MYOB Business brings together all the information you need to prepare your GST return in one place without you having to run multiple reports. This includes GST collected and paid for all GST codes and the transactions the GST codes were assigned to.

You even get to see transactions that were added, edited or deleted since the last return period was completed. These you can add to your current return as late claims so that your end-of-year GST reconciliation balances.

You'll first need to check your GST settings and then use the information in the GST return report to prepare your return. We'll step you through what you need to do.

Before you begin

We recommend that you:

-

enter any invoices, bills or other transactions you still need to

Create a GST return report

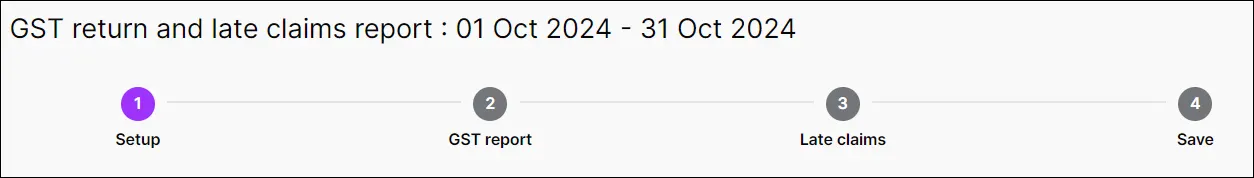

Start by going to the Reports menu > GST return and late claims and click Create new. See below for info on completing each step of the GST return report process.

If you want to pause creating the GST return report, need to make changes or check something, click Close to save it as a draft. You can then reopen the draft and refresh it with any changes. For more details, see 'Save a draft and update it later', below.

1. Setup

This page shows the setup of your GST return report. Check:

the period you're completing a GST return for. If:

this is your first return, you can choose the GST return period you'd like to report on

you've previously completed a return, you won't be able to change the GST return period. To carry over late or edited transactions, reports need to be done every period in order. You can't skip the current period to a future period. If you don’t have any GST to report this period, you’ll still need to finalise this report to move to the next period.

your business details are correct. These details are pre-filled from your MYOB Business data.

your lock date. If you need to add or edit any transactions, you may need to remove or edit your lock date. A lock date prevents anyone from inadvertently creating, editing or deleting transactions prior to a date you specify.

To check your lock date, click Business settings and scroll down to Lock date. Find out more about lock dates.You can go back to the report after looking at the lock date by selecting back (left arrow in top left corner) in your browser.

2. GST report

See the amount of GST collected and paid for each of your GST codes and to confirm that the right GST code has been assigned to transactions.

To:

see all the transactions that make up the totals in the report, click the dropdown arrow next to each GST code

view transactions on all GST codes, click Expand all

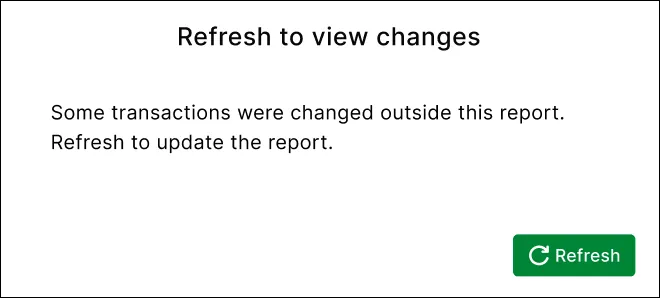

view and edit a transaction's details, click its ID No. If you make any changes to transactions, click Refresh in the GST report to include those changes in the report.

3. Late claims

See if there were any transactions added, edited or deleted in the previous GST return period.

If there are late claims, you can choose to:

view or edit them by clicking the ID No. of the transaction. If you do change a transaction, click Refresh in the Late claims report to include them.

add them to your GST return report by selecting Yes, add the late claims

remove them from your GST return report by selecting No, remove the late claims. You might do this if they aren't relevant to the period (e.g., because you've already included them in a revised GST return). Note that the removed claims won't be included in future GST return reports.

Click Export and choose to export the Late claims report as a PDF or Excel file.

4. Save

This shows the totals you need to enter in each field of your GST return. The amount you need to pay IR (a positive figure), or are to be refunded by IR (a negative figure), appears under Amount owed.

Click Save. If any transactions were changed while you created the report, you are prompted to refresh the report:

Click Refresh and view the updated report. Once you're satisfied with the report, click Save again.

Once you've saved your GST return report, you're prompted to file online with MYOB. If you want to do it later or by another method, click File later. For more info on lodgement options, see 'File your GST return', below.

To prevent any changes to transactions in the period you've just reported, set a lock date.

Save a draft and complete it later

If you need to stop doing your GST return report to do something else, check something or make some changes, you can save a draft of the GST return report. Then come back to it later, update it with any changes and complete it.

Save a draft GST return report

To save a draft of the GST return report, click Close in the GST report, Late claims or Save sections.

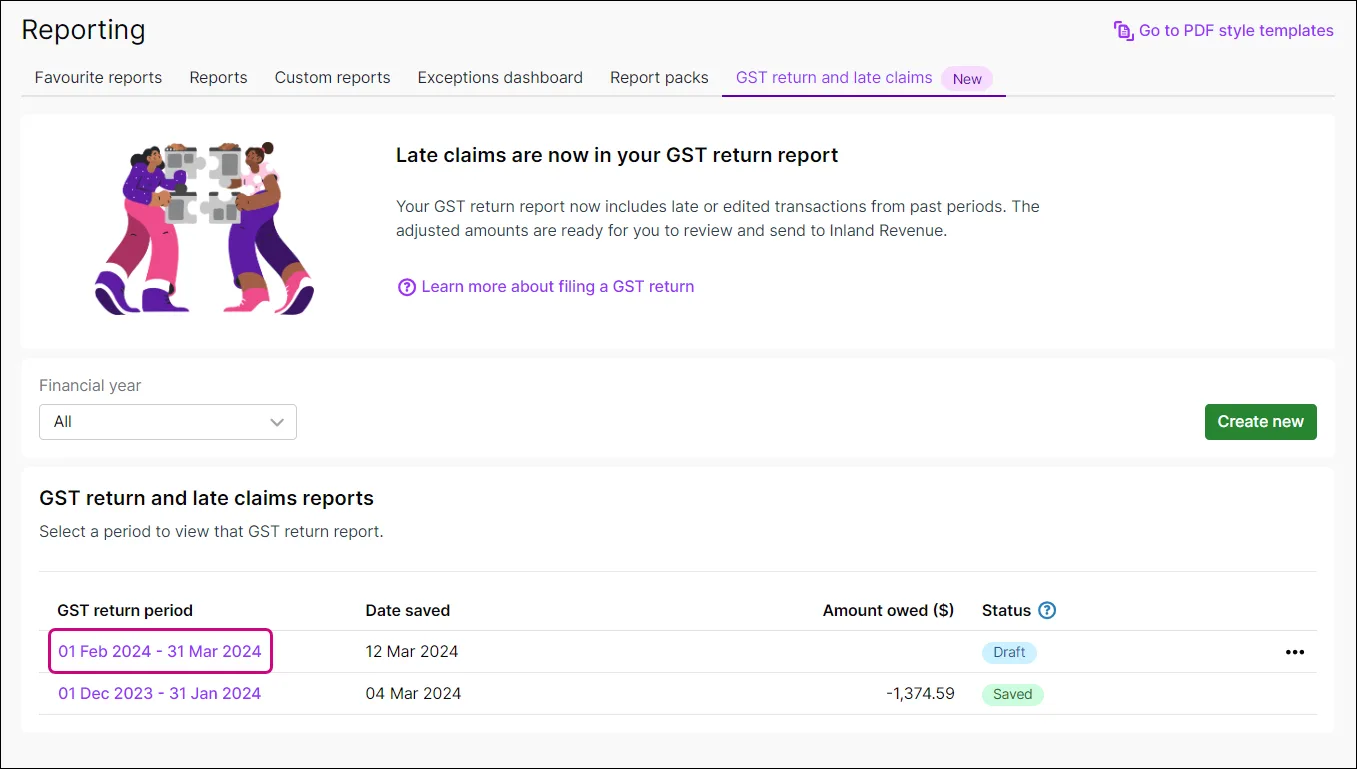

Once you're ready to complete your GST return report, go to the Reports menu > GST return and late claims and click the GST return period of your draft:

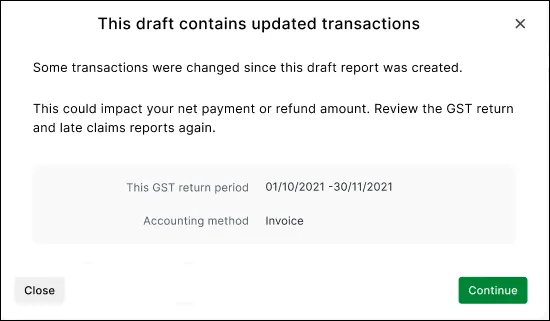

When you open the draft, MYOB Business will display a message if there are updates that have been made to transactions that affect the GST return report:

When you click Continue, the draft reopens. If there are updates affecting your GST return report, we recommend that you review it again.

File your GST return

After completing your GST return report in MYOB Business, use the information in it to help you file your GST return with IR.

We recommend that you file your GST return from MYOB Business. Once you’ve filled in the other required fields you can lodge your GST return online, and get confirmation from IR within seconds.

File your GST return from MYOB Business

Go to the Accounting menu and choose Prepare GST return.

In the File with MYOB section, click Get started.

If prompted, enter your MYOB account details.

To continue working on an existing return, click the date listed in the Period end column, then skip to step 6.

Do you use the AIM method? Find out how to get set up for AIM and how to file an AIM statement of activity.

To add a new return:

Click Add return. The Return details page appears.

Enter your IRD/GST number and select your Return type.

If prompted, enter your myIR user ID and password.

Don't have a myIR user ID? It's easy to register for myIR by heading to the IRD's registration page.

Getting an error when logging in to the IRD website? Clear your internet browser cache and try again.

Enter your GST output tax adjustment account and GST input tax adjustment account. Ensure these are not both the same account.

Select your GST taxable period, Period end and Accounting basis.

Can't select a month in Period end?

If you've prepared a GST return for a previous period, that period won't appear in the Period end drop down list.

Select whether you want to include year-end adjustments in the return.

Click Create. The return appears, pre-filled with the amounts that have been transferred from MYOB.

Review the amounts and click Validate to check the formatting. Make any changes that are required. Refer to the Late claims report you exported in 'Complete your GST return', above, to check if you need to include late claims.

(Optional) To save your changes (if you want to complete the return later) click Save.

Click Prepare to file, and if all details are correct, click File. A message appears requiring you to confirm that you want to file the return with Inland Revenue.

Click Confirm.

Click File to file the return with Inland Revenue. The GST lodgement page reappears showing the submission status of the return.

Once you've lodged your return, pay any outstanding amounts to the IR. After you've paid your GST or received your refund, you'll need to record the payment in MYOB.

You can also file:

with myIR

through your accountant

by post.

For more information about these lodgement options, visit this IR website.

FAQs

How do I view a completed GST return report?

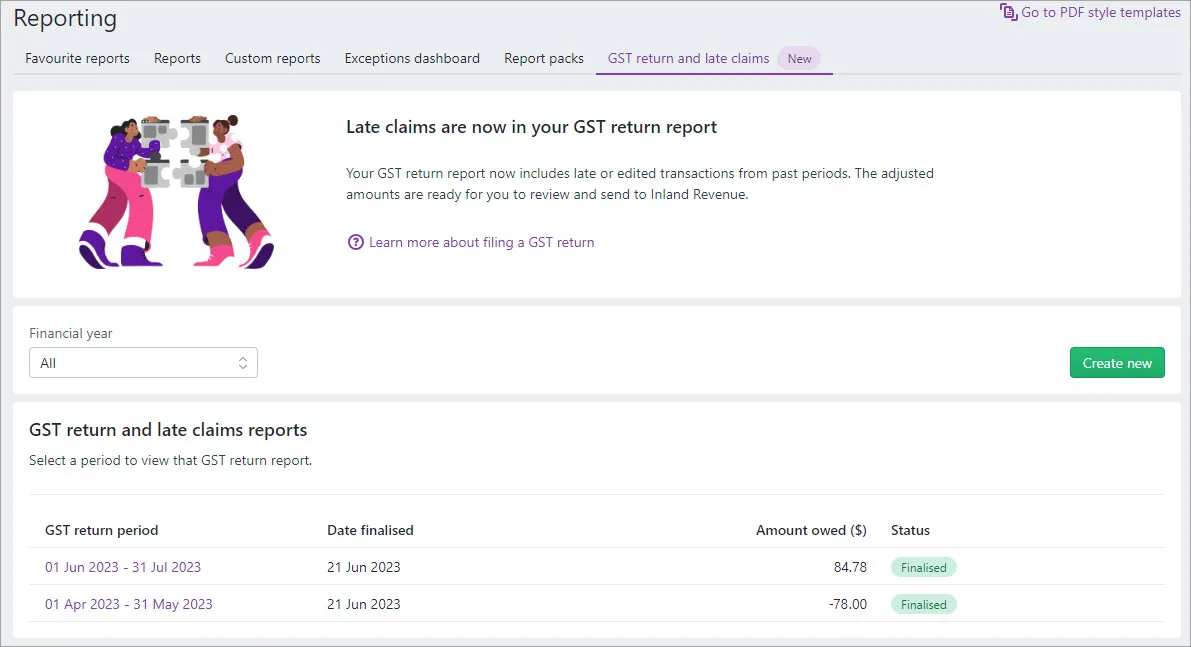

Go to the Reporting menu > GST return and late claims. Any completed returns are listed in the GST return and late claims reports section:

If required, filter the list of GST returns by Financial year.

Click the GST return period of a return to see its details.

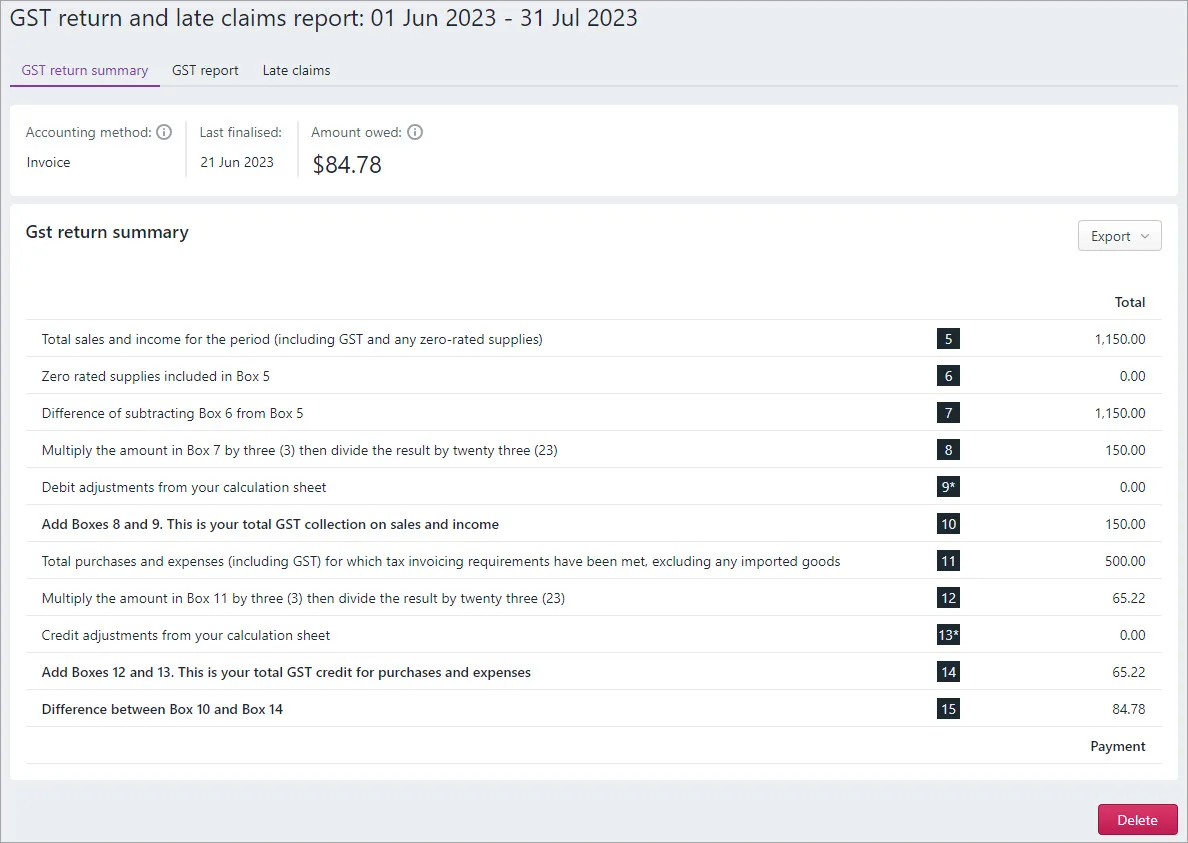

The GST return summary tab lists the totals you need to enter in each field of your GST return. The amount you need to pay IR (a positive figure), or are to be refunded by IR (a negative figure), appears under Amount owed.

The GST report tab shows the totals of sales, income, purchases and expenses for the report period. Click Expand all to see the transactions that produced these totals. Click an ID No. to view the details of transactions.

The Late claims tab shows any transactions added, edited or deleted in the previous GST return period.

Click Export and choose to export a report as a PDF or Excel file.