You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 27 Next »

https://help.myob.com/wiki/x/joNs

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

Most employees are entitled to a certain number of days of annual leave, personal leave and other forms of leave that they can take during the year.

In AccountRight you track the hours and days they are entitled to take, using entitlement categories. When paying out the entitlement, you'll use a wage category. The hours you enter against the wage category will automatically offset the entitlement balance owing to the employee.

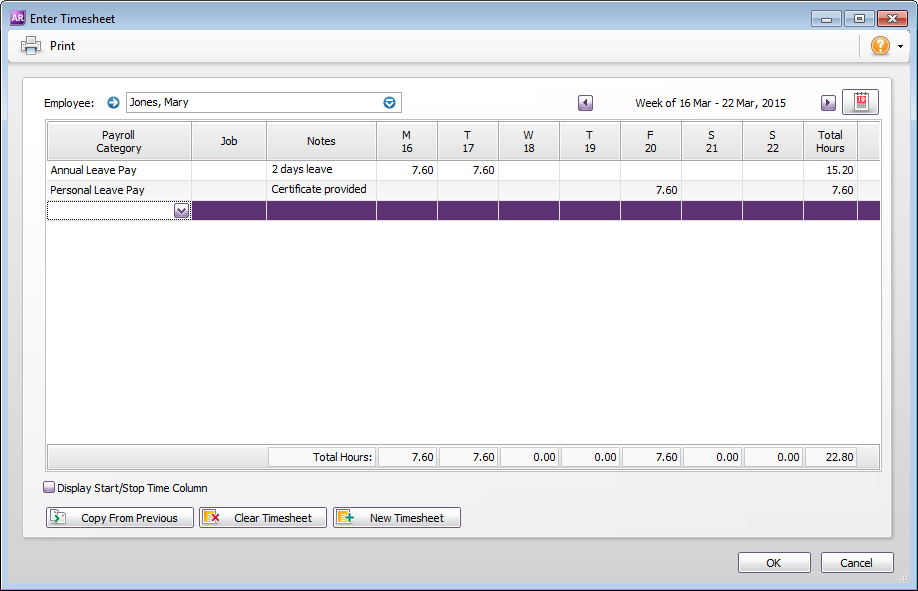

In the example above, the employee has taken 7.6 hours of annual leave during the pay period. The Annual Leave Accrual entitlement category shows the number of hours the employee has accrued over the pay period.

- Go to the Payroll command centre and click Payroll Categories.

- Click the Entitlements tab.

- If the entitlement you want to set up already exists, open the category. Otherwise, click New and give the entitlement a name.

Set up how you want to calculate the accrual of entitlement hours. You have three options:

User-Entered:

Select User-Entered Amount per Pay Period if you want to enter the hours to accrue in each employee’s standard pay, or you want to manually enter the number of hours each employee accrued in the pay period when recording their pay.

Percentage:

If your employees are paid hourly, select the Equals [x] Percent of option.

To calculate the correct number of entitlement hours, you need to specify a percentage rate. When recording a pay, this rate is multiplied by the hours worked, to determine the number of entitlement hours accrued in the pay period.

Here’s the formula: (Total hours entitled to in a year / Total number of working hours in a Year) x 100 = %Example 1: Annual leave entitlements

Say your employees are entitled to 20 days annual leave per year, and they work a 7.6-hour day (38-hour week).

To calculate the accrual percentage:

7.6 hours × 20 days= 152 hours of annual leave per year

152 hours ÷ (38 hours × 52 weeks) = 7.6923%Example 2: Personal leave entitlements

Say your employees are entitled to 10 days personal leave per year, and they work a 7.6-hour day (38-hour week).

To calculate the accrual percentage:

7.6 hours × 10 days = 76 hours of personal leave

76 hours ÷ (38 hours x 52 weeks) = 3.846%Type the percentage in the first field and then select the category to base the calculation on from the selection list. We suggest you select the Gross Wages option and then click Exempt to choose the categories you don’t want the entitlement to accrue on.

For example, say your employees work a 38 hour week, and occasionally work overtime. You need to exempt any categories that are paid in addition to the employee’s standard 38 hour working week, such as overtime hours, holiday leave loading. But don’t exempt categories that are paid instead of their normal hours, such as annual leave or personal leave, otherwise the accrual will not calculate correctly.

Hours:

If your employees are paid a salary, select the Equals [x] Hours per option.

To calculate the correct number of entitlement hours, you need to specify a fixed rate that should be accrued each Pay Period, Month or Year, regardless of the hours worked by the employee. No matter which option you choose, the total hours accrued per year will be the same, so choose the calculation that’s easiest for you to work out.

Example:

Say your employees are entitled to 20 days annual leave per year, and they work a 7.6-hour day (38-hour week). You would enter:

- 152 hours per year (20 days x 38 hours) or

- 12.67 hours per month (152 hours / 12 months) or

- the rate per pay period, which you calculate by dividing the entitlement hours by the number of pay periods. For example, if your employees are paid fortnightly, you would enter 5.846 per pay period (152 hours / 26 pay periods).

- Link a wage category to the entitlement:

Each entitlement category must be linked to at least one wage category. In the Linked Wages Category field, select the categories that you’ll use to record the hours taken by employees for this entitlement. When recording a pay for an employee who has used their entitlement, for example, by taking a holiday, you allocate the hours taken using the linked wage category, and the employee’s accrued leave balance will be automatically reduced.

For example, when setting up a Personal Leave Accrual entitlement category, you could link the Personal Leave Pay and Personal Leave Pay (No Cert) wage categories (or whatever categories you've set up for this purpose).When an employee takes some personal time off, the Personal Leave Accrual balance is reduced by the hours you enter in those linked wage categories.

- Select who the entitlement applies to:

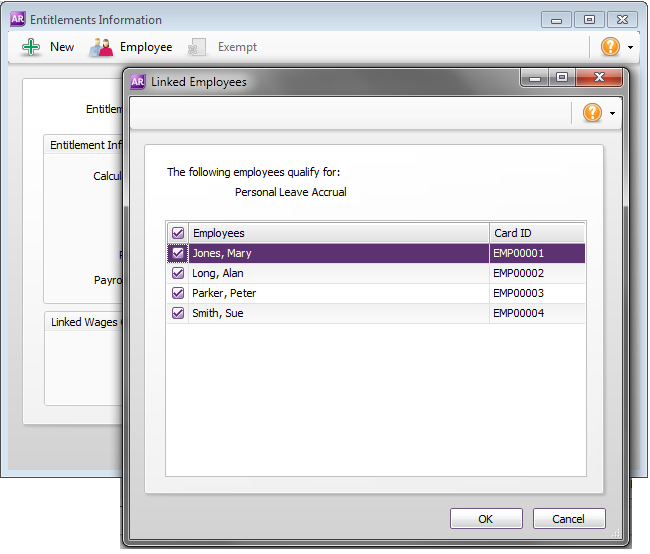

Click Employee and select all employees who are entitled to this leave, and to whom the rate or percentage you've entered applies.

If you have:

- entered a percentage, only select employees who are paid hourly

- entered a fixed rate, only select salaried employees.

- chosen to enter a user-entered amount, select all the employees for whom you've specified entitlement hours in their standard pays.

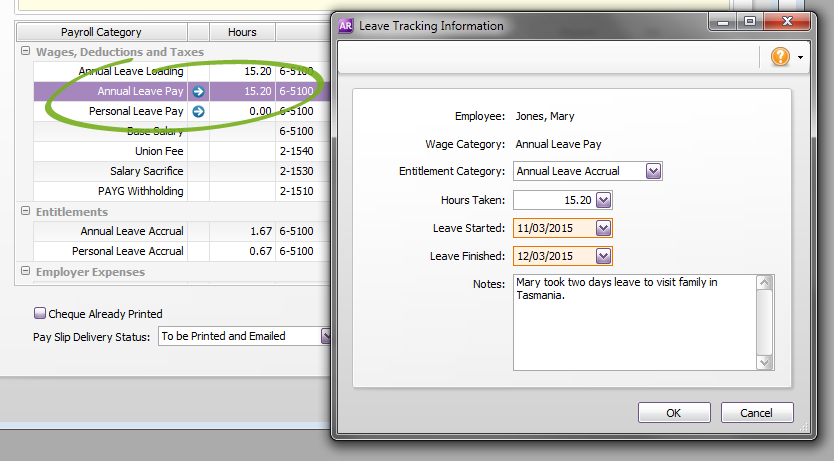

When processing a pay run (Payroll command centre > Process Payroll > Employee Pays step), open the employee’s pay and enter the hours taken during the pay period in the Hours column of the wage category as a positive amount (if you use timesheets to track leave hours, the hours will be filled in for you).

Click the arrow that’s next to the leave’s wage category. Here you can enter some notes about the leave that was taken. You can also enter the start and end date for the leave taken in the period (but if the employee took several non-consecutive days, just note down the details in the Notes field).

FAQs

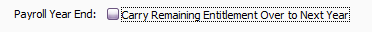

Deselect the Carry Remaining Entitlement Over to Next Year option in the Entitlement Information window.

You’ll need to set up separate entitlement categories - one for hourly-based employees and another for salary based. For hourly employees, specify a percentage rate, and for the salary employees, specify a fixed rate per pay period, month or year.

Then click the Employee button in the Entitlement Information window to select the employees.

Not necessarily. If they are entitled to the same number of days off, then you can link them all to the same entitlement category, because the accrual percentage rate would remain the same.

Assume that all employees are entitled to 20 days of annual leave per year:

Employees who work a 7.6-hour day (38-hour week):

7.6 hours × 20 days= 152 hours of annual leave

152 hours ÷ (38 hours × 52 weeks) = 7.6923%

Employees who work an 8-hour day (40-hour week):

8 hours × 20 days= 160 hours of annual leave

160 hours ÷ (40 hours × 52 weeks) = 7.6923%

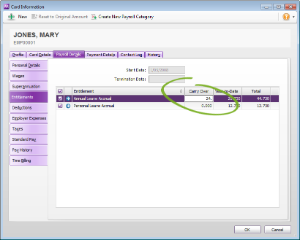

If your employees already had entitlements owing to them when you started using AccountRight’s payroll features, enter the opening balances in their card.

Go to Card File command centre > Cards List, open an employee card > Payroll Details tab > Entitlements. Enter the opening balances in the Carry Over column.

Select the Print on Pay Advice option in the Entitlement Information window.

Either make the adjustment on the employee’s next pay, or record a pay for $0 that only includes the leave hour adjustment. (If you only need to do this for one employee, select the Process individual employee option in the Pay Period step of the Process Payroll assistant.)

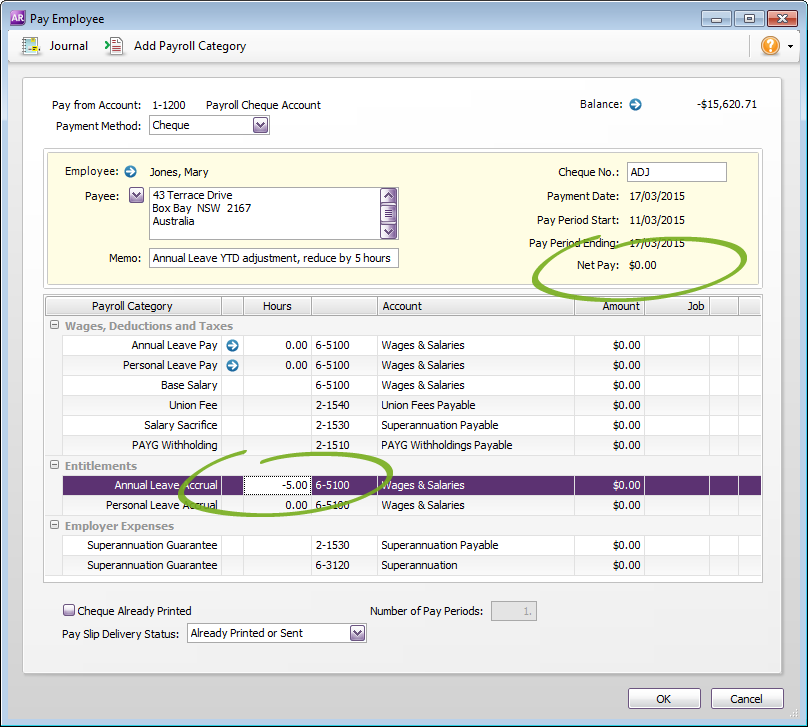

In the example below, we want to adjust the employee’s leave balance by 5 hours. Notice that all hours and amounts on the pay are zero, except for the entitlement's Hours column.

A few more tips:

- Enter ADJ in the Cheque No. field, so you can identify it as an adjustment.

- Enter a description of the adjustment in the Memo field.

- Set the Pay Slip Delivery Status to Already Printed or Sent, so that it doesn’t appear in email and print lists.

- When recording the $0 pay, you'll see a message that you're about to void a cheque. That’s OK in this case.

We suggest you use timesheets. You can include the hours you record on the timesheet (Payroll command centre) in the pay run.

You don’t need to set up an entitlement category to handle holiday leave loading. A wage category for this purpose is set up by default in your company file - it’s either named Annual Leave Loading or Holiday Leave Loading. It’s set up as an hourly wage category with a pay rate of Regular Rate multiplied by 0.1750, as shown below (if you use a different rate, just replace it).

Click the Employee button to assign this category to employees who are eligible for the leave loading.

When you enter the holiday pay hours on an employee’s pay, enter the same number of hours for the holiday leave loading category, as shown below.

If you’re processing a pay that includes their standard pay, plus leave equal to additional pay periods, select the Pay leave in advance option in the Pay Period step of the Process Payroll Assistant. You can then select the number of standard pays you’re processing for the employee (0 or 1) plus the additional pay periods of leave.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.