The Bank transactions page lists the bank and credit card transactions that have been brought into MYOB via bank feeds or by importing a bank statement.

For each bank or credit card transaction on this page, you need to either:

match it to an existing MYOB transaction (or bank transfer)

orallocate it to one of your MYOB accounts.

Did you know you attach documents to your bills and spend money transactions in MYOB? This reduces manual data entry when entering bank transactions, and keeps track of important documents.

Looking for a list of transactions for an account? Run the General ledger report.

What to look for

When you match or allocate a transaction, you’re identifying whether or not it has been entered in MYOB. You should check for:

Transactions already entered in MYOB (e.g. invoices and bills, or payments like Spend Money and Receive Money transactions). You should match these bank transactions to the corresponding MYOB transaction. See Matching bank transactions.

Transactions not entered in MYOB (e.g. bank charges, bank interest, cash withdrawals or deposits). You should allocate these bank transactions to the appropriate MYOB account. See Allocating bank transactions.

If you have regularly occurring bank transactions that always have a particular description (such as a transaction containing the text BANK INTEREST), you can set up rules to manage them. The next time these transactions are received or imported, MYOB will allocate them automatically to an account you choose. For more details, see Creating rules.Transfers between bank accounts. If you’ve transferred money between two of your bank accounts, MYOB can match the two bank transactions, even if you haven’t entered a bank transfer transaction into MYOB. You should confirm that this match is correct. See Transferring funds from a bank transaction.

FAQs

How often will I receive bank feeds?

How often your bank feeds are updated depends on your bank. Search the list of supported banks and their feed frequency (Australia | New Zealand).

If bank feeds are not appearing within your bank's specified feed frequency, contact us so we can look into it.

How do I delete a transaction?

See these topics for more details.

To delete | See |

|---|---|

an invoice | |

a bill | |

a customer return | |

a supplier return |

Need to delete a bank feed transaction? Contact product support to discuss your options.

Why am I getting the error 'An unbalanced transaction may not be recorded' when allocating a transaction when it does balance?

This is a bug and our experts are looking into it.

Until we fix it, you'll need to manually record a receive money or spend money transaction for the money you've paid or received, then match the bank feed amount to that transaction.

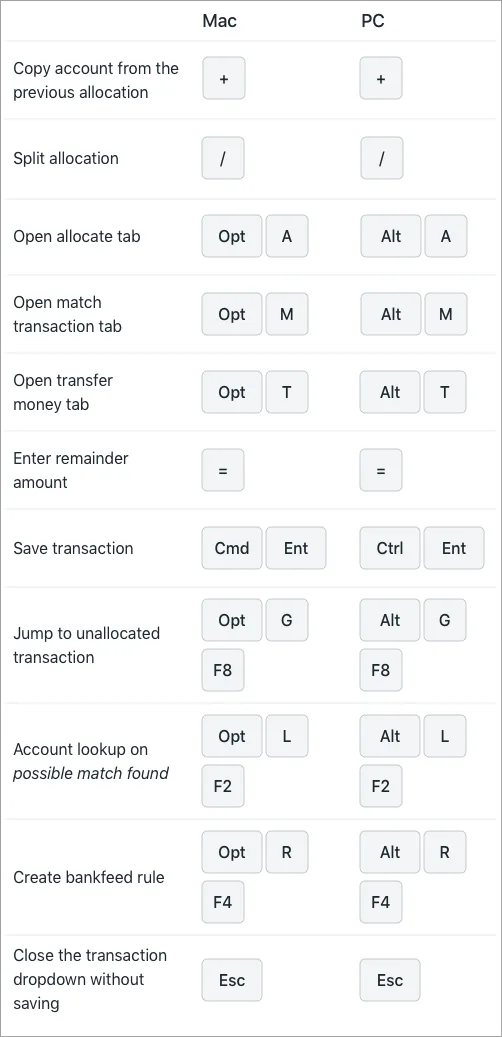

What keyboard shortcuts are available on the Bank transactions page?

There's a range of keyboard shortcuts available to help make allocating transactions faster. To reveal these shortcuts, press CTRL and / (PC) or CMD and / (Mac) simultaneously.

Why are some dates on my bank feed different to my bank statement?

The dates on bank feeds can vary to the dates on your bank statement due to the difference between the transaction date and the date the transaction was processed by your bank. This usually occurs due to weekends and public holidays which delay the bank processing.

This means a transaction made on a Saturday may not be processed until a Tuesday. The transaction will then come through on Wednesday’s bank feed with Tuesday’s date. The bank will subsequently adjust the date to show on your statement as the actual transaction date.

This leaves your bank feed transaction dated for Tuesday, but on your bank statement it shows with Saturday’s date. Although transactions are still able to be allocated and matched normally, this date discrepancy could pose some reconciliation challenges when they occur on either side of a month, quarter or a financial year.

If you need help working out the best way to handle these discrepancies, check with your accounting advisor or contact product support.

Can I attach documents to a bank transaction?

Yes, you sure can. See Attaching documents to bank transactions.

I've imported a bank statement and now I have duplicated transactions in MYOB - what can I do?

This can occur if you've imported a bank statement which includes transactions which have already been brought into MYOB via bank feeds.

To fix this:

Download a new bank statement from your bank, ensuring the date range doesn't include transactions already in MYOB.

What can I do if there's duplicated bank feed transactions?

If there are duplicated transactions in the bank feed, the only way you can get rid of them at the moment is to delete the entire day's bank feed. Individual or partial day's transactions can't be deleted.

If you need to do this, contact product support.

Can I delete bank feed transactions?

We recommend contacting product support to discuss your options.