How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If you’ve never used MYOB Essentials before, you need to sign up before you can create your first business. To sign up, go to the MYOB Essentials website: Australia | New Zealand and click Try it free.

Creating additional businesses

If you’ve already signed up for MYOB Essentials but want to create a new MYOB Essentials business, see Signing up another business.

The sign-up page

On the signup page, enter your contact details (email address and phone number), the password you want to use to log in to MYOB Essentials.

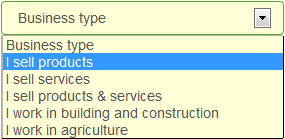

Choosing your business type

Select the business type that best describes what your business does. This will be used to choose the set of default accounts that MYOB Essentials will create for you. Note that you’ll be able to edit these accounts later.

For more information about the default accounts lists for each business type, see Default accounts lists for each business type, below.

Referral or activation code

If you purchased MYOB Essentials from a store, enter your activation code. If your accounts advisor (or someone else) recommended MYOB Essentials to you and gave you a referral code, enter that code. Otherwise, leave this field blank. You’ll be able to use MYOB Essentials for free for 30 days.

When you’re done, click I agree with Terms of Use - Sign me up.

Your business will open, and you’ll be able to set up some of the basic details needed to get started. For more information about these steps, see Basic setup.

Default accounts lists for each business type

All accounts lists provided by MYOB Essentials include the same set of standard accounts, plus some extra accounts tailored for the specific business type.For example, a business that sells products will have a Cost of Sales account for Raw Materials, and a business involved in agriculture will have an expense account for Pesticide.

System accounts

System accounts are required by MYOB Essentials, and will be created even if you choose not to use one of the accounts lists provided by MYOB Essentials. You can’t delete these accounts.

- Asset accounts: ABN withholding credits, Accounts receivable

- Liability accounts: ABN withholdings payable, Accounts payable, GST collected, GST paid, PAYG withholdings payable, Payroll deductions, Superannuation payable

- Equity accounts: Income tax, Historical balancing, Retained earnings, Current year earnings

- Expense accounts: Discounts given, Superannuation expense, Wages & salaries, Discount received.

Standard accounts list

All accounts lists provided by MYOB Essentials include the following accounts, plus additional accounts depending on the business type:

Account type | Accounts included |

|---|---|

| Asset |

|

Liability |

|

Equity |

|

| Expense |

|

Other Income |

|

Other Expense |

|

Additional accounts for each business type

In addition to the standard set of accounts, the accounts list for each business type includes the following accounts:

| Business type | Includes... |

|---|---|

I sell products |

|

I sell services |

|

I sell products & services |

|

I work in building & construction |

|

I work in agriculture |

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.