You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 21 Next »

https://help.myob.com/wiki/x/H42O

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If an employee wants super paid into multiple funds, they'll need multiple employee cards. This is because you can only assign one super fund to an employee's card.

Here's how it works:

The employee will have one primary card for their payroll information, and this card is linked to one super fund. For each additional super fund, a new employee card is created to store the fund information.

When the employee is paid, the fund linked to their primary card is paid as normal. The payments for the additional funds are temporarily held in a "clearing" account, then distributed to the other employee cards and their associated super funds.

OK, let's step you through how to set this up.

We'll use the example of an employee who wants their Superannuation Guarantee payments to go to one fund, and a salary sacrificed amount to go to another fund. Your scenario might be different, but the same approach can be used.

If you've already set up a card for the employee, consider this their primary card. For our example, we need an additional employee card which we'll refer to as the secondary card.

Make sure you've set up your employee's super funds.

Here's what you need to record in each card:

| In the... | record this info... |

|---|---|

| Primary card |

|

| Secondary card |

|

If you're using Pay Superannuation, check super fund and employee details to make sure all mandatory information is recorded.

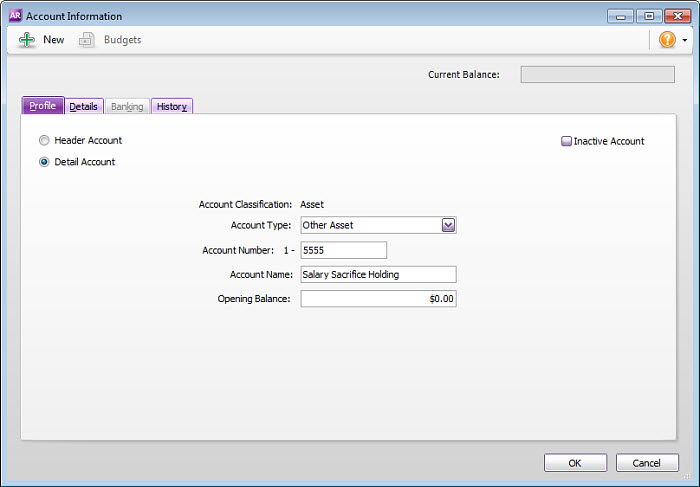

We need to create an asset account which will be used to temporarily hold the super funds deducted from the employee's pay. This type of account is often referred to as a "clearing" account.

When creating this account, set the Account Type to Other Asset as shown in our example:

We need to set up some payroll categories to distribute the employee's super payments. These categories determine how much super to pay, and where to pay it.

For our example, we need to set up 4 payroll categories.

- Set up a superannuation category to cater for the employee's mandatory (employer-paid) super payments. This super category might already exist in your company file.

- Click Employee to assign this category to the employee's primary card.

- Click Employee to assign this category to the employee's primary card.

- Set up a deduction category to deduct an amount each pay for salary sacrifice super payments.

- Select the salary sacrifice "holding" asset account (created earlier) as the Linked Payable Account. Ignore the warning about the type of account you've selected.

- Enter the dollars per pay period to be deducted.

- Click Employee to assign this category to the employee's primary card.

- Set up a wage category to pay the salary sacrifice super payments to the secondary card.

- Select Salary for the Type of Wages.

- Select the Optional Account option and select the salary sacrifice "holding" asset account created earlier. Ignore the warning about the type of account you've selected.

- Click Employee to assign this category to the employee's primary card.

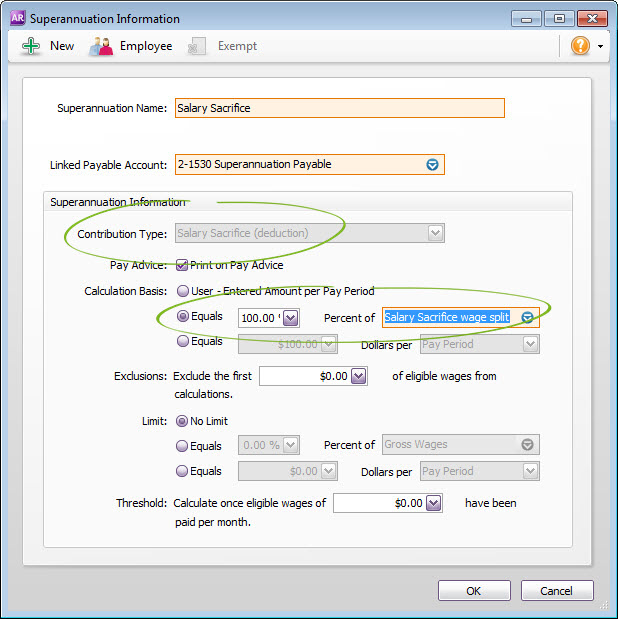

- Set up a superannuation category to pay the salary sacrifice super payments to the applicable fund.

- Select your superannuation payable account for the Linked Payable Account.

- Select Salary Sacrifice (deduction) for the Contribution Type.

- Select Equals 100% and select the wages payroll category (created at step 3).

- Click Employee to assign this category to the employee's secondary card.

If the employee is salary sacrificing the same amount each pay, enter this amount in the standard pay details of the employee's secondary card.

When you process your payroll, click the zoom arrow to review the details of both of the employee's cards.

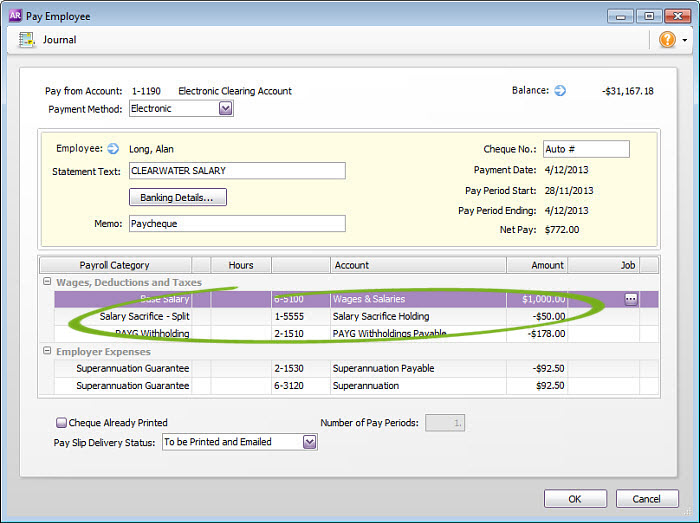

In the employee's primary card

- The deduction will be listed ($50 in our example).

- The deduction value will be temporarily held in the salary sacrifice "holding" account (created earlier), ready to be transferred to the secondary card.

- If needed, you can change the salary sacrifice amount here.

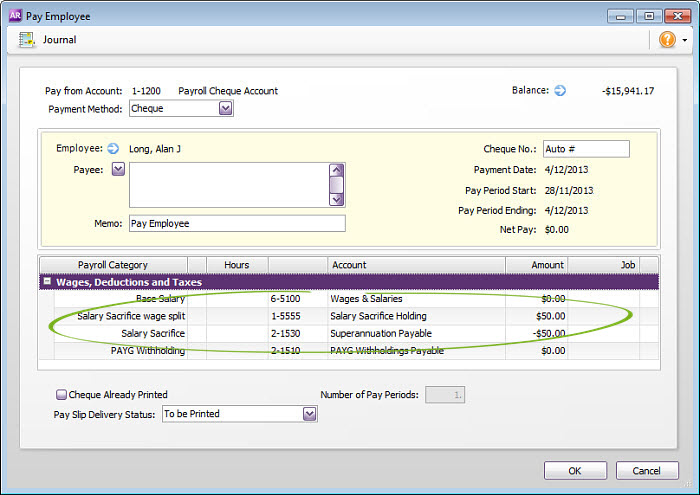

In the employee's secondary card

- Enter or change the salary sacrifice amount against the Salary Sacrifice wage category ($50 in our example).

- The Salary Sacrifice superannuation category will automatically update to show this amount as a negative value (-$50 in our example).

- When you click OK on this window, you'll need to click OK to the warning about a $0.00 Net Pay,

Recording these pays will:

- allocate the superannuation amounts to the respective funds ready for payment, and

- clear the balance of the salary sacrifice "holding" account.

FAQs

To see how much super has accrued for each fund, run the Accrual by Fund Summary report (Reports > Index to Reports > Payroll > Superannuation). You can filter the report for the applicable funds and specify the required date range.

At the Payment Summary Fields step of the Payment Summary Assistant, select the Salary Sacrifice - Split deduction category but NOT the Salary Sacrifice wage category. This will ensure only the employee's primary card will be included in the payment summary and EMPDUPE file.