How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

When you pay superannuation through MYOB's super portal, the ATO needs some details about each of the employees you're paying. Before you can start paying superannuation, you need to make sure you've completed all the required details for each employee you pay super to.

There have been some changes to the way employee records are organised. For each employee, you'll probably need to add some new details and re-enter some information that you previously entered on a different tab.

See Pay superannuation for more information about what else you need to do before you can start paying super.

Enter additional employee details

On the Employee details tab, make sure the following details have been completed. Even if you've already filled in all fields for an employee, you'll need to make a selection in the new Gender field. The new Country field is filled in automatically.

- First name

- Last name

- Gender (new field)

- Date of birth

- Start date

- Address

- Suburb

- State

- Postcode

- Country (new field)

Complete superannuation fund details

On the Superannuation tab, enter details of the employee's super fund and superannuation guarantee.If you previously entered this information on the Employee details tab, you need to re-enter it here. We've made it easier by showing any information you've already entered about the employee's super arrangements.

You should complete all fields on this tab.

Why do I need to do this?

The ATO's data requirements for complying with SuperStream are stricter than what you could previously enter in MYOB Essentials. By re-entering the details on this tab, you can make sure the details comply with these requirements. For example, you can no longer simply enter the fund name - if the employee is with an APRA-regulated super fund, you need to choose one of the approved funds from the list.

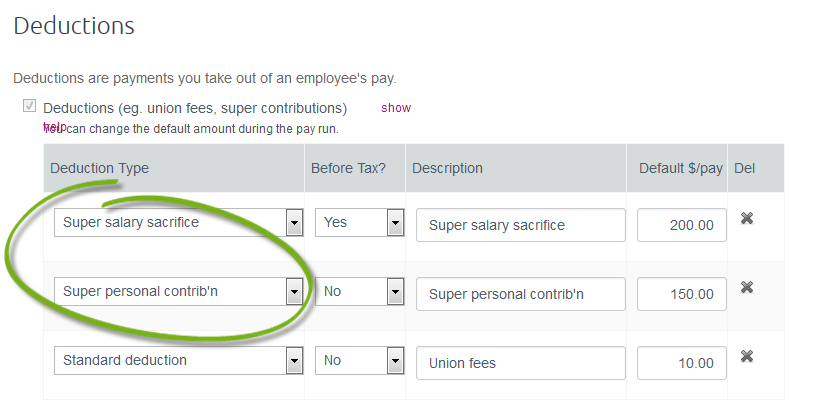

Set up deduction categories for superannuation payments

If your employee makes additional superannuation payments, like salary sacrifice super, or personal super contributions, you might have set them up as deductions on the Additions/Deductions tab.

To ensure that these amounts are included in superannuation payments made through MYOB's super portal, you need to make sure they are assigned to one of the two new superannuation deduction types:

- Super salary sacrifice - use for any salary sacrifice super contributions, taken out of the employee's income before tax is calculated.

- Super personal contrib'n - use for personal super contributions taken out of the employee's after-tax income.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.