You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 9 Next »

https://help.myob.com/wiki/x/RIaO

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

A deposit is a payment for goods or services not yet delivered. This means if you receive a payment against a sales order or make a payment against a purchase order, it's considered a deposit.

Setting up for deposits

Because no goods or services have changed hands, AccountRight treats deposits differently to other payments.

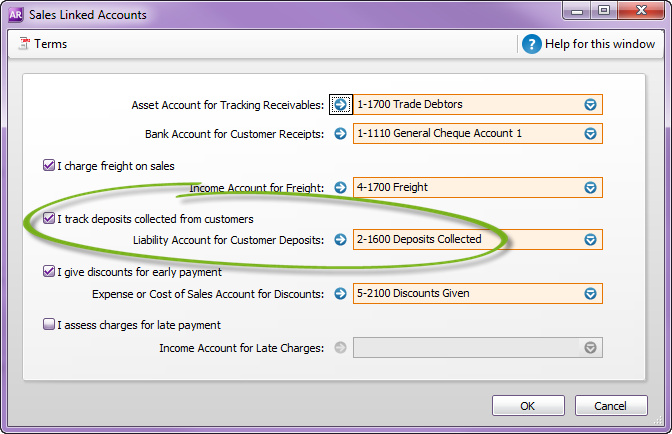

- Deposits on sales are typically posted to a liability account. When the sales order is converted to an invoice, the deposit is transferred to your trade debtors account.

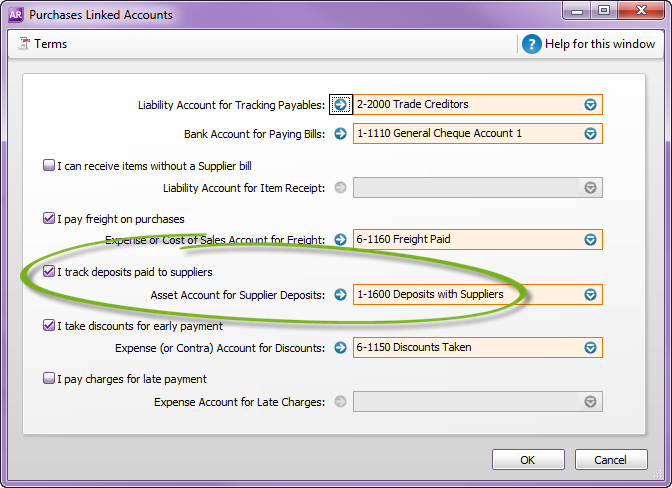

- Deposits on purchases are typically posted to an asset account. When the purchase order is converted to a bill, the deposit is transferred to your trade creditors account.

To check the accounts used for tracking your deposits, go to Setup > Linked Accounts > Sales Accounts or Purchase Accounts.

Recording deposits

| If the deposit is paid | do this |

|---|---|

| when the order is created | enter the deposit amount in the Paid Today field on the order. |

| after the order is created | apply the payment using Receive Payments or Pay Bills. |

Reversing deposits

There's two ways to reverse a deposit, depending on the order to which it has been applied:

| If the order has | do this |

|---|---|

| NOT been converted to an invoice or bill |

|

| been converted to an invoice or bill | Complete the tasks below |

These steps describe how to reverse a customer deposit, but the same principle applies for reversing supplier deposits.

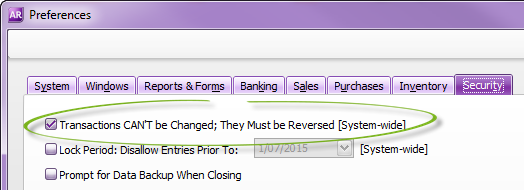

To successfully reverse the deposit, you'll need to set a preference in your software.

- Go to the Setup menu and choose Preferences.

- Click the Security tab.

- Select the option Transactions CAN'T be Changed; They Must be Reversed.

- Click OK.

- Open the invoice you want to reverse. See Finding a transaction for instructions.

- Go to the Edit menu and choose Reverse Sale. A new transaction containing corresponding negative amounts to that of the original transaction appears.

If you want, alter the date and memo.

If you're running on an accrual basis, ensure the date is set in the correct reporting period.

- Click Record Reversal. A credit will be created for the value of the reversed invoice.

Is the deposit non-refundable?

If the deposit isn't being refunded to the customer, create an invoice for the deposit amount to account for the receipt of this income.

- Go to the Sales command centre and click Sales Register.

- Click the Returns and Credits tab.

- Click to select the credit note for the reversed invoice.

- Click Apply to Sale.

If the deposit is non-refundable - Click to select the invoice you created for the deposit amount.

- In the Amount Applied column, enter the value of the deposit.

- In the Credit Amount field, enter the value of the deposit.

- Click Record. This will apply part of the credit to close off the deposit invoice.

If the deposit is refundable - Change the Credit Amount field to be the amount left owing on the invoice (the original order value minus the deposit value).

- Click the Amount Applied column for the original invoice. This will change to match the Credit Amount field.

- Click Record. This will leave a credit amount equal to the value of the deposit.

- Click to select the credit note then click Pay Refund.

- Select the account from which you want to pay the refund.

- Click Record.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.