You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 6 Next »

https://help.myob.com/wiki/x/CoFs

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

Most employees are entitled to a certain number of days of annual leave, personal leave and other forms that they can take off during the year.

In AccountRight you track the hours and days they are entitled to take, using entitlement categories. When paying out the entitlement, you’ll use a wage category.

For example, you’ll enter the hours the employee takes using the Annual Leave wage category, and the Annual Leave Accrual entitlement category to calculate and track the number of hours an employee is entitled to take. The hours you enter against the wage category will automatically offset the entitlement balance owing to the employee.

To review your entitlement setup, or create new categories, see the information below.

- Go to the Payroll command centre and click Payroll Categories.

- Click the Entitlements tab.

- If the entitlement you want to set up already exists, open the category. Otherwise, click New and give the entitlement a name.

Set up how you want to calculate the accrual of entitlement hours. You have three options:

User-Entered: Select User-Entered Amount per Pay Period if you want to enter the hours to accrue in each employee’s standard pay, or you want to manually enter the number of hours each employee accrued in the pay period when recording their pay.

Percentage: If your employees are paid hourly, select the Equals [x] Percent of option.

To calculate the correct number of entitlement hours, you need to specify a percentage rate. When recording a pay, this rate is multiplied by the hours worked, to determine the number of entitlement hours accrued in the pay period.

Here’s the formula: (Total hours entitled to in a year / Total number of working hours in a Year) x 100 = %Example 1: Annual leave entitlements

Say your employees are entitled to 20 days annual leave per year, and they work a 7.6-hour day (38-hour week).

To calculate the accrual percentage:

7.6 hours × 20 days= 152 hours of annual leave per year

152 hours ÷ (38 hours × 52 weeks) = 7.6923%Example 2: Personal leave entitlements

Say your employees are entitled to 10 days personal leave per year, and they work a 7.6-hour day (38-hour week).

To calculate the accrual percentage:

7.6 hours × 10 days = 76 hours of personal leave

76 hours ÷ (38 hours x 52 weeks) = 3.846%Type the percentage in the first field and then select the category to base the calculation on from the selection list. We suggest you select the Gross Wages option and then click Exempt to choose the categories you don’t want the entitlement to accrue on.

For example, say your employees work a 38 hour week, and occasionally work overtime. You need to exempt any categories that are paid in addition to the employee’s standard 38 hour working week, such as overtime hours, holiday leave loading. But don’t exempt categories that are paid instead of their normal hours, such as annual leave or personal leave, otherwise the accrual will not calculate correctly.

Hours: If your employees are paid a salary, select the Equals [x] Hours per option.

To calculate the correct number of entitlement hours, you need to specify a fixed rate that should be accrued each Pay Period, Month or Year, regardless of the hours worked by the employee. No matter which option you choose, the total hours accrued per year will be the same, so choose the calculation that’s easiest for you to work out.

Example:

Say your employees are entitled to 20 days annual leave per year, and they work a 7.6-hour day (38-hour week). You would enter:

- 152 hours per year (20 days x 38 hours) or

- 12.67 hours per month (152 hours / 12 months) or

- the rate per pay period, which you calculate by dividing the entitlement hours by the number of pay periods. For example, if your employees are paid fortnightly, you would enter 5.846 per pay period (152 hours / 26 pay periods).

- Link a wage category to the entitlement:

Each entitlement category must be linked to at least one wage category. In the Linked Wages Category field, select the categories that you’ll use to record the hours taken by employees for this entitlement. When recording a pay for an employee who has used their entitlement, for example, by taking a holiday, you allocate the hours taken using the linked wage category, and the employee’s accrued leave balance will be automatically reduced.

For example, when setting up a Personal Leave Accrual entitlement category, you could link the Personal Leave Pay and Personal Leave Pay (No Cert) wage categories (or whatever categories you've set up for this purpose).When an employee takes some personal time off, the Personal Leave Accrual balance is reduced by the hours you enter in those linked wage categories.

- Select who the entitlement applies to:

Click Employee and select all employees who are entitled to this leave, and to whom the rate or percentage you've entered applies. If you have:

- entered a percentage, only select employees who are paid hourly

- entered a fixed rate, only select salaried employees.

- chosen to enter a user-entered amount, select all the employees for whom you've specified entitlement hours in their standard pays.

FAQs

Deselect the Carry Remaining Entitlement Over to Next Year option in the Entitlement Information window.

You’ll need to set up separate entitlement categories - one for hourly-based employees and another for salary based. For hourly employees, specify a percentage rate, and for the salary employees, specify a fixed rate per pay period, month or year.

Then click the Employee button in the Entitlement Information window to select the employees.

Not necessarily. If they are entitled to the same number of days off, then you can link them all to the same entitlement category, because the accrual percentage rate would remain the same.

Assume that all employees are entitled to 20 days of annual leave per year:

Employees who work a 7.6-hour day (38-hour week):

7.6 hours × 20 days= 152 hours of annual leave

152 hours ÷ (38 hours × 52 weeks) = 7.6923%

Employees who work an 8-hour day (40-hour week):

8 hours × 20 days= 160 hours of annual leave

160 hours ÷ (40 hours × 52 weeks) = 7.6923%

If your employees already had entitlements owing to them when you started using AccountRight’s payroll features, enter the opening balances in their card.

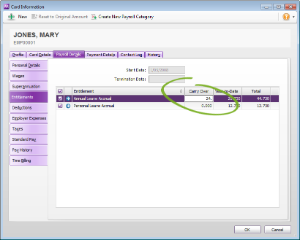

Go to Card File command centre > Cards List, open an employee card > Payroll Details tab > Entitlements. Enter the opening balances in the Carry Over column.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.