- Created by BrianQ, last modified by Rachael Mullins on Feb 06, 2015

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 3 Next »

https://help.myob.com/wiki/x/NYJe

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier only

To manage your super obligations, you need to:

- create the super funds that your employees use

- review the default super payroll categories (and add any others you need)

- assign the relevant fund and super payroll categories to your employees.

Heard about Pay Superannuation?

Set up Pay Superannuation to make super payments directly from AccountRight, meet your employee super obligations in a flash and always stay on top of government changes, including SuperStream. The best bit? It’s free with your AccountRight subscription. To learn more, see Set up Pay Superannuation.

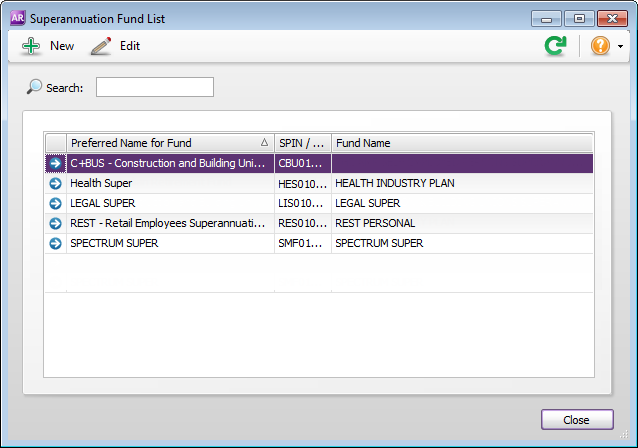

Go to the Lists menu and choose Superannuation Funds. The Superannuation Fund List window appears.

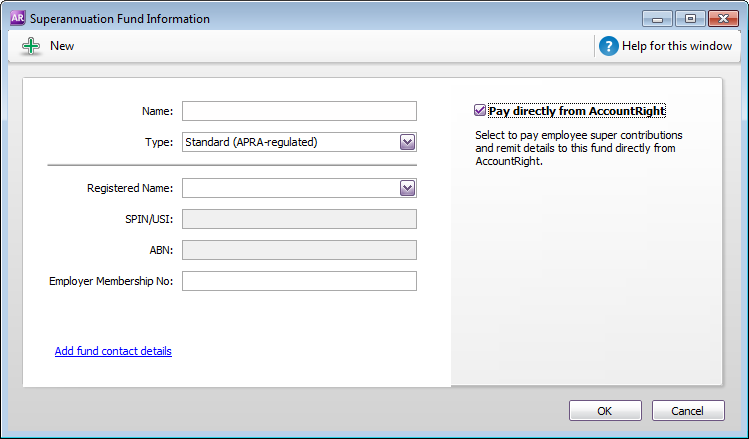

- Click New. The Superannuation Fund Information window appears.

Select the name of the superannuation fund from the Registered Name list.

If a SPIN (Superannuation Product Identification Number) or USI (Unique Superannuation Identifier) exists for the fund, it will appear in the SPIN/USI field automatically. The ABN for the fund will appear automatically as well.Can't find a super fund?

It might be listed under a slightly different name than you're used to. In the Registered Name drop-down, try entering and searching for the fund's SPIN/USI. You can also check our list of super funds to make sure the fund can be paid using Pay Superannuation. Still can't find the fund? Contact MYOB Support on 1300 555 931.

- If you want to refer to the fund by a different name within AccountRight, enter a Name. For example, you might want to give a fund with a long or confusing name a shorter, clearer one.

- If you have your membership number for the fund, type it in the Employer Membership Number field. This is a unique employer identification number provided by some superannuation funds when you register an employee or group of employees.

- Click the Add fund contact details link to add the fund's Phone Number and Website.

- Click OK. The superannuation fund now appears in the Superannuation Fund List window.

- Repeat from step 2 for each additional superannuation fund you need to create.

- Click Close.

Before you can calculate, report and pay superannuation amounts for employees, review the default superannuation payroll categories and assign them to your employees. To help you do this, see Creating payroll categories.

Reportable Employer Super Contributions (RESC)

The ATO requires that some superannuation contributions that exceed the superannuation guarantee amount (for example, salary sacrifice and some salary packaged amounts), be reported on payment summaries. These reportable contributions need be set up as separate superannuation payroll categories, so that they are easily reported when preparing payment summaries and the electronic EMPDUPE file you send to the ATO.

When you prepare payment summaries, you need to select the superannuation payroll categories that are reportable (this does not include superannuation guarantee categories). For more information about preparing payment summaries, see Prepare payment summaries.

For detailed information about Reportable Employer Super Contributions, contact the ATO or your accountant.

Once you’ve created super funds and reviewed the super payroll categories, you need to assign them to your employees. You do this in the Payroll Details view of each employee’s card.

See Entering employee payroll information for instructions on how to assign these details to your employees.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.