You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 5 Next »

https://help.myob.com/wiki/x/b4WO

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Periodical inventory is a system of accounting for inventory whereby the goods on hand are only determined by a physical count.

Unlike perpetual inventory systems, where inventory updates are made on a continuous basis, periodical inventory might be useful for you if you maintain minimal amounts of inventory and a physical inventory count is easy to complete.

Before implementing this method it is advisable to check with your accountant as to its suitability for your business.

If you think a periodical inventory is right for your business, here are two ways you can set it up in AccountRight.

- Create a Stock On Hand (Asset) account and a Purchases (Cost of Sales) account. Both accounts should be Detail Accounts.

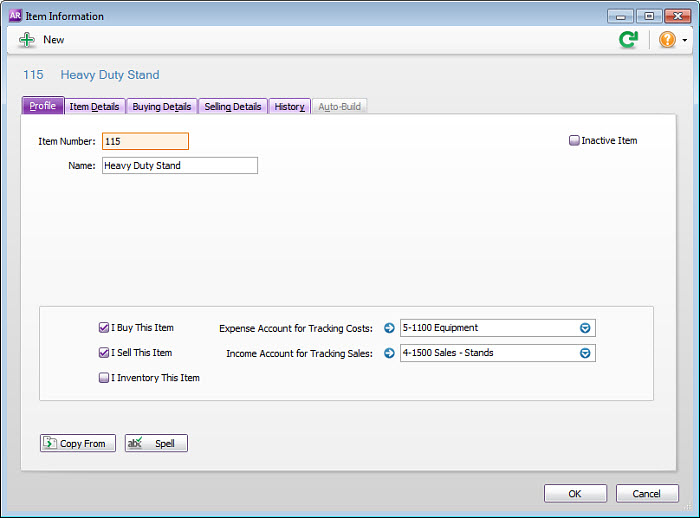

- Create the inventory items and select the options I BuyThis Item and I Sell This Item. The linked Expense Account for Tracking Costs must be the Purchases (Cost of Sales) account. Select a relevant Income account for tracking sales.

Note: The I Inventory This Item option should never be selected when using this method

This means that when stock is purchased, it is immediately expensed to the cost of sales account. When stock is sold, there is no entry to cost of sales. In order to be able to report the value of stock you have on hand, end of period journals must be recorded. This is discussed below. - If at the beginning of the financial year there is a balance in the Stock On Hand account you need to prepare a General Journal entry to debit the Purchases (Cost of Sales) account and credit the Stock On Hand (Asset) account. The amount entered needs to be the value of the Stock on Hand as at the end of the previous financial year.

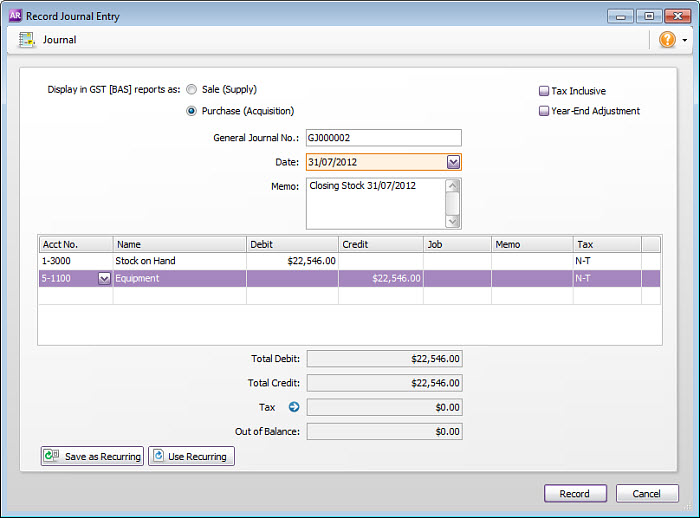

The effect of the general journal entry will leave the account with a zero balance. - At the end of the financial reporting period, in other words Month, Quarter or Year, you need to make an adjustment to the Purchases (Cost of Sales) account to reflect the value of stock still on hand. First, perform a stock-take and accurately value the stock on hand at the end of the financial reporting period. Then, prepare a General Journal entry to reflect the value of stock counted in the stock-take. Debit the Stock on Hand (Asset) account and credit the Purchases (Cost of Sales) account for the value determined in the stock-take.

- Print the Profit & Loss Statement and Balance Sheet reports.

- On the first day of the next financial period, prepare a General Journal Entry to reverse the effects of the Closing Stock adjustment. Debit the Purchases (Cost of Sales) account and credit the Stock on Hand (Asset) account for the same value entered in Step 4.

After the journal entry has been performed, the Stock on Hand (Asset) account should be returned to a $0 balance. At the end of future financial reporting periods, repeat Steps 4 and 5 to accurately reflect the true Cost of Sales figure in your Profit & Loss Statement and show the value of stock on hand in the Balance Sheet.

- Create the following accounts:

- Opening Stock (Cost of Sales)

- Closing Stock (Cost of Sales)

- Purchases (Cost of Sales)

- Stock on Hand (Asset) account

Note: All accounts should be Detail Accounts

- Create the inventory items and select the options I Buy This Item and I Sell This Item. The linked Expense Account for Tracking Costs must be the Purchases (Cost of Sales) account. Select a relevant Income account for tracking sales.

- At the beginning of the fiscal year, create a General Journal entry to show the Opening Stock balance in the Profit and Loss statement. Debit the Opening Stock (Cost of Sales) account for the amount that was shown as Stock on Hand in the 30th of June Balance Sheet and credit the Stock on Hand (Asset) account.

- During the month, record your purchases and sales as per usual. Make sure that the allocation account used for Service purchases is the Purchases (Cost of Sales) account.

- On the last day of the month, perform a stock-take and value the level of stock on hand. Enter a General Journal entry to record the level of stock on hand at the end of the month. Debit the Stock on Hand (Asset) account for the amount determined in the stock-take and credit the Closing Stock (Cost of Sales) account.

- On the first day of the next month, create a General Journal entry to reverse the closing stock entry. Debit the Opening Stock (Cost of Sales) account for the same amounts entered as the previous month's closing stock and credit the Stock on Hand (Asset) account.

- Prepare a Year-End Adjustment to reverse the impact on the opening stock and closing stock expense accounts. If this is not done, the opening and closing stock will increase every time an end of month journal entry is entered. To correct this, you need to debit the Closing Stock (Cost of Sales) account for the same amount as entered in steps 5 and 6 and credit the Opening Stock (Cost of Sales) account.

Year-End Adjustments can be reported by themselves, or they can be included with other transactions.

As shown in the example below, when filtering reports you have the option to:

- Display all transactions

- Exclude Year-End Adjustments

- Display only Year-End Adjustments

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.