- Created by admin, last modified by AdrianC on Oct 14, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 74 Next »

https://help.myob.com/wiki/x/zpGRAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

- To pay an employee, set them up in MYOB Essentials and enter some basic details

- Obtain the relevant declaration form from new employees - see Before you start below for details

- Add new employees from the Payroll menu > Employees > Add employee

- If you'll be paying the employee directly into their bank account, record their bank details - see Paying employees electronically for details

- Once you've added employees, make sure you've completed all other payroll setup tasks

Before you start

There's a couple of things you'll need to do before adding an employee.

| If you're... | Do this first... |

|---|---|

| an Australian business | Give the employee a Tax file number declaration form to fill in and return to you. You can order this form from the ATO website . You’ll need the completed form in front of you when you’re entering their details. Your employee will also need to give you the relevant forms for any variations or exemptions they’re claiming (for example, Flood levy exemption declaration). |

| a New Zealand business | Ask the employee to complete and give you a Tax code declaration (IR330) form, containing their tax information. You’ll need this form in front of you when you’re entering their details. They can download this form from the IRD website (PDF viewer required). Your employee might also give you a special tax code or student loan repayment certificate (IR23), which authorises you to change the rate at which they pay tax or student loan repayments. If you're using Payday filing, you only need to add employee details to MYOB Essentials – you don't need to then add them to myIR. |

Need to change something? See Updating an employee's details or Deactivating or reactivating employees.

To add an employee

- Go to the Payroll menu and choose Employees.

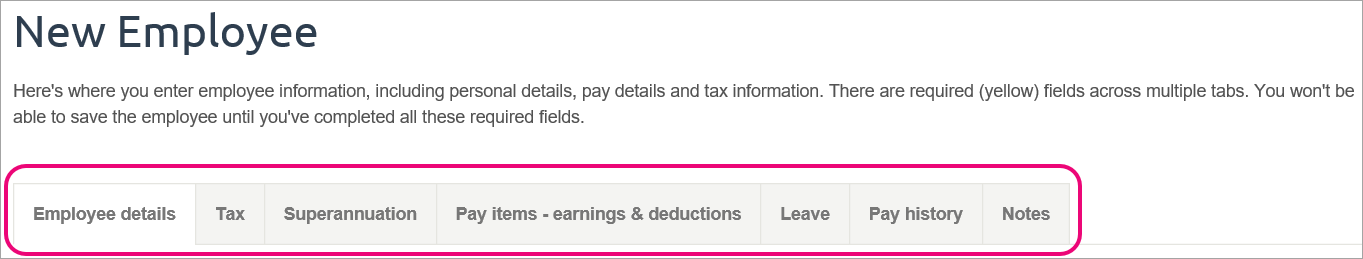

- Click Add Employee. The New Employee page appears. Each tab on this page stores different information for the employee.

Enter the employee's details on each tab:

On this tab Enter these details Learn more Employee details - Personal and contact details

- Tax file number (AU)

- Employment status (NZ)

- Pay rate or salary

- Bank account details

Enter an employee's pay details Tax - Tax file number declaration (AU)

- Tax code declaration (IRD number and Tax code) (NZ)

- Special tax code or student loan repayment form (NZ)

Enter tax details Superannuation (Australia only) - Super fund details

- Super guarantee rate

Set up Pay superannuation Pay items - earnings & deductions Create or assign earnings (like overtime, bonuses or allowances) or deductions (like child support payments or salary sacrifice) Assigning pay items to employees Leave Set up the employee's leave entitlements, like annual leave, sick leave, and personal leave Set up leave KiwiSaver (New Zealand only) - KiwiSaver status

- Employee contribution rate

- Employer contribution rate

Set up KiwiSaver Pay history - Enter pay history prior to using MYOB Essentials

- View and delete past payruns

Pay history Notes Any extra information you want to record for the employee, like emergency contact details Enter notes about the employee When you're done, click Save.

Can't enter info or click Save? The Save button is only active if you've entered all mandatory info on all tabs (required fields are highlighted in yellow). If you're still having issues, try another web browser - we recommend Google Chrome (download it here).

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.