You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 185 Next »

https://help.myob.com/wiki/x/H4-TBQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Version 2023.2 is here

What's new

Payroll AUSTRALIA ONLY

- More help for fixing STP submission errors

If your last STP report was rejected by the ATO or contained errors, when you start a pay run you'll now see clearer messaging about it and what you need to do. - Helping you to set up leave correctly

You are now warned if you haven't linked a wage payroll category to a leave entitlement payroll category (if the Calculation Basis in the leave entitlement payroll category is set to Equals XX Percent of XX). This will ensure leave is paid out correctly when an employee takes leave.

Usability improvements

- If you email invoices via Microsoft Outlook, you'll no longer see the Invoice sent message after each send.

Performance improvements

- We've improved performance for bank reconciliations.

Bug fixes

- Fixed an issue in imported invoices with Online Invoice Payments enabled that was preventing the Pay now button appearing. AUSTRALIA ONLY

- Fixed an issue in bank feed rules that could result in an out-of-balance amount when reconciling.

- Fixed an issue that sometimes caused an error when deleting general journals.

If you use AccountRight PC Edition (version 2021.1 or later) or AccountRight Server Edition (version 2022.4 or later) you'll automatically be updated to the latest release of AccountRight. You'll be prompted to restart AccountRight to complete the update.

If you use AccountRight Server Edition version 2022.3 or earlier you can download the latest version for your server (AccountRight subscription required). Learn more about updating an AccountRight network.

Not sure what edition you're using? If you can see SE in the desktop shortcut description, you're using Server Edition. Otherwise, you're probably using the PC Edition.

![]()

If you're updating from an older AccountRight version, like AccountRight Classic (v19), learn how to upgrade.

After each release we retire an older version

We usually release an AccountRight update around the middle of the month with improvements and fixes.

As updates are released, older versions are decommissioned and no longer work online. If you're using an older version and your file's online, you must update to the latest AccountRight version to keep working.

Shut down AccountRight when you're not using it. If you leave AccountRight open all the time, you may miss out on automatic updates.

| If you're using | You must update by* |

|---|---|

| 2023.1 | TBD |

If you see a message that AccountRight needs updating when you open AccountRight, click Cancel in the message and then restart AccountRight to install any pending updates. See Getting the latest version.

* All dates are indicative only and subject to change.

Previous releases

2023

Your customers can now pay your online invoices using Google Pay on their Android devices, so Google Pay now appears as a payment option in the Sales window, in field help, invoice PDFs and on invoice emails sent from Microsoft Outlook.

We'll provide links to relevant updated help topics when these changes are released.

Performance improvements

- We've improved performance for creating, editing and deleting General Journals.

API improvements

- Contract documentation has been updated with the new Journal Transaction History endpoint.

- You can now create, update or delete build transactions created through the adjustment endpoint.

For more information about our API improvements, visit the API Support Centre.

Bug fixes

- We've fixed an issue that prevented users seeing the View PDF or View completed super choice PDF buttons.

- The correct set up, payment or view invoice options now appear in the Sales window, depending on whether Online Invoice Payments has been applied for or enabled.

- Fixed a FK_BusinessEventLine_BusinessEventOriginal exception error that occurred when deleting a General Journal.

2022

What's new

Payroll AUSTRALIA ONLY

- Easier leave setup

When you set up a new company file, AccountRight now comes with a default set of annual and personal leave payroll categories (for salaried and hourly pay basis) which you can assign to your employees, making it easier to set leave up and ensure it's accrued and paid out correctly. - Leave accrual balance is now set to print on pay slips by default

As employees want to keep track of their leave balances, the Show leave balance on pay slips option (previously called Print on Pay Advice), is now selected by default when you create a new leave entitlement payroll category. - Helping you to set up leave correctly

You are now warned if you haven't linked a wage payroll category or an exemption to a leave entitlement payroll category (if the Calculation Basis in the leave entitlement payroll category is set to Equals XX Percent of XX). This will ensure leave is paid out correctly when employee takes leave. - Super fund details are protected from accidental changes

When you open an employee's super fund information (Cards List > Employees > Employee > Payroll Details tab > Superannuation > Superannuation Fund), the details in the Superannuation Fund Information window are no longer editable, preventing accidental changes to funds that affect all employees. You can still change the fund details from the List menu > Superannuation Funds. - Helpful reminder to move your business to STP Phase 2

If you haven't yet moved your business to STP Phase 2, you'll get a reminder to do so when you complete a pay run, enabling you to start the move or learn more about it. - Avoid employment termination payment (ETP) reporting errors

If you've moved to STP Phase 2 and you've saved a payroll category that has been assigned an ETP reporting category, this reporting category can no longer be changed. This prevents errors in reporting ETP.

We'll provide links to relevant updated payroll help topics when these changes are released.

Customer payments

- More streamlined bulk invoice emailing

When using Online Invoice Payments and emailing invoices in bulk via Microsoft Outlook (from the Review Sales Before Delivery window > To be emailed tab), the Set up payment notifications reminder now only appears once. - As we discontinued the MYOB Direct Debit service from 20 September 2022, we've removed the Direct Debit Requests button from the Sales command centre.

Company file information

- Avoid errors when entering the company file email address

When you create a new company file (using the New Company File Assistant), the email address you enter is checked for the correct format.

API improvements

- We've optimised the GET /Sale/Invoice/* endpoint to retrieve only relevant information from the database.

- You're now able to create, edit or remove a Bill of Materials (BOM) definition when you call the endpoint to create items.

- Fixed a bug that occurs when creating a supplier payment on a purchase using a Hybrid layout via the API.

- The cash method for the balance sheet is now available via the API.

For more information about our API improvements, visit the API Support Centre.

Bug fixes

- The Pay now button in invoices now works for online invoice payments sent via Microsoft Outlook. When Online Invoices Payments is switched off for an invoice, or the service has been cancelled, View invoice appears instead, enabling users to view the invoice online.

- You no longer receive a 404 error when you click View invoice, Pay now, or View full invoice detail in an invoice sent via Microsoft Outlook that uses a form with the # or & character in the form's name.

- Fixed timeout errors when running the Auto-Build Items report.

What's new

More flexible and convenient online invoice payments

You can now use Microsoft Outlook to send your online invoices to allow your customers to pay you online — you no longer need to be sending those invoices directly from AccountRight.- Easier to find Online Invoice Payments settings

We've added an Online Invoice Payments button to the Sales command centre, making it easier to set up online invoice payments or edit your online invoice payment settings. - Apple Pay mobile payment option is now visible in invoices

As your customers can now pay your online invoices using Apple Pay on their iPhones or other Apple devices, Apple Pay now appears as a payment option in the Sales window and on invoices sent from Microsoft Outlook.

We'll provide links to updated online invoice payments help topics when these changes are released.

Payroll AUSTRALIA ONLY

- Helping you fix rejected STP reports

If you're doing a pay run and your previous pay submission has the ATO error CMN.ATO.GEN.XML03, you'll see a message alerting you to this. You can click from the message to the STP reporting centre to view the reason the pay was rejected and how to fix it.

API improvements

- Users can now retrieve build transactions.

- We've improved response times for sales invoice endpoints to reduce 504 Gateway timeout errors.

For more information about our API improvements, visit the API Support Centre.

Bug fixes

Resolved an issue that prevented sending emails from AccountRight when the email address contained an apostrophe.

- You no longer receive multiple Choose Profile prompts when sending an email via Microsoft Outlook when it's closed. AUSTRALIA ONLY

- When the Online Payments option is deselected in an invoice, the Pay now button no longer appears in the online invoice when sent via Microsoft Outlook — View invoice appears instead. AUSTRALIA ONLY

- Fixed an issue that was preventing businesses moving to STP Phase 2 if they had more than 200 employee cards. AUSTRALIA ONLY

What's new

Payroll AUSTRALIA ONLY

- STP 2 is back and better

In July we paused transitions to STP Phase 2 to improve the in-product experience. But the wait is over – you can now make the move to STP Phase 2. Find out how... - Helping you fix rejected STP reports

If a report is rejected by the ATO, depending on the reason, you’ll now see a message about it the next time you start a pay run.

We've also improved the messaging in the STP reporting centre to help fix some rejected reports. - Quicker employee setup

A new employee card is now created as soon as a self-onboarding invitation is sent, allowing you to enter employee payroll information straight away. You can also quickly check the status of the employee's self-onboarding in the Profile tab of their employee card. - More guidance when paying employees aged under 18

If a pay run includes an employee aged under 18, regardless of pay frequency you're reminded to confirm their hours worked. This helps you stay on top of your super obligations. - Improved super calculations

Super guarantee amounts are now calculated only on the current pay period.

If a threshold is set in a super expense payroll category (not super guarantee) the super calculation will only include previous pay periods if the threshold is exceeded.

- Fast, secure and convenient mobile payments with Apple Pay

Your customers can now pay your online invoices using Apple Pay on their iPhones or other Apple devices. Apple Pay now appears as a payment option on your online invoices.

- A user with the Purchases role can no longer access the prepare electronic payments feature. This removes the possibility of a user without Payroll access seeing employee pay amounts.

What's new

Payroll AUSTRALIA ONLY

- Easily check employee self-onboarding details

You can now download a record of your employee's submitted details (employee Card information window > Payroll details tab > Personal details > View PDF button). Learn more... - Quick download of completed Super Choice form

You can now download the completed Superannuation Choice form for self-onboarded employees (employee Card information window > Payroll details tab > Superannuation > View completed super choice PDF button). Learn more... - Improved employment termination payment (ETP) handling

If you're reporting via STP, pays that include an ETP can now only be reversed and not deleted. This ensures your AccountRight payroll information matches the ATO records.

Bug fixes

Fixed an issue that could cause AccountRight to crash when paying an under 18 employee. AUSTRALIA ONLY

Resolved an issue that could cause AccountRight to crash when adding an employee. AUSTRALIA ONLY

Fixed the super guarantee calculation for under 18 employees so it only calculates on the current pay period. AUSTRALIA ONLY

Fixed an issue that was causing hourly wage categories to be checked incorrectly for STP compliance during a pay run. AUSTRALIA ONLY

Fixed a Balance Sheet issue that could occur if a header account was changed to a detail account.

- Fixed an issue that was preventing the use of $ and & in email addresses.

API improvements

Fixed an issue that was causing a 409 error on POST requests on endpoints.

For more information about our API improvements, visit the API Support Centre.

2022.7.1 patch was released to fix a bug that caused AccountRight to crash when recording general journal transactions from a recurring transaction. This occurred when the recurring transaction had a frequency set to Never.

What's new

Employee self-onboarding AUSTRALIA ONLY

More streamlined employee self-onboarding

You're prompted to send an employee self-onboarding request when creating an employee card.Send new employee self-onboarding requests via SMS

Enter a mobile phone number if you want to send your new employee a self-onboarding request via an SMS message as well as by email.Easily track employee self-onboarding requests

We've added a button to the Employee Self-Onboarding window to display a list of employee self-onboarding invitations and their status.

Loans and finance AUSTRALIA ONLY

Quick access to business loans and invoice financing

We've added a Loans and Finance button to the Banking command centre. This gives you access to tailored business loans with Valiant and invoice financing with Butn.

Bug fixes

- Fixed a bug that was causing incorrect year-to-date figures to show in STP reports for previous payroll years. AUSTRALIA ONLY

2022.7.1 patch was released to fix a bug that caused AccountRight to crash when recording general journal transactions from a recurring transaction. This occurred when the recurring transaction had a frequency set to Never.

What's new

Payroll changes AUSTRALIA ONLY

- Helping you stay compliant with super for under 18s — Employees aged under 18 who are paid weekly and have worked less than or equal to 30 hours in the week will no longer have super calculated in their pay.

- Improved transitions to STP Phase 2 — Inactive and terminated employees (paid in the current payroll year) will now be included in the employee details check when moving to STP Phase 2. You'll also now be prompted to send an update event after moving to STP Phase 2 to ensure the ATO has your employees' latest year-to-date payroll information.

- Better reporting for STP Phase 2 — When you send an update event from the STP reporting centre, the year-to-date payroll totals for inactive and terminated employees (paid in the current payroll year) are now included.

Performance improvements

- More accurate general journals — foreign currency general journal transactions are now checked for missing details

- Save time entering transactions — we've improved the response time to display information when creating sales and purchases, such as supplier or item details

Bug fixes

- Fixed a bug that was causing the custom library location to be reset when updating AccountRight.

- Fixed a bug that closed AccountRight when updating account details.

- Fixed a bug that caused an incorrect opening balance for some foreign currency accounts.

- Fixed a bug in AccountRight Server Edition that sometimes resulted in duplicate payments when entering pre-paid invoices.

- General Ledger report (Summary and Detail) now balances correctly when spanning multiple financial periods. This issue affected the Current Year Earnings and Retained Earnings accounts.

- Converting a purchase order with a 100% discount to a bill no longer causes AccountRight to crash.

Payroll changes AUSTRALIA ONLY

- Helping you stay compliant with super for under 18s — If a pay run includes an employee aged under 18, an alert now appears advising you to check how much super you need to pay them. Learn about paying super for under 18s

Avoid mistakes when fixing termination payments — You'll now be prevented from entering negative Employment Termination Payment (ETP) amounts to fix a previously recorded ETP pay, and you’ll be prompted to reverse the incorrect pay instead. Learn about fixing ETPs

Helping you automate the super rate increase — Any super guarantee payroll categories set to 10-10.5% of Gross Wages will be automatically updated to 10.5% when you do your first pay run with a payment date on or after 1 July 2022. Learn more...

Usability improvements AUSTRALIA ONLY

- Added Employee Self-Onboarding button to the Card File command centre. This button is now available in both the Card File and the Payroll command centres. Learn about employee self-onboarding

Performance improvements

- Improved the response time of the Sales Register and Items Register windows, and when opening item sales.

Bug fixes

- We fixed a bug where incorrect COGS amounts were being applied to edited sales. Now, if you edit an item sale, the item's average cost and associated cost of sales are no longer affected. Learn more...

- Resolved an issue where incorrect COGS amounts were being applied to returned goods. Now, if you sell multiple items as a unit, like a box or case, and some of those items are returned, the unit's average cost and associated cost of sales are calculated correctly. Learn more...

- Fixed a display issue that did not affect calculations, but appeared to show an incorrect calculation basis in non-superannuation guarantee payroll categories. AUSTRALIA ONLY

AccountRight Server Edition - reminder

Never manually update your network again — If you're using AccountRight 2022.4 Server Edition, the 2022.5 update will download and install automatically. So that's less downtime for your business and more frequent improvements to AccountRight. Learn more...

2022.5.1 patch was a minor update to fix the following bugs:

- You'll no longer get an error if you try to change the details of an account that's linked to a card.

- We've re-introduced a safeguard to stop you changing an account to a header account, or changing the account subtype, if the account has been used in a sale or purchase.

What's new

Superannuation changes

Helping you automate the super rate increase — a new option has been added to super guarantee payroll categories to automatically increase the rate to 10.5% for pays dated 1 July onwards Learn more...

Simplifying super calculations — the $450 super earnings threshold is automatically removed from super calculations for pays dated 1 July onwards Learn more...

Helping you stay compliant with ATO super reporting — the correct ATO reporting category is now set as the default for all super guarantee payroll categories Learn more...

AccountRight Server Edition

Never manually update your network again — once you update to AccountRight 2022.4 Server Edition, all future updates will happen automatically. So that's less downtime for your business and more frequent improvements to AccountRight. Learn more...

API improvements

Bill of Materials endpoint now allows querying of a single item

For more information about our API improvements, visit the API Support Centre.

Bug fixes

We fixed a bug that prevented you from printing a receipt for a payment recorded from a bank feed transaction

Fixed a DataInvalid error that prevented you from editing or deleting transactions

Performance improvements

- Improved the response time of the Items Register window

What's new

- Save time and minimise STP ATO rejections — your payroll details are checked each time you do a pay run and you're advised if anything needs to be fixed Learn more...

Better reporting for Single Touch Payroll Phase 2 — the Payrun Activity [Detail] report within the payrun now includes STP Phase 2 ATO reporting categories

- More personalised invoice emails — if you've set up a new file and use AccountRight in a web browser, the default invoice email now pulls in customer information, such as customer name and invoice number

API improvements

- API can now retrieve the Bill of Materials (Auto-Build list) for an item

What's new

- You can now move from STP Phase 1 to STP Phase 2 — you'll see a prompt in the STP Payroll Reporting Centre and you'll be guided through the move. See Getting ready for STP Phase 2.

- See what information needs to be fixed when sending an employee self-onboarding invitation email, with an improved Failed to send message

Increased character limit in employee self-onboarding fields (First name, Last name and Email)

Bug fixes

Fixed the ORMDataException error which occurred when transactions were failing to record in a network environment

- Resolved an issue preventing you from saving changes to sales or purchases containing inventory items with zero on hand

- Fixed an issue that was causing an incorrect prompt for double authorisation on super payments

New features

- Employee Self-Onboarding button added to the Payroll command centre to make it easier to add employees — learn more

- Employee self-onboarding contact details are checked to make sure they're complete and in the right format

Pay Super users (AccountRight Plus and Premier, Australia only)

SuperChoice Clearing House now processes all super payments, reducing payment times

There's a new Product Disclosure Statement and a new Direct Debit Agreement

Bug fixes

- Resolved scenarios where incorrect COGS inventory values were calculated and used in transactions

Plus we've tidied up the look and performance of specific windows in AccountRight, and added other general performance improvements.

2021

New features

When using AccountRight in a web browser, you can now:

- Re-download a bank file from the electronic payment transaction

Enter up to 255 characters in the Customer PO number field in invoices (previously, 18 characters)

API improvements

Resolved an issue where AccountRight API used incorrect pricing on an item

STP Phase 2 (AccountRight Plus and Premier, Australia only)

- We're continuing to get AccountRight ready for STP Phase 2

- If you're setting up STP after installing 2021.8, you'll be setting up for STP Phase 2

- The ETP Benefit Type button appears when you process a pay with ETP payroll categories that use STP Phase 2 reporting categories

This is a minor update containing performance improvements.

New features

- (When using AccountRight in a web browser) Invoices now support longer alphanumeric invoice prefixes in invoice numbers

- Performance improvement to the Adjust Inventory window

Bug fixes

Fixed an error causing AccountRight to close when recapping Transfer money

Fixed an error causing AccountRight to close when deleting a Receive money

Plus we've added general performance improvements and we're continuing to get AccountRight ready for STP Phase 2.

New features

- Can now assign Lump Sum E reporting category and associated year for STP Phase 2. If you've paid a lump sum E payment this financial year, you'll need to assign a financial year to it. Learn more

Bug fixes

- (When using AccountRight in a browser) Bank feed transactions no longer get stuck as "matched"

- (When using AccountRight in a browser) E-invoices with blank lines can now be emailed

- Online Invoice Payments (OIP) feature on invoices no longer displays after cancelling the OIP service

- Purchases with 0 quantity items now total correctly in the Item Register

- General performance improvements

API improvements

- Fixed an issue with # of selling units

Plus we're continuing to get things ready under-the-hood for STP Phase 2.

2021.5.2

- (Australia) Last financial year-to-date amounts are now correctly sent to the ATO.

- An extra page no longer prints when printing invoices.

2021.5.1

An error no longer occurs when previewing or printing sales.

2021.5

New features

- Get ready for STP Phase 2 with new fields and reporting categories

Bug fixes

- Newly invited users can now access online AccountRight files in a web browser

- Users can now import QIF Files containing transactions dated in previous financial years

- NullReferenceException error no longer appears when recording spend money transactions

- System.IndexOutOfRangeException error no longer appears when recording transactions

- ItemTotalAmountUnBalanced error no longer occurs when entering data on quotes and orders

- Item Register values are now correct when an item is used more than once on an inventory adjustment

API improvements

The character limit in the Customer PO field has increased to 255 for ARL Public API - Sales & Purchases endpoints.

What's in this release

New features

- Implemented the ability to select a form when sending an invoice to disk

- Added a new Direct debit requests button to the Sales command centre that opens a hyperlink to the Direct Debit portal in the user’s default Web browser (Australia only)

Bug fixes

- Resolved a recently introduced issue where receipts incorrectly show as unprinted in Sales > Print Receipts

- Resolved an issue with Profit and Loss [Cash] report not calculating correctly for imported transactions

- Resolved an issue where AccountRight was not remembering window sizes and locations from prior versions after being upgraded automatically

- Resolved an issue where AccountRight was incorrectly removing previous version information after automatically updating

- Resolved multiple issues with linked accounts on newly created files affecting both Accounting & pay runs (Australia only)

- Fixed an issue where an error was displayed for some users when processing your first payroll for 2022 financial year (Australia only)

- Improved handling of employee names on payslips (Australia only).

API / Developer General Improvements and fixes

- API / Developers: Add Attachment endpoints to the AccountRight SDK

- Public API / Developers: Added validation on Deposit to account for receive payments transactions.

This is a minor update containing performance improvements

e-invoicing improvements

We're continuing to improve the functionality and ease of use of e-invoicing in AccountRight’s browser interface.

Find e-invoices easily: You can now filter your invoice list to show only e-invoices, and there’s an icon to show which of the invoices in the list are e-invoicing enabled.

Improved Tracking: You can now track the status of your e-invoice as it moves through your customer’s accounts payable process. You can see the status on the invoice list and the activity history on the invoice itself. A full list of the statuses can be found on this help page.

Payroll improvements (Australia only)

We're rolling out a few changes to provide better coverage in more tax scenarios as well as helping your business make the transition to paying Superannuation at the new rate of 10% from July 1.

STSL Tax tables: For employers who have employees undertaking higher education and training programs we previously had separate tax scales for FS / HELP / FS + HELP, these have now been combined into one table called STSL.

Working Holiday Maker - Not registered Tax scale: For Employers who have not registered for paying working holiday makers, we have added a new tax scale to support Working Holiday Maker - Not registered.

Default Superannuation % change from 9.5% to 10%: The Super Guarantee (SG) rate goes from 9.5% to 10% as of July 1, for all new files created post-July 1 we will be defaulting the SG to 10%.

General improvements and fixes

- Fixed an issue causing documents to sometimes not upload when dragged and dropped from Microsoft Outlook

- Addressed a bug with some new company files being created with incorrect linked accounts

- Fixed an issue with Profit and Loss [Cash] not reporting correctly for imported transactions

- Fixed an issue causing AccountRight to crash when opening

- Resolved an error when the 'Update Now' button is clicked

Information for Server Edition users

We found a bug in the pre-release version of AccountRight 2021.2 (released earlier this month) that affects what's shown in PDF versions of bills. AccountRight 2021.2.1 fixes this.

If you installed the earlier 2021.2 Server Edition, you'll need to uninstall it and install 2021.2.1 (available from my.myob: Australia | New Zealand).

To check your current version, open AccountRight and go to the Help menu > About AccountRight.

AccountRight 2021.2.1 is now available

Information for PC Edition users

We've had some reports of a System.AggregateException error occurring when starting AccountRight.

We're releasing a minor update that'll be automatically downloaded to fix this issue, so you might be prompted to restart AccountRight to complete the installation.

AccountRight 2021.2.1 has arrived and brings with it a powerful new way to send transaction information to customers using e-invoicing, as well as smaller fixes and enhancements.

This is also the first AccountRight release that will be delivered via the new automatic update experience for PC installer users.

Sending e-invoices will be available in AccountRight 2021.2.1 within the web browser interface. This allows the seamless exchange of transaction data between buyers and suppliers with compatible software.

Reporting enhancements we’ve removed the date range restrictions on more reports, allowing you to run multi period balance sheet and profit and loss reports across unlimited date ranges.

Reminder for Server Edition users if you’re accessing offline company files across a local network using AccountRight Server Edition, you need to make sure that all installations of AccountRight are also the Server Edition version.

As always, we've also included some general improvements and fixes.

Sending e-invoices

E-invoicing is a government-backed initiative that allows invoices to be exchanged directly between buyers and sellers’ accounting software. This will not only cut down on manual data entry, but reduces the risk of human error and helps businesses get paid faster.

In AccountRight 2021.2.1, users in both Australia and New Zealand will be able to send e-invoices to customers using the service. Currently, this is mainly government agencies and large businesses, but the network of users is growing continuously.

Find out more about eInvoicing.

Reporting enhancements

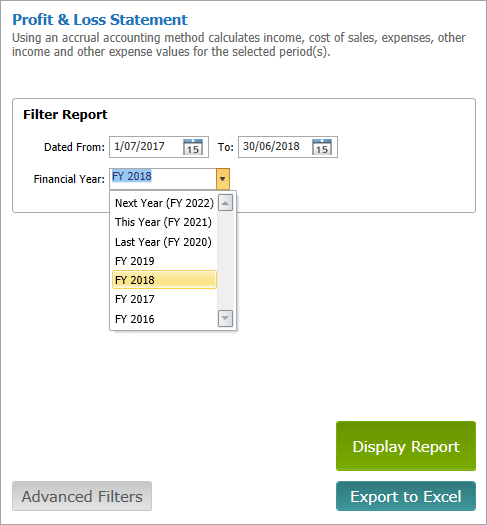

We've removed the data range restrictions on more reports in AccountRight 2021.2.1. Now the multi period profit and loss, the multi period balance sheet and the profit and loss (with year to date) reports can be run over unlimited financial year periods provided there’s data available to report. Previously these reports were restricted to being run one year forward or back from the current financial year set in your business.

Reminder - changes for AccountRight Server Edition users

If you’re using AccountRight Server Edition to share offline files across a network, you’ll need to make sure that all users accessing those files are also using Server Edition, including those workstations accessing the server.

This is to make sure that all versions of AccountRight across your network stay the same, since any PC Edition installer versions will automatically update while the server version won’t. Learn more about updating an AccountRight network.

General improvements and fixes

We’re always working to make AccountRight faster and more reliable and 2021.2.1 is no exception. We’ve made some further performance optimisations in this version and fixed a couple of bugs that were causing AccountRight to crash when an update was installed in the background.

API Improvements and fixes

New endpoint alert!

You can now POST to the /{cf_uri}/Purchase/Bill/{Layout}/{PurchaseTxnId}/Attachment endpoint, enabling you to insert bill attachments via the public API as you can with spend money transactions (via the /{cf_uri}/Banking/SpendMoneyTxn/{Spend_Money_UID}/Attachment endpoint).

For more information, head to the MYOB Developer Centre.

This release will save you time and effort when it comes to how you install and manage your software.

Automatic updates Having to manually install software is so 2020. With automatic updates, your software will update to the latest version in the background without you needing to do anything.

Superannuation status improvements (AU only) We’ve improved how superannuation lodgement status is labelled to make things clearer and prevent overpayment.

Bug fixes and stability improvements As usual, there are plenty of under-the-hood improvements to make your experience using AccountRight better than ever.

To find out about previous AccountRight releases, see Previous releases.

Automatic updates for AccountRight

We’ve had feedback from you that the process for updating AccountRight isn’t always easy.

Having to download and manually install updates can be time consuming, especially if you have multiple PCs in your business using AccountRight. We want to keep our promise to deliver you more value more regularly, without creating extra effort for you to manage updates.

AccountRight 2021.1 will check for available updates, download them and update you to the latest version automatically. This means no more having to pick a time to stop your business using the software, downloading and installing the update and upgrading your file. When a new version is available, the next time you open AccountRight it will be on the latest version – just like that!

Automatic updates are only available for the AccountRight PC installer (which is the vast majority of users). If you’re using AccountRight server edition, automatic updates will be available for you later this year. For more information on how this impacts AccountRight server edition, see below.

Some things to note about automatic updates

The shortcuts for the 2021.1 release look different. Use the new shortcuts to distinguish the silent installer edition from other PC/SE installed versions.

Desktop icon

Start Menu icon

- Automatic updates are available for all PC Edition users whether their company file is online or offline. Only an internet connection is required for automatic updates to work.

After installing AccountRight 2021.1, AccountRight will prompt the user when an update is downloaded and ready to install. The update is triggered when AccountRight restarts. The user can choose whether to restart AccountRight now or do it later.

- Customers using both PC and Server Edition on their network will get out of sync. To prevent this, we recommend customers using AccountRight in a network install Server Edition on all PCs needing access to the company file. See the information for Server Edition users below.

- We'll still need to decommission versions until all users have access to automatic updates. This includes those customers using Server Edition. Automatic updates for Server Edition will be available later in 2021.

- Once you've installed AccountRight 2021.1 and upgraded your company files, you can uninstall older AccountRight versions. If you don't need to open files in older versions of AccountRight, it's a good idea to remove them.

- Clearwater sample files are no longer supplied with AccountRight. You can however download sample files that will work with AccountRight 2021.1. See Using the sample company file (Clearwater).

We'll update relevant online topics with information about automatic updates once we start to make AccountRight 2021.1 generally available to customers.

If you're using on offline file and access third party apps using the Add-on connector, you'll need to restart the Add-on connector after installing 2021.1. For information on how to do this, see Add-ons.

Changes for AccountRight server edition users

If you’re using AccountRight Server Edition to share offline files across a network, you’ll need to make sure that all users accessing those files are also using Server Edition, including those workstations accessing the server. This is to make sure that all versions of AccountRight across your network stay the same, since any PC installer versions will automatically update while the server version won’t.

To check if you're using the Server Edition, look for SE in your desktop shortcut description.

Here's an example:

If there's no SE, you're using the PC edition.

Reminder – support for Windows 7

Microsoft discontinued support for Windows 7 on January 4th, 2020. MYOB ended its extended support of AccountRight on Windows 7 on March 31st, 2020.

If you’re using Windows 7, it’s important that you upgrade to a supported operating system to keep your system secure and operating reliably.

For more information, check out the Windows 7 end of support page from Microsoft, or speak to your IT provider.

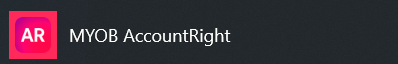

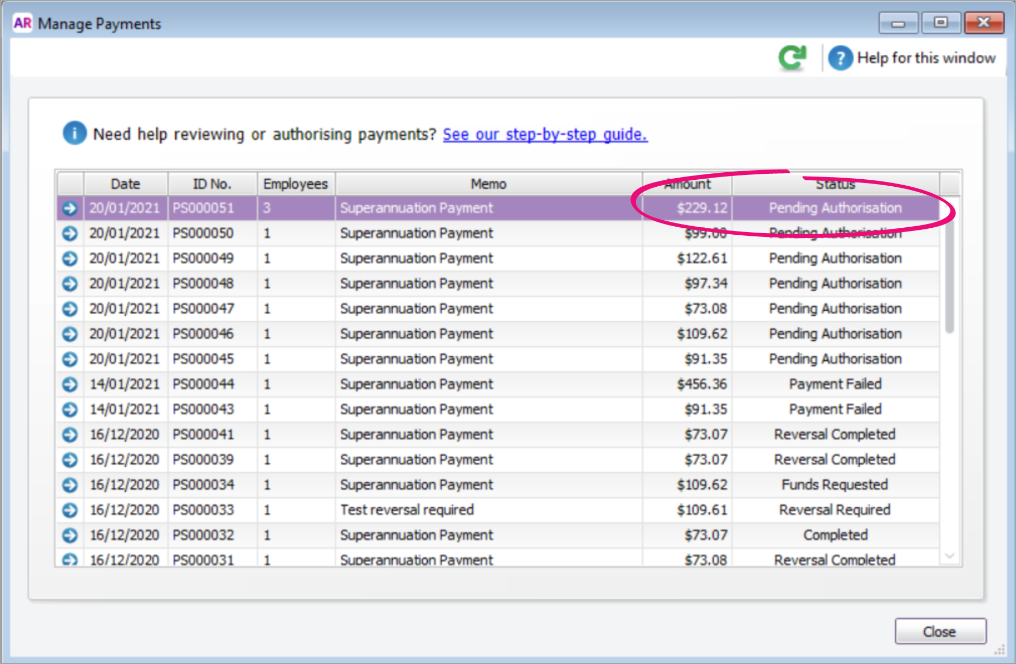

Superannuation status for reversed pay runs

We’ve improved the statuses of superannuation payments to make it clearer when a payment has been reversed. Previously, when you reversed a superannuation payment transaction, the status did not update to reflect that the transaction had been reversed. This meant another user might not realise the transaction was reversed and authorise the payment to the fund.

Now, when a payment is reversed, the status will update to Reversal completed, alerting all users that the payment has been reversed to prevent payment being completed.

Now when payments with the following statuses are reversed, the status will change to Reversal completed:

- Pending authorisation

- Partial authorisation

- Payment failed

- Withdraw failed

- Reversal required

General improvements and fixes

That’s not all! We have the usual enhancements and fixes to make your experience using AccountRight even better in 2021.1.

Job number character limit We’ve extended the character limit for job numbers from 15 to 30 characters

Importing and exporting journals in foreign currencies You can now export your foreign currency general journal transactions, extending the functionality of the recent foreign currency general journal release

Importing activity slips with decimals in the ‘units’ field This is now supported when a payroll category is allocated (AU only)

Bug fixes and stability improvements No release of AccountRight would be complete without squashing some pesky bugs. We’ve improved support for transactions entered via AccountRight’s browser interface as well as smaller bugs using foreign currencies, printing reports and more. And of course, we’ve given AccountRight further tune ups to make it faster and more reliable than ever.

API Improvements and fixes

‘Custom list’ endpoints The custom list feature allows you to set up lists of predefined attributes and assign them to your items and contacts to enhance and organise your data. You can now read the custom lists and their values via the API.

2020

A new release of AccountRight, 2020.4.2, is now available. This release addresses an issue discovered in testing of 2020.4 that prevents some users from printing a remittance advice on a customised remittance template. AccountRight 2020.4.2 is now available at my.myob AU | NZ and will be rolled out to users via in-product messages soon.

AccountRight 2020.4 promises to be one of our biggest releases yet, giving you access to an entirely new way to work with AccountRight, along with further enhancements to reporting, multi-currency and more.

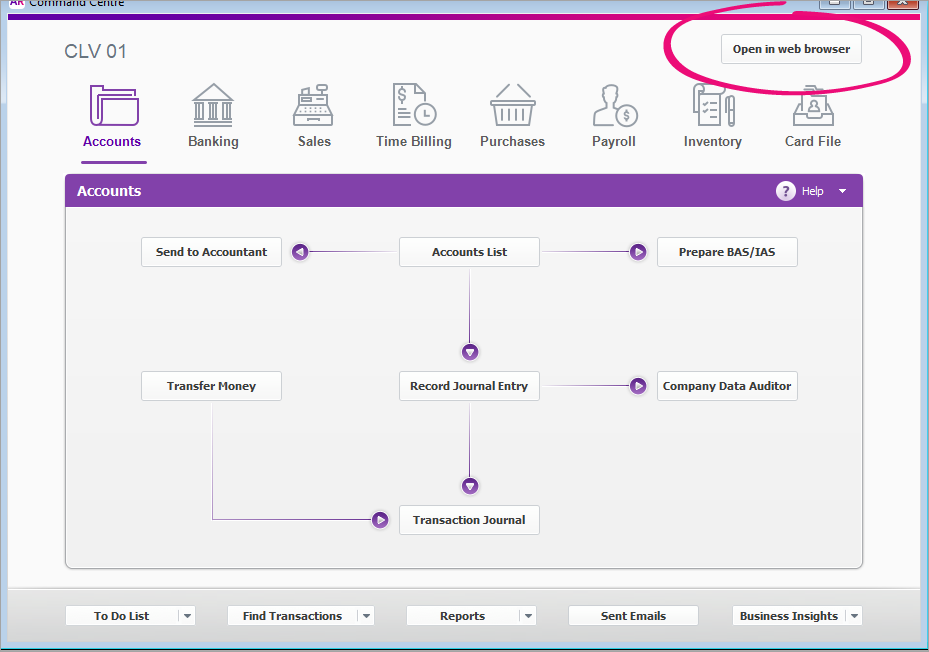

Access AccountRight via a web browser You can now access your online AccountRight files through a web browser interface, giving you the best of AccountRight anywhere on any internet-connected device.

Pass online invoicing card transaction fees to customers When your customers pay you with debit or credit cards using online invoice payments, you can pass along the 1.8% card transaction fee to them. And, we've made reconciliation of online invoicing payments easier.

Multi-currency enhancements We've made more improvements for users working in multiple currencies. You can now create general journals for more account types and we now support foreign currency remittance advices.

Reporting improvements We've removed date range restrictions, allowing you to run key reports across an unlimited period.

Bug fixes and stability improvements We’ve continued the stability and performance focus from AccountRight 2020.3 into this release, with further crash and bug fixes making this release even more reliable and easy to use.

Access your AccountRight file via your web browser

You can now access your online AccountRight file via your web browser. This allows you to perform your most common tasks from any online device, including mobile and tablet devices.

Send an invoice on site, code your bank transactions on the train, check your business performance in the coffee queue – browser access for AccountRight brings new levels of flexibility to the power of the AccountRight platform.

Find out more about working with AccountRight in your browser.

Only online files with a current subscription can be accessed from your web browser.

Just open your AccountRight company file as you normally would and click the Open in web browser button.

Online invoice payments (Australia only)

2020.4 is a big release for online invoice payments users, with the top two feature requests making their way to AccountRight.

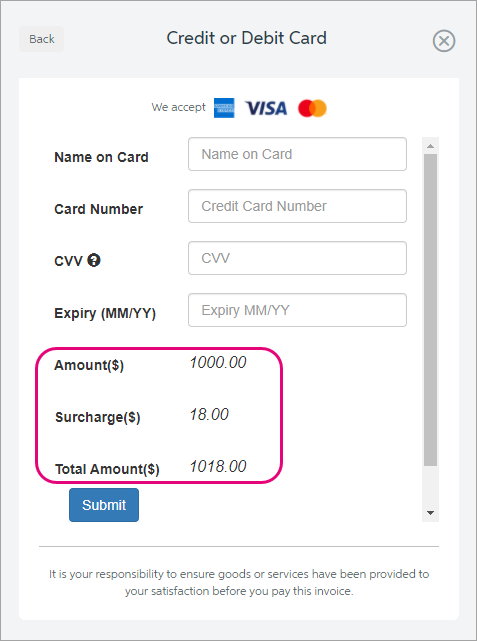

Pass on card transaction fees (surcharging)

In AccountRight 2020.4, you can pass along the 1.8% card transaction fee to your customers. The surcharge will be added to the invoice total and settled to your account after payment. Surcharging is only applicable to invoices paid with credit or debit cards (AMEX, Mastercard and Visa). BPAY fees cannot be passed on.

Easier payments reconciliation

When funds from online invoice payments are settled into your account, AccountRight can automatically create a bank deposit transaction and clear the corresponding transactions from undeposited funds. This will save considerable time previously spent allocating the settlement amount to the individual payments.

Multi-currency improvements

This release improves the functionality of foreign currency general journals, introduced in AccountRight 2020.3:

- You can now post general journals in foreign currencies to other asset and other liability account types (this was previously limited to bank and credit card accounts)

- Foreign currency remittance advice is now supported for pay bills and spend money transactions.

Reporting improvements

AccountRight 2020.4 builds on the previous release by removing date range restrictions on more key reports, allowing you to run reports across unlimited periods that would have previously required you to restore a backup of that financial year.

- You can now run the profit and loss statement and balance sheet reports across unlimited periods.

- The date restrictions on the ‘send to accountant’ (.MYE export) functionality have also been removed.

- Exporting the profit and loss and balance sheet reports to Microsoft Excel has been improved, providing better formatting within the workbook.

Defect and crash fixes

We improved stability in AccountRight 2020.3 by over 60% and we’re continuing this focus with further crash and bug fixes, making 2020.4 the most reliable release yet.

- When importing activity slips with decimals in the unit column, the payroll category wasn’t importing correctly. This has been resolved.

- Fixed display issues with longer item numbers

- We’ve also fixed the most common crashes that happened when

- Processing payroll

- Adding/removing attachments to transactions

- Resizing or closing multiple windows.

API Improvements and fixes

New BalanceSheetSummary endpoint

API users currently call the {cf_uri}/GeneralLedger/AccountRegister endpoint to retrieve the data they require from ARL to calculate an Account Balance which carries a number of limitations, particularly around dates. These limitations required manual calculation work which is cumbersome and can be inaccurate.

The new BalanceSheetSummary endpoint allows users of the API to quickly and easily retrieve account balances for balance sheet accounts as at a date for postable accounts. This endpoint will return accrual balances.

API bugfixes

- The incorrect order type was being returned from Sales and Purchases when performing a GET on the Sales Order and Purchase Order endpoints.

- The default Price Level field in the Company Preferences endpoint was returning an incorrect value.

- The Item Price Matrix endpoint was returning a 404 not found when retrieving items that were created using the API.

To download older AccountRight versions, visit our downloads page.

Need some help?

Was this information helpful?

Yes

Yes

No

No

Why not?

How would you improve this topic?

Unfortunately, we won't be able to respond to your feedback. Please don’t enter any personal information—if you need urgent help, contact our support team instead.

Thanks for your feedback.

Thanks for your feedback.

Thanks! Anything you'd like to add?

We’d love to know what worked so we can keep improving our help. Please don’t enter any personal information—if you need more help, get in touch with our support team.

Bookmark this page to keep up to date with AccountRight releases.