- Created by BrianQ, last modified by JohnW on Jul 24, 2015

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 20 Next »

https://help.myob.com/wiki/x/I4aO

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

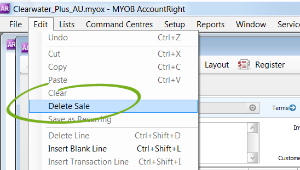

How you delete transactions (like sales and purchases) is similar across all transaction types in AccountRight. You open the transaction and select Delete from the Edit menu (you can also right-click in the transaction window to see the edit options). When you delete a transaction, it's permanently removed from your records.

There are a number of restrictions when deleting transactions. Your security preferences must allow deleting and the transaction can't be in a locked period. There are also some restrictions depending on the type of transaction you're deleting, these are explained below.

Allowing changes to be deleted. You can only delete a transaction if your security preferences allow transactions to be changed. A changeable transaction is identified by a white zoom arrow ( ![]() ) next to it. To make your transactions changeable, deselect the Transactions CAN'T be Changed; They Must be reversed option on the Security tab view of the Preferences window. If your user role allows you to change preferences, you can change this option at any time.

) next to it. To make your transactions changeable, deselect the Transactions CAN'T be Changed; They Must be reversed option on the Security tab view of the Preferences window. If your user role allows you to change preferences, you can change this option at any time.

- Find and display the transaction in its original transaction window. For more information, see Finding a transaction.

- Go to the Edit menu and choose Delete [...]. For example, if you want to delete a sale, choose Delete Sale. The transaction will be removed permanently from your record.

Sales

You can only delete a sale that does not have a payment applied to it. If you have recorded a payment for a sale, you must first delete the payment and then delete the transaction. Any discounts that have been given must also be deleted before the transaction can be deleted.

If you applied a credit note towards a sale, you must delete the credit before you can delete the sale.

If you want to delete a line or other information from an invoice you've recorded, see Add headers, subtotals and lines to sales.

Purchases (Not Basics)

You can only delete a purchase that does not have a payment applied to it. If you have recorded a payment for a purchase, you must first delete the payment and then delete the transaction. Any discounts that have been given must also be deleted before the transaction can be deleted.

If you applied a supplier debit towards a purchase, you must delete the debit before you can delete the purchase.

If you want to delete a line or other information from a purchase you've recorded, see Add headers, subtotals and lines to purchases.

Known issue: In AccountRight 2015.1, we're aware of an issue where settle return and debits transactions (supplier debits) can't be reversed, deleted or recapped, This was fixed in 2015.2.

Grouped receipts that have been deposited

If you want to delete an individual receipt that was recorded as part of a bank deposit of receipts grouped in the undeposited funds account, you must first delete the bank deposit. When you delete a bank deposit, all of the cash receipts included in that bank deposit are returned to the Prepare Bank Deposit window. You can then delete the required receipt from this window.

Reconciled transactions

If you delete a reconciled transaction, your bank reconciliation will be out of balance. If you want to delete a reconciled transaction, you need to undo the bank reconciliation first, then delete the entry and re-reconcile the account. See Reconciliation problems.

GST and activity statement reporting (Australia)

If you delete a transaction that must be reported on an activity statement, the transaction details will not be included in your GST reports or in an activity statement prepared using BASlink. Also, if you delete a transaction from a prior GST reporting period, your GST reported for that period may be affected.

GST reporting (New Zealand)

If you delete a transaction from a prior GST reporting period, your GST reported for that period may be affected.

Insufficient on-hand item quantities (Not Basics)

You cannot delete a purchase that will result in negative inventory on-hand.

FAQs

A transaction's zoom arrow will be shaded if:

- you've set the security preference in AccountRight which prevents transactions from being deleted (they can only be reversed) Tell me more

- the transaction is from a previous (closed) financial year Tell me more

- the transaction is part of a processed Prepare Electronic Payment Tell me more

- the transaction is part of a Prepare Bank Deposit transaction Tell me more

- (Australia only) the transaction is a Pay Liabilities transaction Tell me more

- (Australia only) the transaction is a Pay Superannuation transaction Tell me more

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.