). That way, when leave is paid out, it will debit the liability account instead of the expense account. The termination workflow uses whichever general purpose you choose, it'll be used by the termination workflow

On the toolbar, save the pay item by clicking the Save icon (

).

).

- Go to the Pay Items screen (MPPP2210).

- On the toolbar, click the New Pay Item plus icon (

).

). - In the Description field, enter

TOIL Calculation. - In the Payslip label field, enter

TOIL Calculation. - In the Type field, enter

INCOME. - Click the Calculation Method tab.

- From the Method dropdown, select Rated.

- Click the Additional Info tab.

- In the Override Value section:

- Select the Standard Pay option.

- Select the Current Pay option.

In the Analysis section, complete the General Ledger Purpose field.

The typical practice is to journal the leave accrual (debit the expense, credit the liability account). That way, when leave is paid out, it will debit the liability account instead of the expense account. The termination workflow uses whichever general purpose you choose, it'll be used by the termination workflow

On the toolbar, save the pay item by clicking the Save icon (

). You can now add this pay item to the time off in lieu entitlement.To add the TOIL calculation pay item to the TOIL entitlement

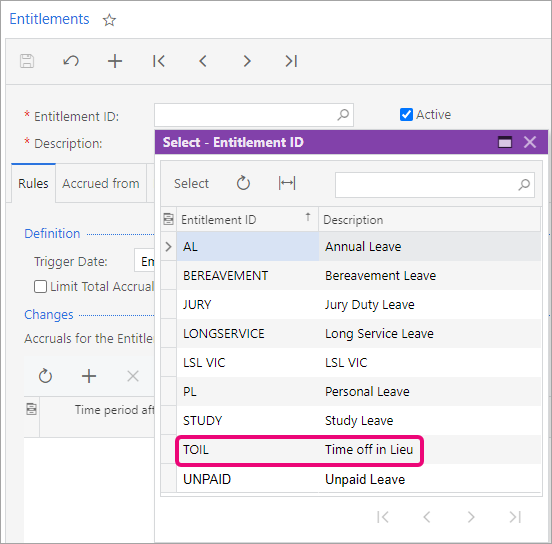

). You can now add this pay item to the time off in lieu entitlement.To add the TOIL calculation pay item to the TOIL entitlement- Go to the Entitlements screen (MPPP3300).

- In the Entitlement ID field, click the magnifying glass icon (

).

). - In the Select - Entitlement ID window, select the time off in lieu entitlement.

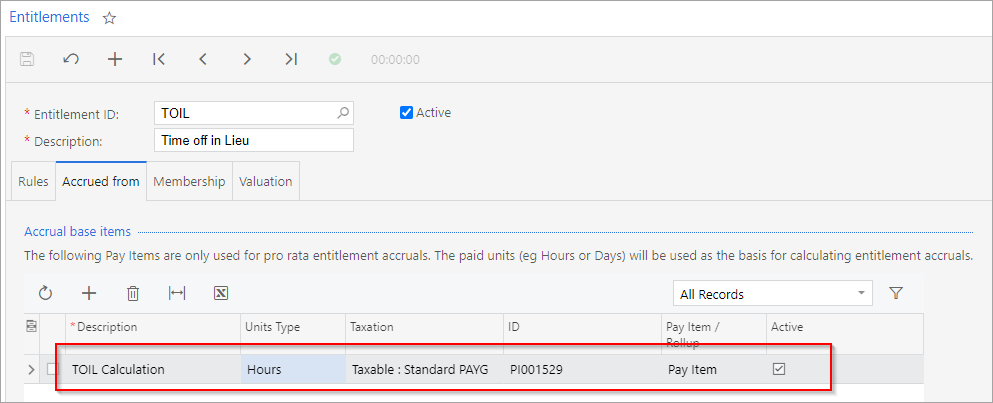

- Click the Accrued from tab.

- In the Accrual base items section, click the Add Row plus icon (

).

). - In the new row, add the details of the TOIL Calculation pay item.

- On the toolbar, save the entitlement by clicking the Save icon (

).

).

- Go to the Pay Items screen (MPPP2210).

- On the toolbar, click the New Pay Item plus icon (

).

). - In the Description field, enter

TOIL Accrual. - In the Payslip label field, enter

TOIL Accrual. - In the Type field, enter

ENTITLEMENT ACCRUAL. - In the Attributes section, in the search field, enter the entitlement you created for time off in lieu.

- Click the Calculation Method tab.

- From the Accrual Method dropdown, select Accrued Pro rata.

- Click the Additional info tab.

In the Analysis section, complete the General Ledger Purpose field.

The typical practice is to journal the leave accrual (debit the expense, credit the liability account). That way, when leave is paid out, it will debit the liability account instead of the expense account. The termination workflow uses whichever general purpose you choose, it'll be used by the termination workflow

On the toolbar, save the pay item by clicking the Save icon (

).

).

- Go to the Pay Details screen (MPPP2310).

- In the Employee ID field, select an employee who you want to pay time off in lieu.

- On the Standard Pay tab, click the Add Row plus icon (

).

). - In the new row, in the Pay Item column, select one of the time off in lieu pay items you created.

- Repeats steps 3–4 for each pay item.

- On the toolbar, save the employee's pay details by clicking the Save icon (

).

).

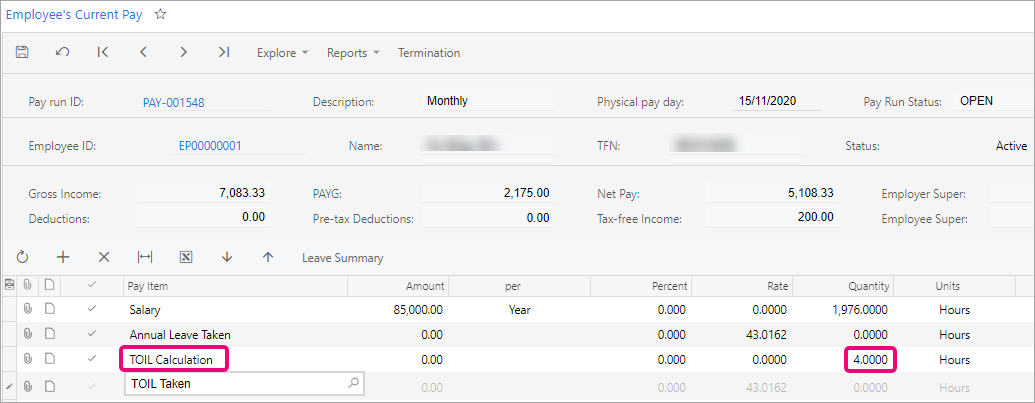

- Go to the Manage Pays screen (MPPP4110).

- From the list of pay runs, click the Pay run ID of the one you want to open.

Click the name of the employee you want to pay time off in lieu. The Employee’s Current Pay screen opens.

In the TOIL Calculation row, in the Quantity field, enter the number of hours of time off in lieu that the employee has accumulated.

To view an employee's entitlement balances, go to the employee's Pay Details screen (MPPP2310) and click the Entitlement Balances tab.

- On the toolbar, save the employee's current pay by clicking the Save icon (

).

).

NZ Holidays Act - Time off in lieu is different to alternative holidays