You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 5 Next »

https://help.myob.com/wiki/x/WZCO

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If you sell goods using lay-by, it's easy to track these sales in AccountRight. All you need to do is create a lay-by stock item for the goods being sold, create a sales order for the goods, then apply payments against that order until the lay-by is paid off.

The example we'll use is selling a bicycle on lay-by, but the same approach can be used for most lay-by scenarios.

We'll also step you through what to do if the customer cancels or defaults on the lay-by.

GST on lay-by sales

In Australia |

|

In New Zealand | Regardless of your GST accounting basis, GST is realised upon the final lay-by payment when the goods are delivered. |

To track the quantity and value of stock on lay-by, you need to create a lay-by item and an associated asset account.

Here's how:

- Create an asset account to track the value of lay-by stock.

- Set the Account Type to Other Asset.

- Enter an Account Number that suits your account list.

- Enter a suitable Account Name, such as Layby Inventory.

- Create an inventory item for the stock being put on lay-by.

- Add "LB" to the Item Number to distinguish it from other stock items.

- For the Asset Account for Item Inventory, select the Layby Inventory asset account created earlier.

Transfer stock from the trading stock item to the lay-by stock item.

Use the Build Items function (Inventory > Build Items).

Enter a positive Quantity for the lay-by stock item. This increases the stock quantity for this item.

Enter a negative Quantity for the trading stock item. This decreases the stock quantity for this item.

Enter the Unit Cost for the lay-by item (to match the trading stock item).

You're now ready to create a sales order for the lay-by.

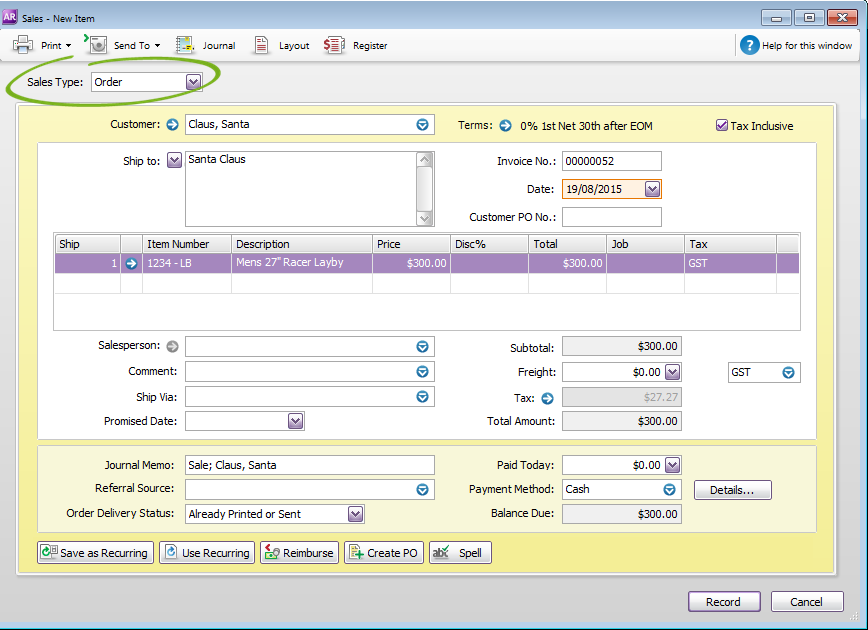

- Select Order as the Sales Type.

- Select the Customer.

- Select the lay-by item and specify the Ship quantity and Price.

Lay-by terms

You might want to change the terms for this order to reflect the date the lay-by needs to be picked up.

When a lay-by payment is made

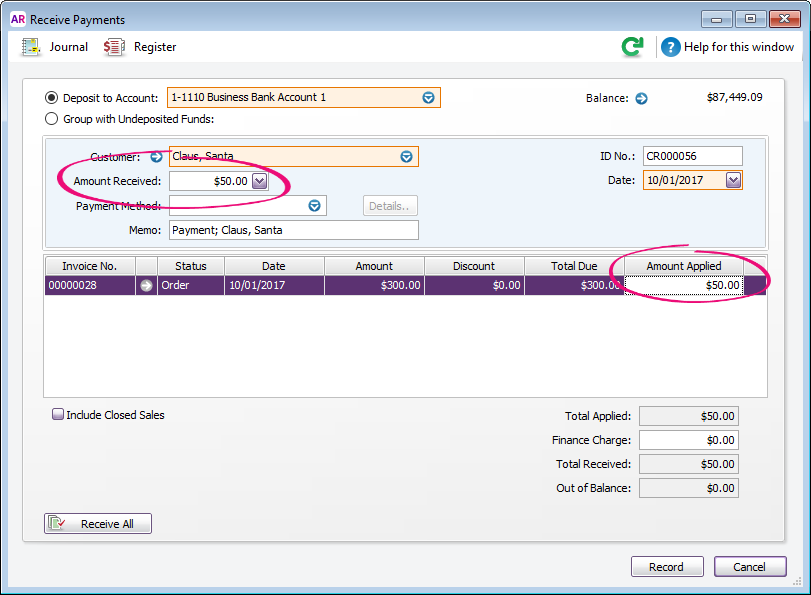

Record the payment against the sales order (Sales > Receive Payments).

- Select the Customer to display their lay-by order.

- Enter the payment in the Amount Received and Amount Applied fields.

After the final lay-by payment is made

When the lay-by is paid off, change the order to an invoice to provide to the customer.

- Find the order (Sales > Sales Register > Orders tab).

- Click the order then click Change to Invoice.

- Check the details of the invoice then click Record.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.