- Created by BrianQ, last modified by AdrianC on Dec 01, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 37 Next »

https://help.myob.com/wiki/x/xgSmAw

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If your accountant wants you to maintain a strict record of all your accounting entries, you should reverse a transaction rather than change or delete it.

A reversal transaction is a new transaction that replicates the original transaction, but with debit amounts shown as credit amounts and vice versa. After posting a reversal transaction, you have two transactions (the original and the reversal), but the account balances appear as if the original transaction was never posted.

A reversal transaction is automatically posted to the same account for the same amount as the original transaction. You cannot change the amount or account of a reversal transaction.

For sales and purchases, a reversal creates a credit note (if reversing a sale) or a debit note (if reversing a purchase). After reversing the sale or purchase, settle the credit or debit by applying it to the original transaction. Learn more about settling customer credits and settling supplier debits.

Before you can reverse a transaction

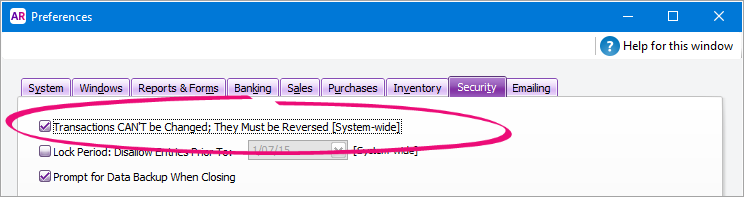

You can only reverse a transaction if it is unchangeable. An unchangeable transaction is identified by a grey zoom arrow ![]() next to it. To make your transactions unchangeable, select the Transactions CAN'T be Changed; They Must be Reversed option (Setup > Preferences > Security tab). If your user role allows you to change preferences, you can change this option at any time.

next to it. To make your transactions unchangeable, select the Transactions CAN'T be Changed; They Must be Reversed option (Setup > Preferences > Security tab). If your user role allows you to change preferences, you can change this option at any time.

A few things to be aware of

| Reversing a transaction can affect closed periods | When you reverse a transaction, be aware of the transaction date you enter:

|

| Negative inventory (Not Basics) | You cannot reverse a purchase if it will result in a negative on-hand inventory count. |

| Reconciled transactions | If you reverse a reconciled transaction, your bank reconciliation will be out of balance. If you want to reverse a reconciled transaction, you need to undo the bank reconciliation first, then reverse the entry and re-reconcile the account. See Reconciliation problems. |

| Customer and supplier credits | After settling a credit or debit (created after reversing a sale or purchase), there will be a remaining credit or debit amount equal to the payment amount. This can be applied to other open sales or purchases or issued as a refund. Learn more about settling customer credits and settling supplier debits. If an early payment discount was applied to a sale or purchase, a separate discount transaction would have been created. This discount transaction will also need to be reversed. When it is, a credit or debit will be created for the discount amount. You can then apply the credit or debit to the original discount transaction. For information about how to find a transaction, see Finding a transaction. |

To reverse a transaction

Find and open the transaction you want to reverse. Need help finding a transaction?

Go to the Edit menu and choose Reverse [...]. For example, if you want to reverse a sale, choose Reverse Sale. A new transaction containing corresponding negative amounts to that of the original transaction appears.

Reverse option greyed-out? Your user role needs to be set up with permission reverse transactions. If you need to regularly reverse transactions, ask your administrator to add this permission to your user role.

If you want, alter the date and memo. Note that you can’t change the accounts and amounts.

Recap transaction

Before you record this transaction, you can use the recap transaction feature to view the journal entries that will be created when the transaction is recorded. To recap, choose Recap Transaction from the Edit menu.

- Click Record to record the reversal transaction. The transaction is reversed and all account balances are returned to their previous levels.

For sales and purchases, a reversal creates a credit note (if reversing a sale) or a debit note (if reversing a purchase). After reversing the sale or purchase, settle the credit or debit by applying it to the original transaction. Learn more about settling customer credits and settling supplier debits.

FAQs

How do I delete a reversed transaction?

If you need to delete a reversed transaction, you'll first need to deselect the option Transactions CAN'T be Changed; They Must be Reversed option (Setup > Preferences > Security tab).

You can then find the reversed transaction, open it, then go to the Edit menu and choose Delete.

Australia only Payroll transactions which have been reported to the ATO via Single Touch Payroll cannot be deleted.

How do I reverse a payroll transaction?

How do I reverse a payment applied to a sale or purchase?

To reverse a payment applied to a sale or purchase:

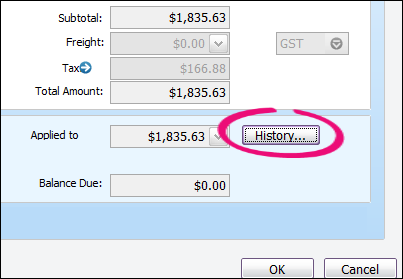

- Open the sale or purchase the payment was applied to.

- Click History.

- Click the zoom arrow for the payment transaction. The payment transaction will be displayed.

- Go to the Edit menu and choose Reverse Payment. If you only have the option to Delete Payment, you'll need to change your security preference as described above.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.